Observations From the Last NAED Eastern – November 2023

Last month’s NAED Eastern brought an end to an era. NAED announced that this was the last NAED Eastern and the Eastern region will be merged with the NAED SouthCentral, hence the next regional endeavor for attending distributors will be February 2025 when they join distributors from the South and the Central to meet with manufacturers February 17-19 in Tampa, Florida (it will be interesting to see the operational dynamics of more distributors, from multiple territories, meeting with the same manufacturers, who may need to bring an additional regional, meeting over the same number of days, with most manufacturers having the same number of meeting slots … but that’s a story for another day.)

Last month’s NAED Eastern brought an end to an era. NAED announced that this was the last NAED Eastern and the Eastern region will be merged with the NAED SouthCentral, hence the next regional endeavor for attending distributors will be February 2025 when they join distributors from the South and the Central to meet with manufacturers February 17-19 in Tampa, Florida (it will be interesting to see the operational dynamics of more distributors, from multiple territories, meeting with the same manufacturers, who may need to bring an additional regional, meeting over the same number of days, with most manufacturers having the same number of meeting slots … but that’s a story for another day.)

While a number of people said, “one less conference”, a senior member of one distributor lamented the passing of the conference as he felt that the Eastern was an opportunity to spend more time with key suppliers. This company is a member of a marketing group, but he said “17-minute meetings are not enough time to accomplish anything other than setting up the next meeting. At the NAEDs I could meet with key suppliers to get more insights from them.” And this individual was someone who is in the C-suite but not CEO, sales or purchasing … so he doesn’t get the “attention” of manufacturers.

There were about 136 distributor registrants from about 53 distributors / operating companies and 267 manufacturer registrants. There were about another 100 people who were service providers, independent manufacturer representatives or individuals from marketing groups.

Heard around the conference

The following are some things that I heard around the conference.

- Most distributors have seen the market slowdown in the past month or two and expect the market to be flat next year. For many, this year will be flat or mid-single digits.

- Manufacturers are seeing the same. Those with growth goals are focused on the industrial market, are launching new products, are targeting specific verticals / niches, and/or expect to win big in some of the “unicorn” (large) projects in the area.

- From manufacturers I heard flat to 3-5%. Many expect to go back to historical price increase trends … early winter and a nominal increase.

- Don’t ask a switchgear or transformer manufacturer when deliveries are going to get better (some companies and certain product categories are much better than others.) I heard one of the leaders quoting 90 weeks for some products and a transformer company, for some products, talking “years”. The reality is these companies can’t build them fast enough nor have the capacity for the demand. Demand is being driven by the industrial construction market, extremely large projects, data centers, the EV market (and every segment of it) coupled with the challenge of finding factory workers.

- Heard of a few more manufacturers interested in understanding their market share and share by territory. Companies are becoming more data-oriented. They will be using this to align efforts with their manufacturer representatives. (Note: CMG also supports manufacturers and reps in this area, frequently using data from DISC so that a common database is used among manufacturers, reps, and distributors.)

- Heard of another manufacturer coming to market with PVC-coated products.

- POS continues to be an issue due to “traveling / large contractors.” A quasi-national distributor commented on providing rebates to contractors who are outside of their “core” markets and a reluctance to share information with reps in those markets (where they have no physical presence.) Another rep talked about POS reporting from a factory that is selling to a distributor who is not authorized in their market but brings material in from their CDC / RDC. These are examples of what is / will occur, and is challenging manufacturers, due to distributor expansion.

- NAED met with some manufacturers and distributors to present the “benefits” of contributing to the “Next Level Now” campaign. The association is soliciting “millions” in funding for its digital initiative. It will be interesting to see what their roadmap is, and which distributors / manufacturers commit to implementing the deliverables, not only funding it (as companies also fund to be “politically correct.”)

- Heard about “quiet” layoffs occurring among manufacturers and distributors. It’s more “pruning” as no one has seen WARN notices. Graybar reportedly recently laid off a number of people with someone commenting “at least one per branch.”

- Manufacturers are seeing an increase in SPA requests, with some also promoting utilization of them. It’s an issue of how to improve margin and win business. The benefit of SPAs is targeting the initiative as well as ensuring utilization of the SPA (and limiting the number of SKUs on the SPA.)

- Had three companies ask about our Customer Satisfaction Strategy which generates a CSI (Customer Satisfaction Index), indicating that companies want to hear how they are performing so that they can “meet customer expectations.”

- A number of manufacturers commented on distributors’ inventory rightsizing with one commenting that Sonepar has “massive rightsizing of their inventory.”

- A number of manufacturers talked about vertical marketing and developing tools for them / distributors to use to pursue specific verticals that they believe represent growth for them. The challenge, for many, will be which distributor(s) in a market to align with. Further, for distributors, the ability to execute on pursuing a vertical can be challenging as it requires market research, databases, sales force targeting and more. (if interested, give a call as there are ways for both to approach it if willing to be “bold”.)

- More of the “larger” manufacturers are deploying sales resources to call on key end-users, engineers, contractors, and EPC firms to supplement their manufacturer sales agents. When asked why, the feedback is that these sales / application engineers are more technical and that they know distributors are not reaching these audiences to create demand AND they need to expend the effort to ensure brand support as they are not confident that distributors support “a” manufacturer (except maybe gear), so they need to be the brand influencer.

NAED Content

While I didn’t get to attend the NAED keynote speaker or the various other events, Adam Sparks, Senior Account Executive, from ProKeep and Will Quinn from Infor, who attended these sessions, graciously offered to write their perceptions of the sessions.

Regarding the keynote, I heard, essentially, “okay”. It was better than some of the past speakers but nothing that was overly memorable or “take home” value. It was about managing change (which seemed a little late given that people feel Covid is well in the past and we’ve survived much of the supply chain issues.) Unfortunately, this time slot has been a lost opportunity.

Futures Group

Adam sat in on the Futures Group and shared this input:

“Purpose: this is a summary of the Futures Group Round table Discussion held at the NAED Eastern Regional Meeting in Marco Island.

Overview: NAED’s Future Group brought together conference attendees to discuss challenges and opportunities the electrical industry faces.

Topics Discussed:

- Talent and Innovation: Building a 21st Century Team

- Electrification: The $275 billion Opportunity of Electrification

- Digital Transformation: Where is your company on their digital transformation journey

Talent and Innovation: Building a 21st Century Team

- During this break session distributors around the table discussed how to recruit, develop, and retain talent.

- The big takeaway is that electrical distributors need to lean on associations such as NAED, NEMA, NECA, & IEC to work with city/county school boards to incentivize high schools to add more vocational classes/subjects specific to the electrical industry to curriculums across the US. This ultimately could lead to higher attendance rates for vocational/technical colleges.

- Furthermore, parts of this discussion lingered around the transfer of knowledge between senior and newer generations, which ultimately leads to onboarding and hiring the right people.

- Distributors need to double down on how they onboard young talent, as well as offer internships and training programs that can help develop talent.

- Who better to lead these programs than people who have been in the industry for decades and are on their way out. Capturing and transferring years of tribal knowledge.

Electrification: The $275 billion Opportunity of Electrification

- The future of electricity is defined by electrification, renewable energy, distributed power, and decarbonization creating opportunities for selling new products and services. The federal government has committed $28B in building retrofits and energy efficiency, $67B in manufacturing, and $7.5B in funding for a national EV infrastructure network.

- Distributors further discussed the importance of skilled and talented people that will help their businesses to continue to innovate in these spaces.

- Many distributors are already in the beginning stages of getting ahead of the curve in this regard, offering services that go up and down the vertical to capture more wallet share from their customers. Many already have and are continuing to hire electrical engineers, as well as continuing down their digital transformation journey and looking into AI.

- With the use of AI upstream, distributors can better predict the materials and lead times associated so they can be better prepared to serve the future of electrification without being as dependent on manufacturers

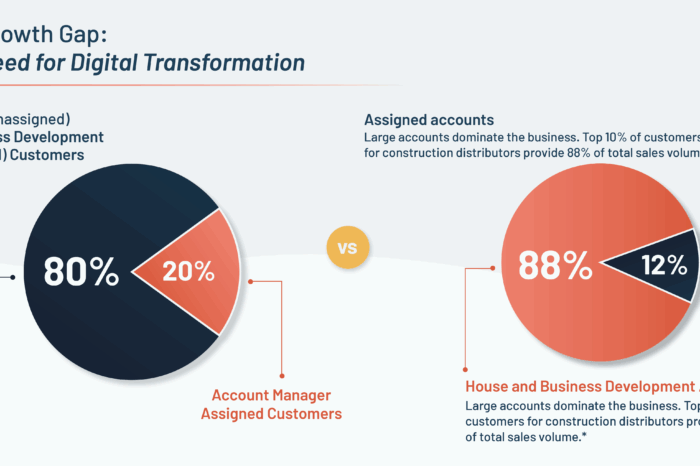

Digital Transformation: Where is your company on their digital transformation journey?

- Digital transformation is underway, marked by the growing importance of mastering data capabilities for running our businesses, selling online using artificial intelligence (AI) for smart pricing, guiding purchases, and directing sales activities. Today, members mainly adopt digital technologies driven to stay current or catch up instead of fitting technology to a new purpose or competitive strategy.

- Broadly discussed topic and probably nothing new here, but now more than after distributors have to do something to stay competitive. Incremental value adds across all departments as well as the big projects to tackle efficiency are the forefront of all digital transformations

- One table discussed the importance of having an end goal, and with every purchasing decision asking, “does this help get us closer to our end goal?”.

- Distributors should continue to self-source for technologies that address their specific needs, and lean on their buying and trade associations for the latest technologies that can help them stay ahead of the curve.”

Technology & Service Providers Panel

Will, coming from Infor, has his pulse on technology and shared his input from NAED’s Technology and Services Providers Panel:

“The Business Solutions with Technology & Service Providers Panel at the NAED 2023 Eastern Region Conference provided a compelling discussion on the pivotal role of technology and services in streamlining business processes, digital transformation challenges, and the application of artificial intelligence (AI) in operations. Notably, the panelists addressed the critical need for change management in digital transformation and how to prioritize competing technology efforts effectively.

Overview of Service/Technology and Addressing Pain Points:

Denise Keating, VP of Customer Success at IDEA, emphasized the importance of addressing industry pain points through technology. While IDEA focuses on standardized product information and digital commerce solutions, Denise highlighted the need for change management to ensure that distributors fully embrace these tools and realize their benefits.

During the panel discussion, Will Quinn, Director of Industry Solution & Strategy at Infor, highlighted a critical aspect of Infor’s industry-specific ERP solutions. He emphasized that Infor’s solutions come with prebuilt industry best practices integrated into the software, significantly accelerating the time businesses take to realize value from their technology investments.

Quinn pointed out that electrical distributors and manufacturers have distinct business requirements due to the nature of their operations. Infor’s solutions are tailored to meet these unique needs in both industries. This customization ensures that businesses can benefit from a software solution that is not only aligned with their specific processes but also optimized for efficiency and productivity right from the start.

By incorporating industry best practices and catering to the unique requirements of each sector, Infor’s ERP solutions offer a fast track to value realization. This approach reduces the need for extensive customization and allows businesses to adapt to the software quickly, ultimately streamlining their operations and enhancing their overall competitiveness in the marketplace.

Jacqueline Calza, Executive Account Manager at PROS, underlined the role of pricing optimization in addressing pain points related to pricing inconsistencies. She emphasized managing change when introducing dynamic pricing and AI-driven solutions within distribution organizations.

Greg Preuer, VP of Strategic Accounts & Initiatives at SPARXiQ, highlighted the importance of data analytics and actionable insights, which often require cultural changes within an organization to prioritize data-driven decision-making effectively.

In digital transformation, organizations need to have a clear end goal that aligns with their company vision. The panelists at the NAED 2023 Eastern Region Conference stressed the importance of this alignment, emphasizing that a well-defined end goal serves as a guiding light throughout the transformation journey. Here are some key points they discussed:

- Aligning Digital Transformation with Company Vision: Digital transformation should not be pursued for its own sake but as a means to fulfill the broader vision and goals of the organization. Having a well-defined end goal that aligns with the company’s vision. This ensures that every step in the transformation process contributes to realizing strategic objectives. It’s not just about adopting new technology but about strategically leveraging it to drive business growth and competitive advantage.

- Listening to All Stakeholders: The panelists acknowledged the importance of listening to proponents and opponents of the proposed changes. In digital transformation, not everyone may immediately embrace the changes, and some individuals or teams might have reservations or concerns. Listening to these perspectives is essential. It allows organizations to address concerns, gather valuable insights, and build a more inclusive transformation strategy. By involving all stakeholders, organizations can ensure that the transformation process is well-informed and considers diverse viewpoints.

- Staying Focused on Goals: Maintaining a laser focus on the goals of digital transformation is crucial. The panelists stressed that it’s easy to get distracted by the many tasks and changes associated with transformation. To prevent burnout and ensure employees are engaged in the process, it’s essential to avoid simply piling on more responsibilities. Instead, organizations should prioritize initiatives and tasks, ensuring that each directly contributes to achieving the transformation goals.

- Building a Culture of Adaptability: Digital transformation often necessitates a significant cultural shift within an organization. The panelists emphasized that fostering a culture of adaptability, continuous learning, and open-mindedness is critical. This culture encourages employees to embrace new technologies and processes, adapt to change, and be receptive to innovative ideas. It also promotes an environment where employees feel safe contributing their insights and are encouraged to participate actively in the transformation journey.

- Prioritizing Change Management: The panelists underscored the importance of making change management a central element of the digital transformation strategy. Change management ensures that the cultural shift required for successful transformation is well-planned, communicated, and executed. It involves providing the necessary support, resources, and training to help employees adapt to new technologies and processes.

In summary, the panelists at the NAED 2023 Eastern Region Conference emphasized that digital transformation is not just about technology: it’s about aligning with the company’s vision, listening to all stakeholders, staying focused on goals, nurturing a culture of adaptability, and prioritizing change management. By following these principles, organizations can overcome the challenges of managing change and successfully navigate the path toward digital transformation while ensuring the well-being and engagement of their workforce.”

Needless to say, it was a busy event.

If you attended, what were your observations?