Rexel 2015 Performance, 2016 Outlook and 5 Year Guideline

Rexel has had a busy first part of February. They’ve

Rexel has had a busy first part of February. They’ve

- Purchased a Rockwell distributor

- Released their 2020 roadmap (essentially a strategic plan)

- And provided their 2015 annual results which generated shares “plunge(ing)” last Thursday

So, as we typically do, we’ve taken a US perspective:

- The acquisition was of Brohl & Appell, a Rockwell distributor in Sandusky, OH (Great Lakes area). Brohl & Appell was an AD distributor with almost $27 million in revenues. Given that Rockwell has been undergoing a year long initiative to reauthorize / reappoint its distributors, this could have been part of the impetus to sell. Additionally, another element could be succession issues (which many distributors are either facing or need to address … and key manufacturers are inquiring.)

In this press release in Industrial Distribution, we also learn that about 15% of Rexel’s US business is “industrial automation (don’t know if this means Rockwell, controls or industrial). The acquisition adds 7 locations and Rexel plans to enhance the product mix of these locations.

- Roadmap to 2020:

- Seeking average annual organic growth of 1-2% (globally) with EBITDA a minimum of 2X sales growth.

- Looking to spend about $1.7 billion (US) for acquisitions, globally.

- Positioning as “value-added partner” to customers (and presumably suppliers)

- Focusing on energy, IoT and urbanization which requires building renovation and construction.

- Continue evolution to customer centric model. Focus on more, and higher, contacts with increased frequency

- Key markets

- Small & medium contractors to be “one-stop” shop

- Medium / large contractors for sourcing and support in complex projects

- Being an electrical specialist with segment specific applications

- Industrial automation solution provider

- MRO supplier for industrial accounts for cost optimization

- Serve OEMs with sourcing and supply chains solutions

- Key markets

- Enhance investments in marketing, services and eBusiness, inclusive of software tools for customers

- New IT and logistics infrastructure

- Globally, down 2.1% (constant and same day basis, up 5.6% overall, includes acquisitions and currency issues)

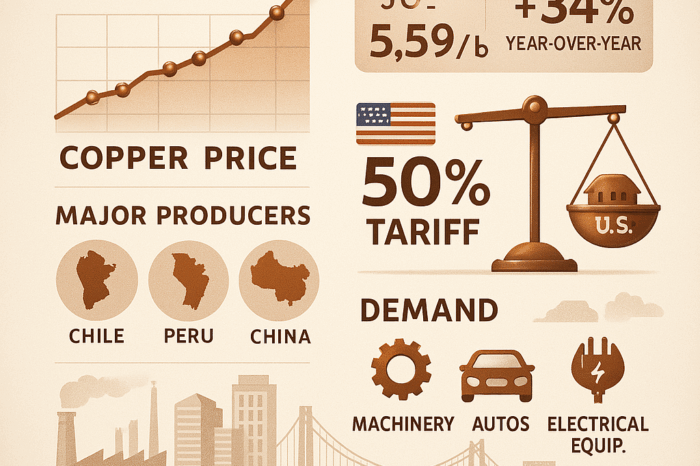

- For Q4, up 3.2% on a reported basis and down 2.9% on a constant and same day basis. Impact of copper was -0.9%

- North America is 36% of Rexel’s overall sales. (Europe is 54% of sales, hence Asia is 10% of sales)

- Q4 down 6.4% and down 5.2% for FY on a constant and same day basis

- Sales up 4.4% on a reported basis including positive currency benefits of 127.6 million euros

- Oil & gas down 37%, accounting for 3.6 percentage points of the drop

- The decline in copper contributed 1.9 percentage points to the decline, and

- branch network optimization resulted in 1.3 points of the drop

So, with the US down 5.9%-6.4% (as the numbers vary between their PPT and their press release, but there close, and these 3 segments / issues totaling 6.8 points, hence their construction business (commercial and resi) was essentially flat.

-

- Gross margin in North America was 21.6% for Q4 and 22% overall for 2015, a slight improvement of 19 basis points.

- North American EBITDA was 4% for FY2015, down 64 basis points (and Q4 was 3.9%)

- Canada is 21% of North America sales and were down 8.8% with a 34% drop in oil / gas, 90% drop in solar and 29% drop in mining

- “Distribution and administrative expenses in the US declined by 2.5 million euros in North America in Q4 based upon YoY

- “Completed ‘business transformation program in the US'”

- Performance down due to low copper, oil, Chinese economy and “uncertainty around North American industrial market” (the last part is interesting as in previous years Rexel commented about the slowdown in the US residential market)

2016 Outlook

Expect to be -3 to 1% for organic sales, globally inclusive of a -1.1% negative impact from copper (which, considering this is an annual number, is no change from 2015 and will further put pressure on distributor margins, in general.

They are projecting an average copper price of $4500/ton in 2016 (in USD), a 20% decline vs 2015

From what we hear from manufacturers, competitors and reps, Rexel appears to have “stabilized” albeit in many markets is not a top 1 or 2 competitor. Additionally, from reps we’ve heard about POS / POT reporting challenges and, in some instances, a hesitancy to support it material is in a regional distribution center and they question if they will be compensated. Hopefully Rexel is working on this issue (for Rexel and the reps’ sake”.)

What are you hearing / seeing from Rexel?