Q1 2022 Electrical Industry Performance – DISC

Last week Chris Sokoll from DISC delivered their April Flash Report to subscribers and shared an excerpt with ElectricalTrends.

Last week Chris Sokoll from DISC delivered their April Flash Report to subscribers and shared an excerpt with ElectricalTrends.

Much is written, and discussed, regarding the macro-economic challenges that the economy faces and how this is affecting the electrical industry.

Key issues such as:

- Inflation, which impacts material commodity pricing but is also driving manufacturer and distributor costs in the areas of transportation costs, healthcare and staffing costs.

- Labor challenges, be it resignations, recruitment / availability, training and the increased cost of labor for all roles … especially warehouse and drivers.

- Supply Chain issues which is a holdover from last year but is exacerbated by labor issues, fuel issues, lack of trucking, COVID interruptions that producers incur and, most recently, the increase in the COVID rate in China which will have cascading shipping delays to the US let alone production issues in factories.

- The Fed increasing rates which is expected to slow the housing market.

And there are positives including:

- Increased demand / needs in the industrial sector, inclusive of automation.

- Companies bringing employees back to offices, even if some are only doing hybrid, as this drives office demand (and remodeling) as well as ancillary business for restaurants and more.

- The energy sector, inclusive of renewables, is “humming”.

- Contractors are challenged in finding labor … and they are “booked”!

So, there are challenges in the market as well as opportunities. And everyone tells us that their staff is “extremely busy” / “flat out”.

As economic pundits mention the R word (recession) potentially being on the horizon.

But this is observational and what we’re hearing from clients. DISC is an electrical industry economic informer and a projector of the overall market for many manufacturers and distributors on the forecast for the electrical distribution industry.

Q1 According to DISC

Q1 According to DISC

“The 1st quarter of 2022 has been the most unpredictable of the past few years. The waning pandemic, pent-up demand, return to work, rising prices and the Ukraine invasion have made looking into the future for a reliable forecast challenging. While the outlook remains complicated, relative economic strengths lead us to believe the near-term outlook remains positive on a year over year (YoY) basis.

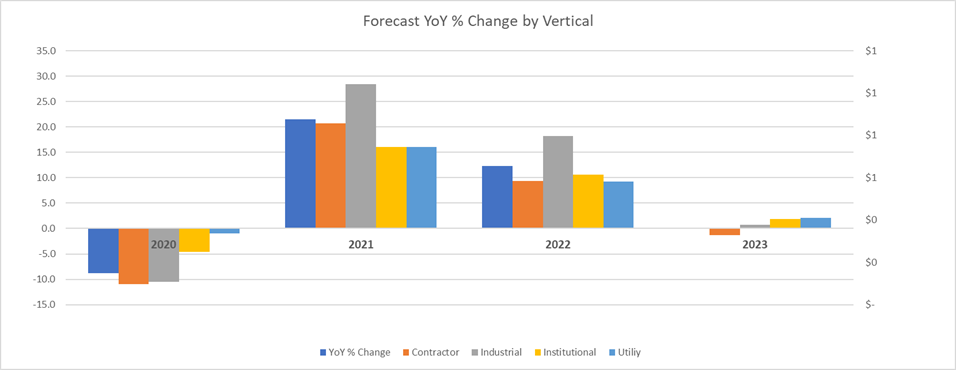

The electrical industry’s markets (contractor, industrial, institutional and utility) were up over 21% from 2020.

The 2021 high growth vertical was the industrial segment with an estimated performance of 28.4% YoY. While some of this growth is fueled by pent-up demand and recovering expectations of future sales, price also played a key factor. Residential construction has started slowing, but business fixed investment has picked up additional momentum. Institutional investments are mostly centered around communications, schools, and return-to-the-workplace activities such as air handling and social distancing-related equipment upgrades. The industrial and institutional sectors will provide the largest opportunities for growth in 2022. Average segment growth rates were hit hard by the 2020 downturn

Here at DISC, we maintain our expectation of slowing yet positive sales and revenue growth in our industry for the balance of the year. We had previously forecast a growth slowdown in 2022 following the strong results in 2021. Other than mining and exploration, we do expect some continued weakness in construction. The industrial manufacturing vertical and the office MRO markets will remain in positive territory for the balance of the year. Infrastructure investment will create opportunity for anyone who wants to capitalize on it. In light of recent geopolitical events, we also foresee that defense spending is likely to accelerate.

Headwinds that will remain a challenge for the year are: persistent supply chain disruption compounded by recent COVID lockdowns in Chinese territories and the war in Ukraine; along with FED interest rate hikes that will attenuate business investment. Slow growth must be watched. If the FED raises rates too quickly and aggressively, a recession could be triggered.

We have experienced meaningful elevation of risk in the first quarter of 2022. At DISC we still feel confident about the prospects for sustained growth and opportunity. Our economy has reopened and is resilient. By keeping an eye on opportunity and maintaining strength in the balance sheets, we will enjoy continuing success. “

Takeways

So, according to DISC, Q1’s growth is a product of residual demand from Q1 coupled with the benefits inherent from inflation and the supply chain issues.

The disconcerting part is a slowing rate of growth going forward. Parts of this are to be expected due to actions from the Federal Reserve which hopefully will impact the inflation rate and “eventually” elements of the supply chain should improve.

Some dynamics will help the industry. Think:

- Infrastructure projects funded by the Infrastructure Bill.

- Renewables / green and this will also impact copper pricing due to copper’s usage for electric vehicles.

- The migration “south” of people and businesses … be it the Southeast or Southwest.

- Industrial investments

We’ve recently written an article for another industry’s publication on preparing for a recession. The focus is distributors. While times are good, there are things distributors should consider now to prepare for a potential recession. Using today’s success, and profitability, to fund tomorrow’s needs represents a unique opportunity (and if you want a copy, email me and/or we can connect at the NAED National Meeting.)

And if you’d like a copy of DISC’s April Flash Report, a 1-month issue is $100. An annual (12 issue) subscription is only $895 (but ask for the ElectricalTrends discount.). Email Chris Sokoll at DISC. He’ll also tell you the industry Q1 performance (hint, it starts with a “2”) as well as performance by customer segment.

So, three questions:

- What is your impression of Q1?

- What do you see for the industry for Q2?

- Do you think the economists / financial institutions that are suggesting a recession “sometime in the next two years” are correct? Why?