A Pair of 8s for Hubbell in Q3 But Nets 4

Hubbell announced its 2025 earnings on October 28, 2025. Net sales increased 4%, and 3% organically for the entire company, operating margin was 22.0%, and adjusted operating margin was 23.9%, reflecting robust pricing and productivity gains amidst cost inflation. The strong performance of the Electrical Solutions (HES) and Utility Solutions (HUS) with grid infrastructure drove the strong performance.

Hubbell announced its 2025 earnings on October 28, 2025. Net sales increased 4%, and 3% organically for the entire company, operating margin was 22.0%, and adjusted operating margin was 23.9%, reflecting robust pricing and productivity gains amidst cost inflation. The strong performance of the Electrical Solutions (HES) and Utility Solutions (HUS) with grid infrastructure drove the strong performance.

Hubbell Deals 8’s in Q3

Hubbell Utility

The utility division (HUS) showed strength with Grid Infrastructure growing 8% organically, to $715 million, while Grid Automation declined 18% due to weaker meter and AMI projects. There was broad-based strength across distribution, transmission and substation markets, as load growth drove robust grid interconnection activity. Resiliency investment was solid. The telcom markets returned to growth, while gas distribution activity was softer. Hubbell anticipates stronger y/y growth rates in 4Q supported by accelerating orders.

Hubbell Electrical

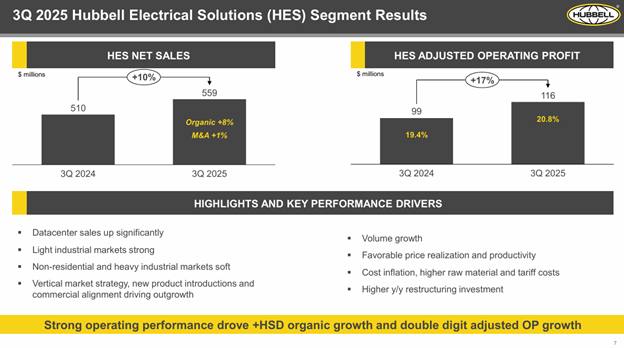

The HES segment, best known by electrical distributors for Hubbell Wiring Devices, Raco, Killark, Weigmann, Acme and other brands covering the wiring, power distribution and control, data and communication products and industrial and harsh and hazardous lighting markets, grew 8%, driven by demand in data centers and light industrial markets.

This was offset by weakness in non-residential and heavy-industrial end user markets. Profitability was up a strong 17%. The slide below, from the earnings presentation, highlights the drivers that HES benefitted from volume to drive its growth and favorable pricing:

Hubbell 2025 Q3

Stakeholder Concerns

There were some concerns around the slight miss on top line revenue and caution about persistent cost inflation and tariffs, which could pressure margins if not fully offset by pricing and productivity improvements.

Questions were also raised regarding the potential for double-digit growth in the utility segment in 2026 and the sustainability of the company’s pricing strategy amid growing competitive pressures. Shareholders were also cautious about the integration risks and costs from the $600 million acquisition of DMC Power.

Guidance

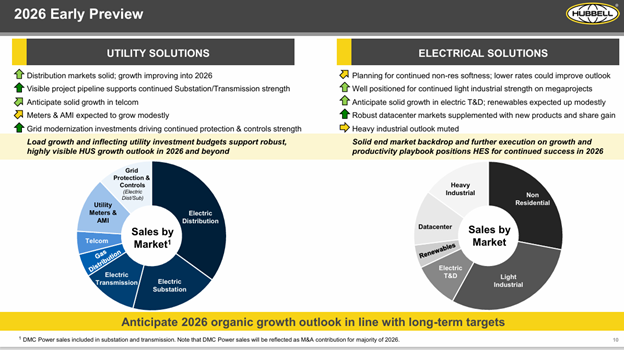

Management guidance reflects confidence in growth in both the electrical and utility segments driven by grid modernization and electrification demand.

The company raised its full-year 2025 total sales and organic growth to the range of 3% to 4% for 2025. For Q4 2025, they expect 8% to 10% organic sales growth and further margin expansion as headwinds in Grid Automation ease and demand in data centers continues strongly. Hubbell anticipates continued operating margin expansion of 50 to 100 basis points. Management said it will handle cost inflation with pricing and productivity gains.

The drivers and assumptions for guidance were laid out in the following chart which shows how sales by end user market are split for Hubbell’s two segments:

Hubbell 2026 Preview from Q3 Quarterly Report

Thoughts about Hubbell

Some questions remain

- Can margin expansion be maintained in 4Q and into 2026?

- Can the strong growth in utility and grid be sustained?

- Will nonresidential turn around?

- Can Hubbell take share in data centers?

If 2025’s projection is 3-4%, is that really unit growth given rising material input costs, tariffs (as some products are imported, especially for HES), the reality of price increases, and the sluggish commercial construction market. While industrial grows and data centers opportunities abound, is Hubbell taking share or treading water?