Border States Expands in Southeast

Last week, while reporting on Forward Solutions’ acquisition of ElectroRep and R/B Sales Corp we heard of the pending news of a Southeast electrical distributor

Last week, while reporting on Forward Solutions’ acquisition of ElectroRep and R/B Sales Corp we heard of the pending news of a Southeast electrical distributor

On Friday, Border States confirmed that it acquired Sequel Electric. This is the second electrical distributor acquisition of the third quarter.

Border States Acquires Sequel Electrical Supply

According to the press release:

“Border States, a 100% employee-owned company, announced it has reached an agreement to purchase Sequel Electrical Supply, LLC, headquartered in Meridian, Mississippi.

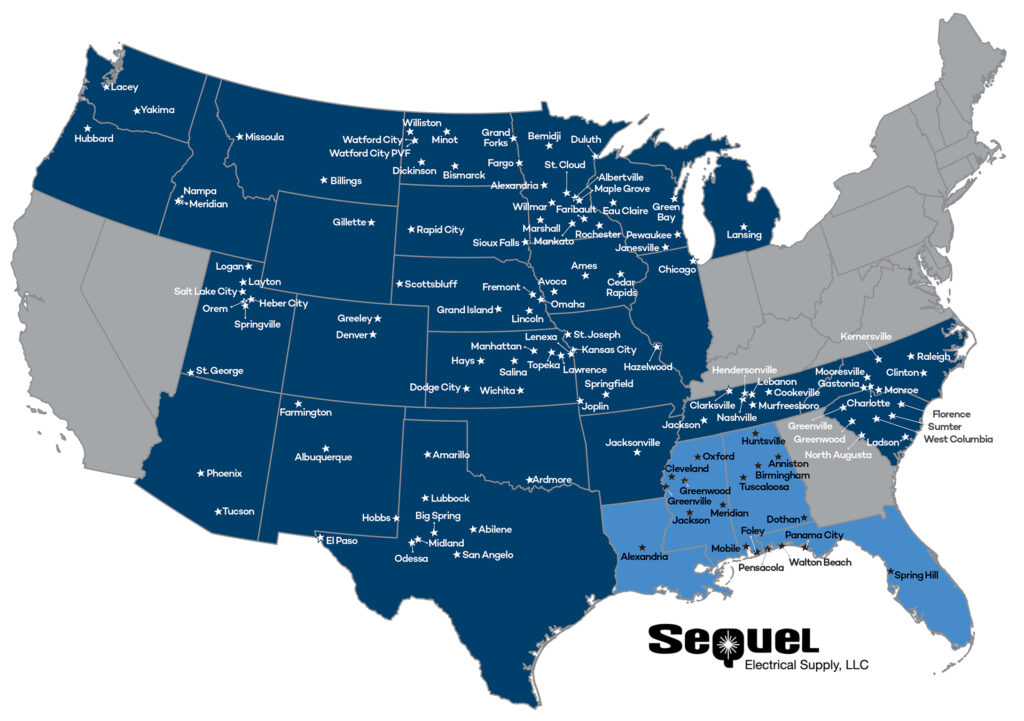

Sequel was founded in 2004 as a single location in Greenwood, Mississippi, under the name of Dixie Supply. Today, the company operates in 18 locations across Louisiana, Mississippi, Alabama and Florida. Lee Moseley, President, leads the organization and the 220-plus employees, primarily serving the construction and industrial markets. Under Lee’s leadership, Sequel has become a leading electrical distribution company in the region.

“We have an incredibly talented, dedicated group of employees — the move to join Border States places each of them in a position to enjoy the rewards of employee-ownership,” said Moseley. “Being part of an American employee-owned-and-operated company was part of our plan and important to our team, Border States has a reputation of being a successful Employee Stock Ownership Plan and a place employee-owners can build a career and develop professionally — this is a great fit for Sequel.”

Sequel’s geographic coverage is strategically appealing to Border States; the acquisition adds four states in the economically growing Eastern U.S. Gulf Coast while creating no overlap with its current 25-state footprint.

“They have built an impressive distribution company in the Eastern U.S. Gulf Coast,” said David White, Border States’ CEO. “Sequel is the right geographic addition for our footprint; the potential for growth is clearly present. The Sequel team is well respected, driven for success and focused on customer service. We are excited to welcome them to our 100% employee-owned company.”

The acquisition will close, pending regulatory review, on Saturday, August 26.

Additional Insights and Takeaways

- According to local sources, Sequel was a $175-185M distributor. Recently they were ranked by Electrical Wholesaling as the 88th largest electrical distributor, based upon 2022 sales.

- According to these same sources, Sequel has a “preferred” relationship with a leading contractor in the Mississippi marketplace, Edwards Electric Service, which represented a significant percent of sales. Edwards is a wholly-owned subsidiary of Yates Construction (a general contractor.)

- In 2019 they won IMARK’s Platinum Award for members with purchases through the group of over $50 million.

- Sequel Electric is a “dual house” with ABB in central and northern Alabama and Siemens on the coast. Border States has relationships with all of the gear lines. It will be interesting if they remain a dual house or if Border States seeks to consolidate under one of the incumbents or convert to one of the larger firms, both of whom seem to be jockeying to align with different national chains.

- The deal fills in a “hole” for Border States. Some may remember that Border acquired Harris Electric in 2008. Harris had locations in central and eastern Tennessee. The below map highlights Border States’ current footprint, which covers 120 locations.

- Some may remember that Border States moved into the Chicago market last year with the acquisition of Advance Electrical. Perhaps “one a year” due to integration or that they budget a % of their growth to come from acquisition?

- And with a broad network, Border States is exhibiting at the upcoming NECA conference

- Speaking of locations, Border States is also investing in improving / expanding branches in the west Texas oil market.

- Reportedly Border States’ electrical sales now exceed $3 billion (they were ranked #7 by Electrical Wholesaling with electrical sales of $2.85 billion) and overall sales are about $4 billion.

Congratulations to Border States and Sequel Electric.

And I was looking at the EW Top 150, which is based upon 2022 sales. Consider:

- 9 of those companies have been sold

- 11 I “removed” as they are either considered manufacturers / master distributors, are Canadian companies or are utility distributors, and

- 16 are “too large to buy” (unless private equity) and these are national chains or the electrical elements of larger companies (i.e., Win Supply and Motion Industries)

So, perhaps the next EW will be down to a Top 100, otherwise EW will need to expand its reach. But remember, AD and IMARK, collectively, still represent over 700 independent electrical distributors. Independent distribution isn’t dead, but there are less larger companies. How will this change manufacturer channel strategies? How should it change their 2023 distributor programs / co-op programs?

So, the question is, with 45 days left in the quarter, will there be more distributor deals in Q3?