Targeting Can Generate Higher Sales and Profits

Recently I spoke with a manufacturer about the market and he commented that they are seeing a number of very large projects (he actually said “it seems like there are more with extra 0’s attached”) but seeing less overall projects.

Recently I spoke with a manufacturer about the market and he commented that they are seeing a number of very large projects (he actually said “it seems like there are more with extra 0’s attached”) but seeing less overall projects.

The inference is the market is slowing.

Whether it is slowing due to the “effectiveness” of the Fed, the challenge in getting labor, the impact of continued supply chain (switchgear) issues or something else, the end result is the market is tightening.

Coupled with this is that many manufacturers over the past few years have tightened eligibility of their marketing co-op / MDF / BDF programs and are focused on the ROI of their marketing co-investments.

Further, distributors are seeking to generate greater ROI from their people and technology investments, both of which have come at higher costs over the past few years.

And then we have consolidation …

The end-results are all want more from their current investments and there is a greater focus on using data (after all, why invest in all of the software tools if they are not used) to target sales and marketing efforts.

In sales and marketing parlance this is called Account-based Marketing and Account-based Selling.

It can become very targeted – it can be for vertical markets, and/or it can also be referred to as segmentation marketing. They key is using the data you’ve gathered, analyzing it, and identify trends (or sometimes lack of expectations) to identify segments that can be marketing to, enabling awareness to be generated so that sales can then proactively seek to close opportunities.

Distributors who become proficient in this can accelerate growth and take market share.

But it all starts with having a plan and both the marketing AND sales groups being able to execute.

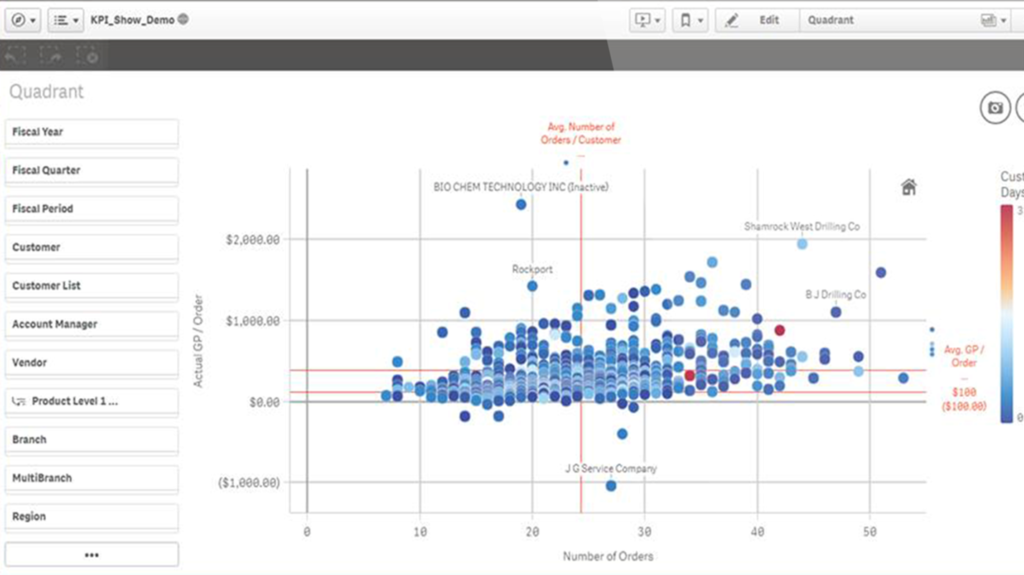

Sales Management Plus (SMP)’s tools have helped their clients become proficient in this endeavor. Jason Birch shares some of SMP’s experience.

Want More Sales? Higher Order Size? Target Buying Behavior

Segmentation is all about data analysis at the customer level. Having hypotheses, conceiving strategies and then doing some research to determine groups of customers that you can market to and/or call on. Segmentation is a powerful tool for electrical distributors, allowing them to better target their marketing efforts by focusing on the needs and wants of specific customer groups. One of the most effective ways to segment customers is by using buying behavior, or sometimes lack of buying behavior (i.e. customers who buy X but don’t buy y … buy only conduit but no fittings? Huh? Wire and no connectors?) as a criterion.

In a recent survey of the use of targeted marketing in distribution, it was found that segmenting based upon buying behavior had the single greatest impact on any benefit of any segmentation method.

Customers were 4.5 times more likely to see increased order profitability and 2.5 times more likely to experience higher order sizes when segmenting based upon buying behavior. In this article, we’ll explore the benefits of using buying behavior in targeted marketing and discuss how businesses can harness this information to improve their marketing efforts.

An Advanced Technique Made Simple with SMP

Segmenting by buying behavior is a more advanced technique than typical customer profile (industry served, geography, size, or role) segmentation. It requires point of sale data and careful analysis to uncover the buying patterns and preferences of customers, enabling companies to deliver highly tailored offers and messages.

Studies have shown that this method of segmentation significantly boosts order profitability (GM$/invoice). Distributors might be worried that this type of segmentation can involve large amounts of data and may require additional resources to implement. Fortunately, solutions exist that make it easy to leverage buying behavior with easy to use tools. SMP is one such solution which brings not only powerful technology and ease of use, but also access to distribution sales and marketing expertise, having worked with electrical distributors for almost two decades.

To ensure success, it is important to thoroughly analyze all available data to create accurate customer segments. Distributors should be sure to regularly review their segmentation strategy in order to remain up-to-date with changing consumer trends and buying patterns. With the right approach, segmenting by buying behavior can be a powerful tool for boosting profits.

Personal Offers are Key

Segmenting customers by their buying behavior provides the highest impact on order profitability because it allows distributors to craft personalized offers that are less sensitive to price and target the right customers at the right time. We have seen SMP users zero in on customers who are buying cable without conduit, conduit without boxes for example, and offering those customers incentives to buy the complementary items. Companies who do this can capture more orders with each customer and increase overall profitability.

A Quick Route to Higher Gross Dollar Profitability

Adding an extra item to every fifth order can drastically increase your profits. For example, if a distributor writes 100,000 orders per year and can add an extra line to just 1 in 5 of those orders, profit dollars jump significantly. Assuming an average order size of $375 and a typical gross profit margin of 20%, that extra item will results in an additional $1.5 million in gross profit.

With access to the right purchasing, profiling, and behavioral data, it’s easy to determine which orders are most likely to benefit from this strategy. On average, adding a single line per order on every fifth order can result in 40% more profits. Small changes like this can make a big difference in overall sales and help your business grow. With the right data and analytics tools, it’s easy to make well-informed decisions about which orders to add the extra line to and maximize profits.

By leveraging insights from your purchasing, profiling, and behavioral data, you can easily identify opportunities to increase profits by adding a single line per order. This kind of analysis will help you determine where to add the extra line and make sure that you’re making the most of your resources. Best of all, you’re adding revenue without a significant increase in the cost of that order.

Many SMP customers have leveraged the solution to do this. During a recent account review with a major Massachusetts-based electrical distributor, we heard from their VP of sales how they use SMP to analyze buying behaviors, paying particular attention to opportunities to upsell customers to a higher margin product line. This analysis is shared with their preferred supplier who then offers marketing support and rebates to help secure the upsell. The distributor then loads the targets for upsell activity into SMP and this helps the sales team manage the process, track their success, and provide accurate and timely feedback to their supplier.

Analysis with Action

With business slowing, distributors need to arm themselves with tools that can quickly analyze data and, based upon the right “questions”, provide guidance on where there is opportunity. The old phrase “there’s gold in them thar mountains” is accurate … your customers represent opportunity. The question becomes how do you mine the data to penetrate your customers and generate greater share within each account?

Moving forward, marketing must be actionable, and it is important to “dollarize” initiatives. The typical distributorship has a small percent of their accounts assigned to outside salespeople and a small percent of accounts are responsible for 90+% of sales. Marketing should have a sales responsibility to pursue the non-assigned accounts.

Tools like SMP can help you target customers, giving you a better opportunity to target sales and profit growth.