Introducing the DISC Electrical PPI

We jokingly say that there was a demarcation of business in 2020. There is BC and AC. Before Covid and After Covid. This Black Swan event changed many things. In the case of the electrical industry, it was the harbinger of much change that resulted in economic stimulus and economic policies while also introducing us to a term we took for granted (supply chain) and resulted in significant commodity price changes.

We jokingly say that there was a demarcation of business in 2020. There is BC and AC. Before Covid and After Covid. This Black Swan event changed many things. In the case of the electrical industry, it was the harbinger of much change that resulted in economic stimulus and economic policies while also introducing us to a term we took for granted (supply chain) and resulted in significant commodity price changes.

While all of this is intellectual understood, when you consider it in its totality, it has significantly impacted the electrical industry.

In fact, it has impacted it so much that it impacted historical norms.

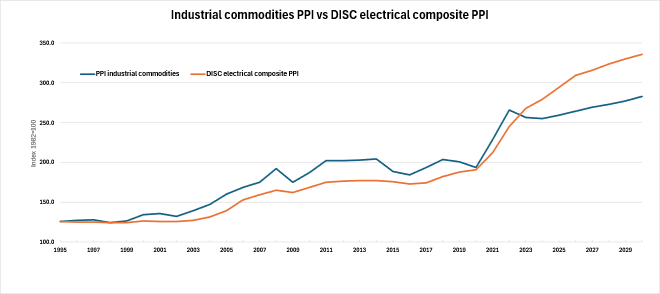

Chris Sokoll from DISC has been reviewing the disconnect that Covid created and recognized that there has been an economic divergence between the PPI (Producer Price Index), which is an economic indicator from the Bureau of Labor Statistics (BLS) measuring average changes in selling prices received by domestic producers for their output, tracking wholesale inflation, and what is experienced “on the ground.” The PPI is an input to the DISC market forecasting algorithm. The result is that the electrical distribution market forecast has been muted.

To resolve this, he and his team have created a DISC Electrical Industry PPI based upon trusted sources to better project the size of the market. He shares the what and the why with ElectricalTrends.

Bringing Better Data to the Electrical Industry – Introducing the DISC Electrical PPI

“Since 1985 DISC Corp has been providing the electrical distribution community with reliable forecasts. Our forecasts and models rely primarily on government issued data from the Census, BLS (The Bureau of Labor and Statistics), BEA (The Bureau of Economic Activity) and FRED (Federal Reserve Economic Data) among its primary components. These have proven to be reliable and consistent data sources.

“Since 1985 DISC Corp has been providing the electrical distribution community with reliable forecasts. Our forecasts and models rely primarily on government issued data from the Census, BLS (The Bureau of Labor and Statistics), BEA (The Bureau of Economic Activity) and FRED (Federal Reserve Economic Data) among its primary components. These have proven to be reliable and consistent data sources.

Since 2022, and the acceleration of blue ocean electrification initiatives post pandemic, we have noticed our forecast becoming misaligned with true market performance. This dislocation of data and forecasts with market dynamics led us to review the model, which we feel needs adjustment to keep up with the times.

As with much since COVID, change has been the name of the game for business dynamics, the economy, commodities, and our industry.

The adjustment takes two forms. One is the intensity of consumption of electrical supplies and the other is in how price is factored in.

The new electrification initiatives from 2022, as well as advancements in AI and the need for massive amounts of Data Centers, created the blue ocean of opportunity for the electrical distribution community. These initiatives are summarized as

- Inflation Reduction Act (IRA): Provided consumer tax credits for new EVs (up to $7,500) and incentivized domestic battery manufacturing, significantly accelerating EV adoption.

- Bipartisan Infrastructure Law (BIL): Allocated $7.5 billion for EV charging stations (NEVI Program) and funding for electric school buses, ferries, and port electrification.

- National EV Targets: The U.S. set a goal for 50% EV sales share by 2030, spurred by auto industry investments.

- State-Level Fleet Targets: States like Connecticut, Hawaii, and Maine enacted laws to transition state-owned vehicle fleets to EVs, with mandates for diesel bus procurement bans.

- Grid Modernization: The Department of Energy (DOE) advanced its Grid Modernization Initiative (GMI) to support integrating renewables and new loads like EVs.

- Corporate Initiatives: Organizations like EPRI (Electric Power Research Institute) focused on “Efficient Electrification” to explore electrifying end-uses like heat pumps for better efficiency.

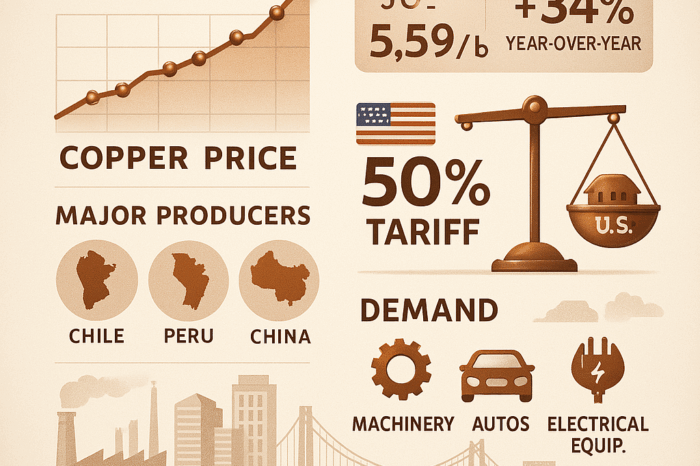

Price is a prime determining factor for forecasting our industry. Surges in copper, supply and demand have changed the price landscape substantially. The price surge in electrical parts distribution has been driven by a combination of supply chain disruptions, raw material shortages, geopolitical tensions, and increased demand for electrification. These factors are expected to continue influencing prices in the near term.

Key Events Driving Electrical Parts Price Surge (2022–2026)

- COVID-19 Supply Chain Disruptions

- Global supply chain breakdown: The pandemic triggered unprecedented labor shortages and logistics delays, hitting heavily import-reliant components in electrical parts distribution (e.g., copper wire, breakers, EV charging stations).

- Demand surge rebound: The post-COVID economic recovery in 2021 caused a sharp spike in demand for durable goods, overwhelming limited global capacity and exacerbating price hikes.

- Russia‑Ukraine War (Feb 2022)

- Energy cost spike: The conflict led to surging energy prices, raising production costs for energy-intensive products like steel and aluminum used in electrical parts.

- Raw materials bottleneck: Ukraine and Russia together accounted for significant shares of steel, aluminum, copper, neon, and krypton—critical for components and chip manufacturing. Their disruption triggered a sharp spike in input costs.

- Sanctions and transportation bottlenecks: EU and U.S. sanctions reduced raw material exports, further tightening global supply chains for metals and logistics.

- Raw Material Price Surges

- Aluminum & copper: Prices reached multi-year highs in early 2022 driven by post-pandemic demand, energy cost spikes, and geopolitical uncertainty. Aluminum peaked near $4,000/ton; copper exceeded $11,000/ton.

- Primary metals index U.S. Bureau of Labor Statistics reports primary metal import prices increased notably: +0.8% in 2022, –6.6% in 2023 and rebounding +12% in 2024—a volatile period.

- There were also transportation price increases

- Transformer and Cable Constraints

- Grid modernization boom: Strained by demand for renewables, EVs, data centers, and heat pumps, global transformer and cable demand doubled since 2021. Delays grew from 2–3 years pre-2022 to 3–5 years for critical grid components.

- Price inflation: Transformer costs increased ~75%, while cable prices nearly doubled since 2019 due to capacity constraints and surging demand.

- Semiconductor and Electronics Component Impact

- Semiconductor input cost spikes: Input costs (e.g., silicon, rare gases) rose sharply in 2022; semiconductor import PPI climbed ~2.4% in 2022, then declined due to easing supply issues.

- Tariffs & currency pressures: U.S.–China trade tensions introduced tariffs on semiconductors and related electronics, contributing to rising landed costs · Additionally, exchange rate fluctuations and inflation further elevated component prices.

- Broader Inflation, Tariffs & Trade Policy

- Global inflation transmission: Rising energy, labor, logistics, and raw material costs were passed through to manufacturing and distribution in 2022–2025.

- Tariff shocks: U.S. implemented 25% tariffs on steel and aluminum in 2022, with additional tariffs on EU and UK metal imports. Those tariffs increased domestic metal prices and spread cost pressure across electrical components.

Historically DISC had used the PPI to track price changes for industrial and construction products, excluding energy as our price reference. This historically was an input into our algorithm. This served us well up to 2022.

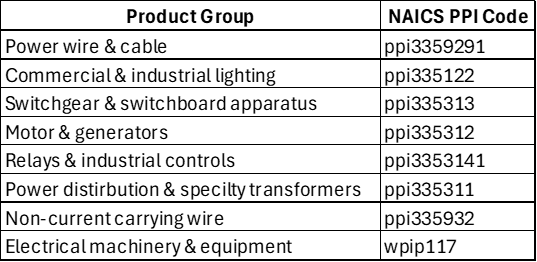

After a review of the broader picture, and accounting for the factors listed above, we concluded that it would benefit the industry to develop our own DISC PPI for Electrical Parts distribution by combining FRED PPI data for select product groups such as XYZ and others and weighting the PPI data against overall percentage of distributor sales by product category.

The chart below highlights how our new model would have, essentially, replicated the PPI for 27 years, hence proving its validity, but has since diverged, highlighting change in the marketplace.

Given this, we have moved to use the new DISC PPI moving forward.

What does this mean?

In practical terms, we’ve had to restate electrical industry performance from 2022. This means that the market, in dollars, is larger than previously projected. This does not affect individual company performance or even the number of units of a given product that may have been sold, just the overall value. Contact DISC to

And the difference in total market size is significant because it is cumulative. PPI Charts by commodity follow at the end of this report. Here are the products we used to calculate the new DISC PPI:

Take Aways

At the end of the day, the change

- Better states the size of the electrical distribution market by more fully taking into account the impact of inflation, whether it be due to commodities, labor, supply chain issues or other influences.

- The result for 2026 is that the electrical distribution market is bigger.

- A company’s sales do not change nor do the units that were sold.

- What does change is a company’s market share as your sales are now divided into a bigger number. But this is the same for every company in your market, so your relative position has not changed. Companies may need to adjust their goals (if they have them). A deeper analysis of your market may reveal that you have other competitors, albeit perhaps not significant players, but who are classified as “distributors” per the NAICS code, who are nibbling away at the market.

DISC is updating its databases to reflect the change and is sharing its 2026 forecast in the next issue of its Flash Report. If your company does not subscribe, I’d recommend that you do (annual subscription is only $895), even if only for the current issue (only $100). Click here to learn more.