Encore … Delivering the Copper

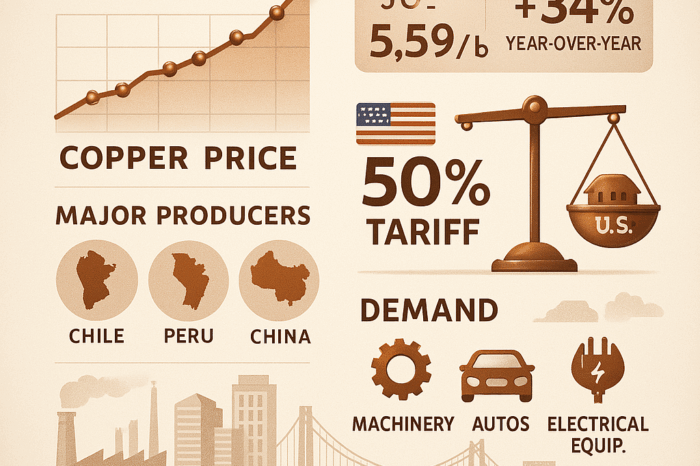

The copper wire has been on a tear for the past year. On March 16, 2020 the price was $2.39 and on February 16 it was $3.83 (according to https://www.macrotrends.net). Lot’s of reasons for the increase and, as you’d suspect, an opportunity for wire companies as Encore shared during it’s Q4 earnings call.

Earnings call

According to the transcript:

- Net quarterly sales were $381M, up $79M vs 2019.

- For the year sales were $1.277 billion vs 1.275 billion in 2019.

- Copper unit volume increased 4.3% in Q4 vs 2019 and 3.2% vs Q3

- For the year, copper unit volume decreased 5.4% vs 2019.

- Copper spreads increased 25.3% vs Q4 2019 and 7.3% vs Q3 2020. For the year it increased 8.9%.

- Aluminum wire represented 8.7% of sales in Q4 and 9.1% for the year

- Gross margins increased to 15.4% vs 11.8% in

2019, with much attributed due to the increase in the spread

- For the year gross margin increased to 15.2% from 13% (a 200 basis point increase!)

- Average selling price of wire per copper pound sold increased 21.1% Q4 2020 vs Q4 2019 while the average cost of copper per pound purchased increased 18.9% (a difference of 2.2 points!)

- “Customer buying patterns began to return to more historical levels and accelerated in the second half of 2020.” (residential and a return of the overall electrical market.)

- Encore believes it has a “superior order fill rate” which enhances its competitive positioning (distributors – your thoughts? We’ve heard similar from some distributors and this has helped Encore take some share. Encore’s claim to fame, and a founding principle, has been ease of doing business and reliability.)

- Emphasized their “low cost structure, one location model”

Analyst questions

- Feedback from customers is that the demand outlook is good and continuing to be good. Residential expected to continue to be strong. Expect current weather issues to simply push projects into “next week / next month”. Seeing positive in commercial space. Aluminum showing positive signs due to tight copper market.

- Haven’t seen much substitution of aluminum for copper.

- Biggest issue, from a customer perspective, seems to be product availability.

- Encore is charging for some services that “used to be done at other steps in the supply chain”, hence the need for its new service center which is coming online in the first half of 2021. Encore expects these requests / services to increase. Hopes to also be able to get a product price premium when these services are involved, in time. (but doesn’t break out service revenue from material revenue.)

- Encore commented that is it “super selective” and works with “higher quality distributors.”

- Resi was 27% of the business in 2020 vs 21.8% in 2019 and 29.7% for Q4. Expects resi to be strong through the end of 2022.

Overall a strong quarter from Encore. Looks like they were able to profitably take share while enhancing the product offering by adding services and they are positioning for further growth with the new service center and other investments. As to the future of copper pricing …. If demand is there and supply is challenged, for various reasons, expect a “strong” copper market.

In thinking about wire / cable manufacturers – Encore, Southwire, Prysmian, Cerro, Colonial, Priority and then some of the smaller ones (Alan, CME, Cameron, etc) – how are they performing for you? Other than price and availability, is there a reason to do business with one vs the other? What differentiates them?