Survey Shows Smart Home Products = Smart Investment for Distributors

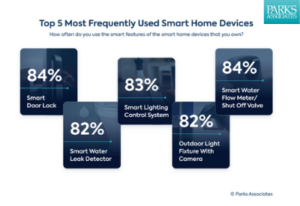

Electrical distributors who offer smart home products such as light bulbs, video doorbells, door locks, garage door openers, and thermostats might want to promote and expand their offering in order to take advantage of the growing demand for this category among homebuilders, home buyers, and property managers. A recent survey of 10,000 people conducted by Parks Associates indicates that the smart home category will continue its upward trajectory as well as expand into the MDU (multi-dwelling unit) market.

Electrical distributors who offer smart home products such as light bulbs, video doorbells, door locks, garage door openers, and thermostats might want to promote and expand their offering in order to take advantage of the growing demand for this category among homebuilders, home buyers, and property managers. A recent survey of 10,000 people conducted by Parks Associates indicates that the smart home category will continue its upward trajectory as well as expand into the MDU (multi-dwelling unit) market.

“In short, while the world has been dealing with turmoil for the last two years with major economic decline, problems in the supply chain, and transportation issues, we’re still seeing growth in the smart home category,” said Chris White, Senior Analyst at Parks Associates, who noted that smart light bulbs and plugs make up approximately 40 percent of sales.

This is happening because of a combination of factors, according to White. “Prices have been coming down for years, and part of that has been due to the tech giants and existing players expanding their SKUs to include a value offering. Also, there are new entrants like Wyze and Abode coming into the space, selling inexpensive cameras and doorbells just as they’re starting to get hot — which put gasoline on the fire in terms of growth. We’ve seen explosions of growth in particular categories where they’ve been able to get prices down and defeat the number one barrier to overcome in the smart home market, which is price,” he stated.

What’s next? “We think the biggest thing coming up in the smart home space is going to be Matter,” White commented. [Matter is a global, open-source standard for IoT devices and ecosystems from member manufacturers of the Connectivity Standards Alliance to simply and securely communicate with each other regardless of brand.]

Another significant influence on the category comes from the automobile industry. “EVs are going to happen, and that’s going to have a temperature-changing effect on what everyone else is doing in their smart home in terms of how they think about using smart energy, and how they think about using an eco-system that extends outside the home,” White stated.

The concept of a “smart home” is moving beyond the confines of the interior space. “Now it includes the packages delivered on your porch, the car in your driveway, the person walking by on the sidewalk, and the delivery man coming to bring stuff into your garage,” White remarked. “The lines are blurring and the walls are starting to come down between the smart home space and the connected entertainment space. We’re starting to see smart TVs, smart appliances, and smart energy products all working together on the same eco-system.”

Additional research by Parks Associates points to several emerging areas of interest in the smart home sector. In the age of COVID-19, health, wellness, and antibacterial products are becoming a priority. Therefore, indoor air quality monitoring devices including smart air quality monitors, air purifiers, and fresh air ventilation systems will increase in demand. “Smart” air quality products can identity volatile compounds and other air quality issues and automate actions, such as activating air purifier or humidifiers to improve air quality.

According to the Association of Home Appliance Manufacturers (AHAM), air quality is now a consideration of household cleaning. Forty-six percent of U.S. consumers who now clean and tidy their homes more since COVID-19 have taken measures such as purchasing air purifiers to improve their indoor air quality.

Another area Parks Associates predicts as a growth category for smart home products is independent living. The U.S. Census Bureau estimates that ~20% of the population will be age 65 or above by the year 2030. Nearly 90% of consumers aged 65 or above want to continue living in their homes for as long as possible. They are most interested in independent living solutions that provide home safety and security, along with solutions that automatically alert first responders if the homeowner is experiencing a security breach or is exposed to a safety hazard.

The idea of package safety is a new one, but today we live in a world that has increasingly relied on Amazon, Instacart, and other package/grocery delivery services. Package safety solutions have become important. Package safety solutions allow retailers and package couriers to deliver goods to consumers securely and combat an increase in package theft. Solutions include services like Amazon Key that monitor indoor package deliveries, video doorbells that can alert users when packages are delivered or removed, and smart storage containers that can be accessed only by delivery personnel and the package owner.

Parks Associates also has its collective eye on energy resilience solutions that include batteries for storing excess power. The Texas blackouts of February 2021 that led to the loss of lives have put energy resilience solutions top-of-mind for many consumers.

While use of smart home devices and appliances is mostly among early adopters, many markets will inch closer to the early majority in the next few years. Parks Associates predicts the integration of new technologies in consumers’ lives will force homebuilders to think about buyers’ expectations and how to design homes to meet those needs. The majority of large-scale homebuilders report that smart home products are important in single-family homes. As the market for smart products grows, offering them in new construction can provide builders with differentiated products that can command higher price points. With wide-scale adoption, new buildings must be designed to accommodate these products. Nearly 50% of large-scale single-family homebuilders estimate that 40% or more of new single-family construction will include smart home devices and systems as a standard by 2025.

The multifamily home market is seeing rising demand as well. Parks Associates anticipates strong growth for smart home solutions in the multifamily space, given the benefits to both residents and property managers. Futureproofing multifamily properties will involve building to accommodate efficient deployment and effective operation of these technologies. No longer being viewed as a post-sale product for homebuyers to work out with their preferred ISP, property managers are exploring the benefits of integrating smart home devices to improve operating efficiencies through remote energy and access control management. Doing so can not only attract and retain residents, but increase revenues through premiums on rental fees.