Atkore Considers Strategic Options

Atkore , a manufacturer of electrical products for commercial, industrial, data center, telecommunications, and solar applications, announced its 4Q 2025 and full year 2025 results on November 20.

, a manufacturer of electrical products for commercial, industrial, data center, telecommunications, and solar applications, announced its 4Q 2025 and full year 2025 results on November 20.

Atkore sales continued to slide, with net sales down -5% year-over-year and net income down 174% to a net loss of $54 million. For the full year 2025, net sales declined 11% to $2.85 billion from $3.2 billion in 2024, and net income declined 103% to -$15 million.

Gross profit was $147.8 million in Q4 2025, down roughly $68.2 million from about $216.1 million in the prior-year quarter, a decline of around 31.6%. and gross margin fell to about 19.7% from 27.4% a year earlier, reflecting substantial margin compression driven by the combination of lower average selling price and high material costs.

Atkore – Electrical Performance

The core Electrical segment (about 70% of the business) saw an 8% sales decline, reflecting tougher pricing and competitive conditions in electrical products, even though Safety & Infrastructure posted modest growth. Higher raw material and other input costs combined with lower pricing pressured margins, contributing to weaker profitability even on only mid‑single‑digit revenue decline.

Strategic Options

As a result, the company is expanding the scope of strategic alternatives to include “potential sale or merger of the whole company,” and “sharpening focus on electrical end markets through divestiture of non-core businesses.” Actions already taken in 2025 include divesting Northwest Polymers in February and exploring the potential sale of High-density polyethylene (“HDPE”) business and the identification of two other modest non-core assets for potential divestiture in late Q1 or early Q2 202

Cost reduction actions include closing 3 manufacturing sites in 2026 and headcount reductions at the end of 2025. 205 people were recently laid off in Phoenix.

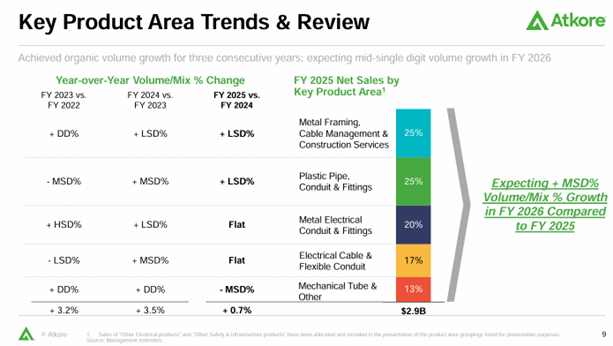

For 4Q 2025, organic volume was up 1.4%, driven by the plastic pipe, conduit and fittings products which experienced double digit volume growth. For the fiscal year 2025, organic volume was up 0.7% marking three consecutive years of organic volume growth, with plastic pipe, conduit and fittings and metal framing, cable management and construction services growing low single digits.

The chart below shows key product area trends and sales mix for the last three years and the outlook for FY 2026, which is overall mid-single digits.

The decrease in net sales was primarily attributed to an approximate $53–54 million reduction in average selling prices as pandemic-era and peak-cycle pricing continued to normalize. This price headwind was partly offset by around $11 million of higher sales volume and roughly $8 million related to a lower economic value of solar tax credits transferred to customers, which mechanically increased reported revenue versus the prior year.

Results by business segment starting with Electrical, net sales declined 8.1% year over year to $518.9 million, driven primarily by lower average selling prices and divestitures. Adjusted EBITDA dropped sharply by 54.7% to $65.9 million, with margins compressing from roughly 25.8% to 12.7%.

The Safety and Infrastructure segment had net sales increasing 4.0% to $233.4 million, despite a decrease in the economic value of solar tax credits and some pricing pressure. Adjusted EBITDA surged 80% to $26.8 million, with margins improving from approximately 6.6% to 11.5%, helped by volume growth and lower input costs. This segment showed resilience and contributed positively but could not offset the higher mix performance and challenges of the Electrical segment.

Atkore Guidance

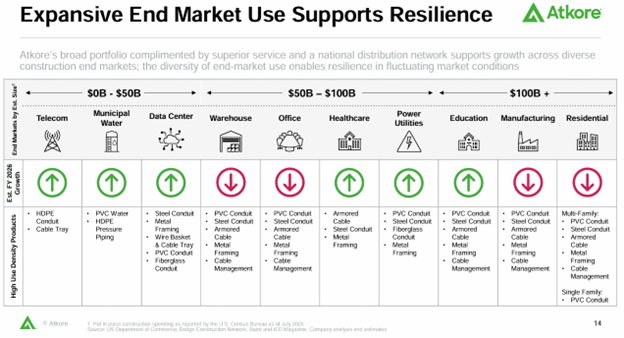

Atkore management expects mid-single-digit volume growth, growth in data centers, healthcare, and utilities markets, but faces ~$50 million in unmitigated headwinds from lower prices, tariffs, and input costs. With net sales expected in the $3.0 billion to $3.1 billion, implying modest growth from FY 2025’s on, this reflects a cautious outlook amid pricing headwinds, strategic reviews, and expected market improvements.

The outlook by vertical market for 2026 as well as product offerings per market provide additional insights into Atkore’s business and outlook.

There were analyst questions about volume growth, backlog visibility, and balancing tariff offsets with construction demand risks. Particular concern was raised about the slowing non-residential market (specifically citing the Dodge Momentum Index) and resulting delays in volume. Tariff questions were centered around steel and aluminum. Stakeholders highlighted declines in PVC and steel conduit pricing due to imports and competition, seeking clarity on stabilization timelines. CFO John Deiser added that pricing declines (17% YoY overall) were offset by 5% organic volume growth in conduit and related areas, with productivity gains supporting margins. Tariffs were viewed as net positive, though unpredictable macroeconomic effects were flagged. Outgoing CEO William Waltz stressed that the 25% tariff on steel imports (post-exemption removal) was a tailwind for regaining market share, improving gross margins over time, and boosting demand for domestic products like Atkore’s, though short-term volatility persists.

Analysts asked about the expanded strategic review, including potential sale or merger timelines, process details, and range of outcomes. CEO Bill Waltz responded that it’s early in the process, with the board exploring a full spectrum—from standalone operations to full company sale—to maximize shareholder value. He committed to staying as CEO through completion and noted activist investor input (According to this Reuters article, the company is Irenic Capital Management.) while emphasizing no set timeline and focus on long-term electricity demand growth.

What are your thoughts on Atkore?

- Performance in the field?

- Are they winning or losing share? Or is this a case of “the market” for conduit?

- In the age of consolidation, can Atkore remain independent or are the destined to be “reinvented”? And, if “reinvented”, by a strategic acquirer or a private equity firm?