Electrical Contractors’ Buying Behaviors Are Changing

Back in the fall, HMI released a white paper, researched and written by Channel Marketing Group, titled “6 Contractor Trends Affecting Distributor Relationships”.

The report focused on 6 specific areas that over 750 contractors from a number of construction industries. The six highlights were:

- Channel erosion is continuing, and possibly accelerating although distributors retain 72% of contractor spend but direct, DIY and online are growing.

- The definition of loyalty to contractors is not sole-source. 53% are “loyal” to 1 or 2 distributors with the average contractor purchasing most of their material from 3.5 distributors.

- People and process are important to contractors. It is still a people business but the “people” who are important today are more likely to be an inside salesperson.

- 65% of respondents shared they are doing some online purchasing.

- 61% of contractors have been involved in an incentive program and 73% state a program could influence their purchasing decisions.

- Contractors are becoming more adept at marketing.

These were the macro takeaways (and yes, the electrical industry could learn some tidbits from other industries.

HMI, the white paper’s sponsor, dived deeper into the data to share findings from electrical respondents:

“As you read, HMI commissioned Channel Marketing Group to conduct a survey of contractor buyer preferences across a range of industries. Among these were HVAC, roofing, landscaping, and electrical supply – and today, we’d like to focus in on the feedback we received from electrical contractors.

The respondents in the electrical industry were mostly the owners or presidents of small businesses (earning less than $5 million in revenue with an electrical spend of typically $1-2 million). So, what makes electrical contractors buy? What specific buying preferences do decisionmakers in electrical contracting have that their suppliers should be aware of?

The Key Differentiator: It’s Not About Price

Earlier this year, we covered some of the major trends in the B2B electrical supply industry, one of which was the importance of customer service. With all other factors being held equal (or even if your competitors have slightly better prices), outstanding service makes your company stand out in a crowded market.

That idea was very much supported by HMI’s research. When asked about the two most important reasons they choose to purchase from one distributor over another, the majority (about 53 percent) of contractors highlighted the relationship and trust they have with their distributor’s key inside salesperson. That’s actually a bit higher than the numbers for all of the industries, with only about 45 percent of contractors overall selecting the same thing.

Similarly, the second most popular choice for electrical contractors was the distributor’s ability to perform day in and day out (about 46 percent, compared with about 38 percent overall). Only around 9 percent of electrical contractors picked low prices as a key reason to purchase from a specific distributor.

Much as we tend to give pricing all the focus, it’s vital to remember that it’s not the most important thing sometimes. Business is still conducted between people, after all, not computers, and people don’t want to spend the majority of their waking life dealing with channel partners who are unhelpful, rude, or uncommunicative. As we move further into the era of eCommerce and digital exchange, the role of the salesperson will increasingly be to represent the human face of the distributor.

eCommerce and Online Info Gathering

When it comes to business in the digital realm, smaller electrical contractors are slightly ahead of their fellows in other industries. The vast majority still buy over half of their product from traditional distributors, but 74 percent of them reported buying between 1-25 percent from online-only retailers (compared with 62 percent across all industries reporting the same category). While online purchasing currently only represents 2% of distributor sales, according to electrical industry sources, it is interesting to note that online information gathering has risen in importance. More on this later.

Most B2B business is still conducted in the physical world, but the digital transformation seems to be creeping slowly into the electrical industry in the form of information gathering, as online-only retailers seem to be present to highlight other purchasing options for contractors.

When asked what electronic tools they use to purchase products from retailers or distributors, smaller electrical contractors highlighted the website as their preferred method (around 54 percent, compared with just 42 percent overall). The most popular reason for these contractors to use a distributor’s website was to place orders – that option was picked by 31 percent of electrical contractors, compared with 18 percent overall.

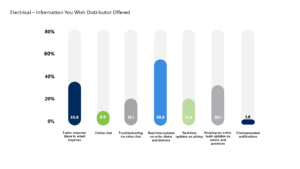

Online ordering is evidently a vital piece of small contractors’ decision-making. When asked what information they wish their distributors would provide, the majority (around 59 percent) selected real-time updates on order and delivery status, followed by faster response times to email inquiries (34 percent) and keeping the contractor’s whole team up to date on orders (32 percent).

These responses may indicate the somewhat transitional stage that many business find themselves in at the present moment, where they’re starting to build out their eCommerce capabilities but haven’t quite got it streamlined yet. Rome wasn’t built in a day, and eCommerce is turning out to be an individual Rome for each distributor working on that transition.

However, that challenge can be somewhat mitigated by focusing on what improvements contractors are most clearly asking for – in this case, it seems that what electrical contractors most want from their distributors is the rapid and convenient communication that digital offers.

Conclusion

Contractors have various wants and needs that distributors should be able to anticipate and satisfy if they want to really stand out amongst the competition. Outstanding customer service and fast, clear communication are differentiators that take sales transactions a step beyond the basic, computational exchange of dollars.

For more insights on the buying preferences of contractors across a variety of industries, download HMI’s full report here.