Coronavirus Impact on US Electrical Industry

The old phrase “when x sneezes, others get a cold” may be the major US impact from the Coronavirus. While it’s unfortunate that 37,000+ are ill and over 800 have died (as of 2/9/20), here in the US there is confidence that the spread of the virus will be contained. But there could be a lagging impact on the electrical industry, directly correlated to the percent of material imported from China. Why? If plants are shutdown, therefore no product. If copper consumption in China declines, spare capacity for elsewhere.

DISC, the industry’s leading economic forecaster and market data resource, shared some thoughts:

While the team at DISC does not feel the Coronavirus will have any near-term impact on the US electrical distribution market, it will have some ripple effects across the globe. It is important to understand how a contagious disease can affect an economy in a very short period. From January 23rd, the first day of lockdown in Wuhan, the escalation of precautionary measures has brought this outbreak to the forefront of our attention and virtually shut down China’s economy.

As of Wednesday, 2/5/2020, China was reporting 25,000 cases and 500 deaths. Of the 31 regions in China, 26 have work stoppages causing 80% of Chinese manufacturing to be offline. Some international big names experiencing these shutdowns in Chinese operations are Apple, Levi Strauss, Tesla and Anheuser-Bush InBev and the overall automotive industry. Some reports suggest this could last to the end of the February.

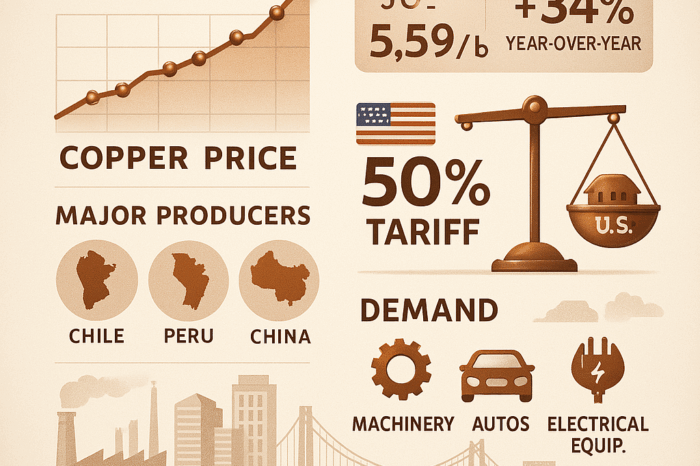

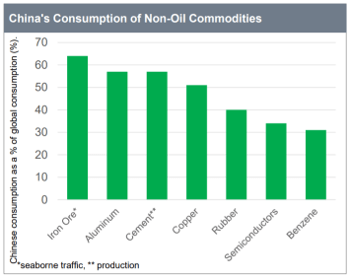

This wise “play it safe and stay at home” strategy from the Chinese government and local employers has stifled demand for commodities. Petroleum has fallen by 700,000 barrels per day, a 50% drop in demand from the world’s largest importer of oil. Copper contracts are being cancelled and other commodity shipments are stalled. This pandemic will have consequences for industrial products across the globe as China is the world’s largest consumer of many commodities.

With China’s output at a virtual standstill we expect the impact of this pandemic to fall primarily in the Asia Pacific region. Container lines have yet to be canceled or slowed down, any impact on exports will not be felt until Q2 2020. IHS is reporting a 0.0% impact to Q1 2020 GDP in the USA if the shutdown lasts until the end of February and a -0.1% impact in Q2. With normalization beginning in Q3.

The World Health Organization has declared this outbreak a public health emergency. The US government has banned or severely limited travel in the US from China. Some US companies are reporting a quarantine style 14-day incubation period before being allowed to return to work for those traveling in from China. US based airlines have halted service to and from China. We believe the best option for our industry is to keep a close eye on commodity prices and continue to monitor the situation.

So, as the media reports and economic pundits share, the impact on the US is nominal … today. However, with China using less copper, copper pricing has been declining. The impact for distributors can be significant with customers asking for significant projects to be requoted regularly (and sometimes delaying purchases until they absolutely need them) and inventories being devalued. With wire / cable representing 10-20% of a distributor’s business it could be expected that distributor revenues will suffer with gross margin dollars impacted.

And distributors need to be aware of supply chain derivatives. Here’s a warning in the auto industry, which could be one of the first industry’s impacted as many auto parts are made in China.

From a manufacturer side, supply chain delays are tough to forecast right now not knowing the extend of the virus’ impact or how long factories will be closed. Sourcing for short-term needs is tough. Distributors may want to stock up for selected items and/or recognize that there could be delays if the virus continues longer-term.

Additionally, from a production viewpoint, the Coronavirus coincided with Chinese New Year, when many Chinese manufacturing facilities were closed anyways. The impact today is just an extension of these closures.

As we shared with analysts recently, if the coronavirus has a 14 day incubation period, perhaps much of this dissipates in mid-March or Q2. If so, tragic but a non-economic event. If not, then it could have some impact. And remember, SARS was essentially a 9-month event from beginning to end but it didn’t have a major US economic impact. Perhaps we’re containing the impact better?

Are you seeing any pricing or inventory issues yet? Your thoughts on the coronavirus and potential impact on the US electrical market?