Sales Growth Acceleration Forecasted for 2021

DISC, the electrical industry’s leading resource for electrical distribution market information, released its February DISC Flash report last week and it was a surprise … a significant acceleration is projected for the electrical industry.

Channel Marketing Group, due to our preferred relationship with DISC, received an advance copy and while we won’t share or reveal the results, the information was so surprising that we reached out to Christian Sokoll with some observations / questions and asked him for a little write-up to share with ElectricalTrends readers.

Christian shared:

“Seems economic forecasts and Texas weather have a lot in common. If you do not like what’s happening just wait a while.

The economic recovery has hit the accelerator and is headed to much faster recovery than we expected.

Just a year ago we were forecasting the electrical distribution community in 2021 to grow 4% year over year. Every forecast since has seen continued and growing optimism. Currently our expectation for this year is just under 12% YoY.

Residential housing, pent up demand in equipment and the return to public spaces is driving these uplifting forecasts.

A complete and detailed forecast by each market vertical: Construction, Industrial, Institutional and Utility, including opportunities and price trends can be found in the Monthly DISC Flash report. Email for a sample of the type of data in our reports. The full report is 29 pages of information you can use to make informed decisions.

The annual subscription rate (12 copies) is only $895, individual monthly reports are $100. Call 346-339-7528 or Email Chris@disccorp.com for further details.”

The forecast, and number, was surprising and, since it was a February report, it wasn’t taking into account the recently passed American Cares Act ($1.9 trillion) or a potential green / infrastructure bill.

Sales Growth Acceleration Drivers

But, with some hindsight, consider:

- Demand has been strong in the residential market.

- 2020 wasn’t the “disaster” it was originally forecasted to be

- In October distributors, in our final COVID survey, were projecting “nominal” growth for 2021.

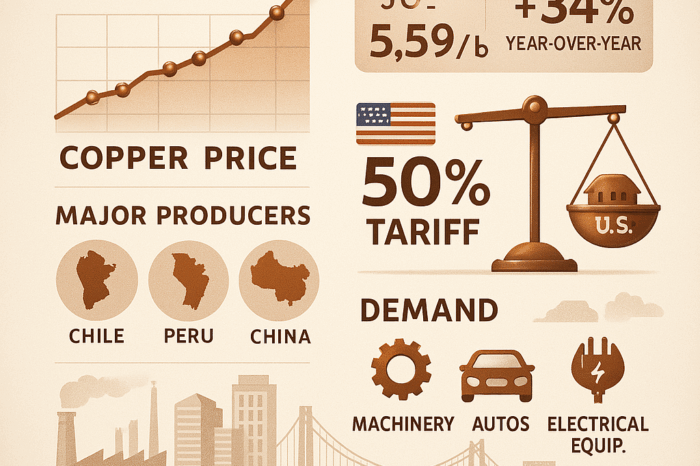

- Price increases, due to commodity pricing, appears to be running rampant with distributors reporting more price increases than ever before and manufacturers suggesting multiple price increases this year.

- Three vaccines being used today, and it is hoped all adults being vaccinated by May … so the economy is opening “full-throttle”.

- Industrial market has rebounded.

- Macro trends regarding digitalization (warehouses, datacenters, industrial automation) are driving business investments.

- With more businesses opening, especially in the hospitality / tourism sectors, there will be more employment. Additionally, these business may need some renovation work. Increased financial resources by businesses and individuals can lead to more investment.

So, double digit growth could be on the horizon as Christian is projecting.

From reviewing the report, some questions we had were:

- “Won’t the unemployment rate decline, and the number of employed increase, naturally as there is more vaccination and states open solely because there will be more travel, hospitality and entertainment open? Especially since this sector of the economy laid off so many people and will need to rehire people? By definition, that will further stimulate the economy and generate other needs.

- Now projected double digit industry growth for 2021! That’s a huge change. What % of that is price vs organic activity?

- And remember when we were saying come back from pandemic in late 2022 or 2023? Now we’ll eclipse 2019 this year.

- And this could go higher, especially 2022 and 2023 if there is an infrastructure / energy bill

- Feb somewhat challenged due to weather, but this could also represent a segmentation in the industry … some distributors doing really good, others doing marginal. People participating unevenly in the recovery? Depends upon their focus, sales and marketing “energy”, geographic area?

- Interesting that residential declines / is flat in 2022 and beyond. Wonder if this is need, cost and/or interest rates?

- The PPI’s by product category is excellent and informative.

Takeaways

- Are you prepared for growth? Do you have processes and people to handle?

- With supply chain disruptions, in some categories are distributors considering “opening” their supplier lists and entertaining doing business with “whomever” has the material? Especially since in some categories there isn’t customer brand preference?

- With growth opportunities, this also highlights that there can be marketing opportunities to capture discretionary business.

- If companies did “decent” in 2020 with many salespeople confined to telephones (or in computer boxes) and the market is driving the growth, what are your expectations of your salespeople? What are, perhaps, more effective, behavior inducing, compensation models?

- With this type of market growth, access to cash / credit lines is important to distributors to finance inventory.

- Assuming the growth is profitable, what are the longer-term dynamics to invest in today to ensure continued growth? (and yes, there are a number of emerging trends that distributors and manufacturers can explore to further differentiate themselves to “ride the wave.”

If you don’t get the report, you should. It is a nominal investment and speaks directly to what impacts the electrical industry.

If you do, or are experiencing the growth, increased sales should drive increased profits. Consider using some of the incremental net profit dollars as an investment fund to support growth initiatives (and there are ways to further capitalize upon the opportunity … give us a call!)