Q1 Earnings – AD, Grainger, Graybar, Rexel, Wesco and Emcor

Over the past few weeks companies have been releasing their quarterly earnings, which enables a peak into performance and strategies and gives the opportunity to identify any trends.

Over the past few weeks companies have been releasing their quarterly earnings, which enables a peak into performance and strategies and gives the opportunity to identify any trends.

Kevin Coleman, formerly Director of Market Intelligence for Signify, supports Channel Marketing Group, and our clients, with various research initiatives.

He has been diving into all of the reports, First we’re sharing his findings on a contractor (EMCOR) and various electrical distributors. I’ve then added some observations / commentary. We’ll be sharing information on manufacturers in the coming week.

EMCOR Group, headquartered in Norwalk, CT, a conglomerate with expertise in planning, installing, operating, maintaining, and protecting systems that create facility environments—such as electrical, mechanical, lighting, air conditioning, heating, security, fire protection, and power generation reported 1Q25 earnings on April 30. EMCOR is structured into three divisions, Construction, Building and Industrial Services, and operates through many companies, including Dynalectric, Shambaugh, Ohmstead and other local and regional operating companies.

Revenues increased 12.7% to a record $4.87 billion driven by driven by the U.S. Electrical Construction and U.S. Mechanical Construction segments, which had year-over-year revenue growth of 42.3% and 10.2%, respectively, and operating margins of 12.5% and 11.9%, respectively. On the back of sales growth, EMCOR had a 26% increase in diluted earnings per share to $5.26.

Backlog, or what EMCOR calls “Remaining performance obligations” were a record $11.75 billion, growing 28% or $2.57 billion year-over-year. From a market sector perspective, EMCOR “experienced increases in the majority of the sectors in which it operates, with the most significant growth coming from Network and Communications, Healthcare, Manufacturing and Industrial, Hospitality and Entertainment, and Institutional. Such increases were partially offset by reductions in RPOs within the High-Tech Manufacturing and Commercial market sectors.”

There were a few challenges, namely, the Industrial Services segment was impacted by a slow start to the turnaround season due to frigid January weather in Texas, and there was an increase in the allowance for credit losses in the Industrial Services segment, the US Building Services segment faced headwinds due to reduced site-based revenues, resulting in a 4.9% decrease in revenues and high-tech manufacturing backlog/RPOs decreased, although the company remains optimistic about future awards in this sector.

Observations – perhaps a slowdown in new data center orders (unless this is categorized under Network and Communications) but, with such a backlog, perhaps more timing than anything. Growth in the manufacturing / industrial segment is a positive. It also highlights that large projects gravitate to large contractors.

Grainger

Grainger announced 1Q25 earnings on May 1, 2025, of sales of $4.3 billion, up 1.7%, or 4.4% on a daily, constant currency basis, driven by strong online demand and diluted EPS of $9.86, up 2.5% compared to the prior year quarter. This exceeded estimates of $9.46 per share, however the revenue estimates fell a bit short of expectations.

In the High-Touch Solutions – N.A. segment, sales were down (0.2)%, or up 1.9% on a daily, constant currency basis, year-over-year driven by growth across all geographies. In the Endless Assortment segment, sales were up 10.3%, or 15.3% on a daily, constant currency basis, year-over-year, driven by strong performance at both MonotaRO and Zoro.

Grainger reaffirmed its 2025 cautious guidance from earlier in the year, which incorporates known impacts of tariffs today and assumes that mitigating actions help offset future potential impacts.

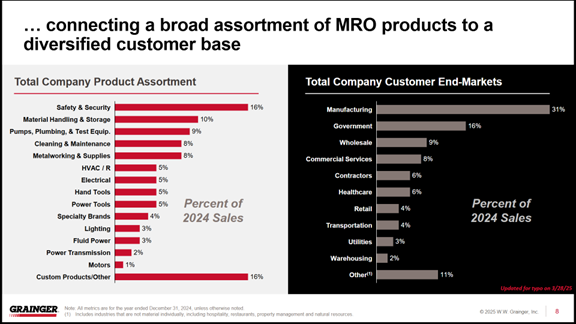

The following shows the breakdown of Grainger’s sales

Observations – High Touch for Grainger is their core business that is typically “in-plant” and serving the Fortune 500 companies. It also includes www.grainger.com. Their Endless Assortment is what could be called, “non-Grainger branded”, hence Zoro and MonotaRO (which is in Japan). Historically this is small and mid-sized customers who purchase periodically.

The core business, which is most comparable to an electrical distributor’s standard customer, has slow performance in Q1.

The other business is akin to the unassigned accounts from electrical distributors. We recently conducted research that highlights this is an opportunity for distributors … to serve their unassigned accounts, which are frequently institutional or commercial accounts. With the right eCommerce strategy, distributors could offer an array of product categories (but not stock them.)

On the chart it is interesting to note that the electrical and lighting markets total 8% of Grainger’s sales. Add in hand tools, power tools, and motors and there is another 11% of sales, so, theoretically, electrical distributors carry up to 19% of Grainger’s offering. (It won’t be perfectly equivalent due to specialized tools as well as motors for different industries / applications.)

Also notice that 31% of their business is in Manufacturing with another 16% in Government. Depending upon what percentage is federal, will there be a DOGE effect? If tariffs drive US industrial production, this could be beneficial for Grainger.

WESCO

WESCO, on the other hand, had a mixed quarter, exceeding revenue estimates but missing earnings per share. Overall sales were flat at $5.3 billion, with organic sales up 6% driven by 70% growth in data center sales and high single-digit growth in the Broadband and OEM businesses but offset by the Integrated Supply divestiture and foreign exchange headwinds impacts.

WESCO reaffirmed full year 2025 outlook based on positive momentum from the first 4 months of the year. Backlog increased in all three WESCO business units. WESCO increased inventory to help manage potential supply chain impacts of global tariffs and will focus on other activities under Wesco’s control in the uncertain and volatile environment including cross-selling, an enterprise-wide margin improvement program, and operational improvements resulting from business transformation initiatives.

Gross margins declined, leading to a decrease in Adjusted EBITDA. This primarily reflected a $6.9 million increase in SG&A expenses driven by higher facilities and transportation costs that were partially offset by lower payroll expense, a $6.3 million decrease in net sales, and a $6.0 million increase in cost of goods sold related to increased large project sales to customers.

Observations – While WESCO’s overall performance was muted, this is due to divisional performance. Its EES (Electrical) group was up a modest 3% in Q1. Nothing to write home about, however, positive given the challenging Q1 environment as defined through weather and the tariff overhang which started in February.

The data center business is strong, although much of that is captured in the other segments, but it further highlights that this business goes to the largest distributors.

The company apparently invested into inventory in preparation of tariffs.

AD

AD reported member sales in 1Q25 increased 23% to a record $24 billion across the group’s 14 divisions and three countries. AD welcomed over 550 new members in the first quarter through both organic growth and the IMARK Electrical merger. AD members also acquired another 10 companies outside of AD.

Same-store sales increased by 2% in the U.S. Within AD’s nine industries, same store growth in Plumbing, PVF and HVAC were the most robust. Member purchases from AD suppliers grew 19%, a strong metric for share of wallet.

Observations – While the sales growth looks great, the topline “performance” is distorted by the IMARK merger which generated much of the revenue and membership growth.

The same-store sales information is of greater interest. With the same weather impact and tariff overhang, coupled with the roller-coaster performance of copper, the group, was up only 2%. It’s reference to three divisions that being more robust could be indicative to flat / nominal electrical performance.

One the positive side, the impact of electrical acquisitions was negligible as only Schwing was sold outside the group (to Rexel at the end of the quarter) and Wiseway made a small acquisition of a former IMARK member.)

As noted with Wesco, and is evident in Graybar’s results, the large data center projects seem to go to national chains. While some independents participate, the impact is not as noticeable. Part may relate to contractor-alignment; part may be to size of project and hence project / order financial considerations. Perhaps AD could develop initiatives to increase independent distributor visibility / viability at the largest contractors?

Graybar

Graybar reported 1Q25 sales were $2.95 billion, a 7.9% increase year-over-year. Profit for the quarter was $100.9 million, down 4.1%, attributable in part to continued investments in Graybar Connect, a multi-year digital transformation initiative.

Graybar, which was the first wholesale distributor to adopt SAP enterprise-wide, is implementing advanced technologies, streamlined business processes, and faster, easier ways to get work done. At the core of the project is a transition from SAP ECC to SAP S/4 HANA. Other technology platforms, including Salesforce, will be combined with SAP into a personalized dashboard for each employee, providing the resources they need to serve each customer. Graybar Connect will also incorporate AI to automate routine tasks and providing faster access to data and insights.

Observations – Graybar performed the best of all of the distributors, and their contractor business mix is the highest of the companies mentioned here. Perhaps an indication of success with large contractors / large projects? Perhaps benefiting from Schneider Electric’s improved supply chain performance? Or Schneider brand preference within data centers?

Rexel

During the first quarter of 2025, Rexel’s same-day sales returned to growth for the first time in a year, posting +1.4% increase. North America up +3.8% on a same-day basis to 2.15 billion Euros, driven by good backlog execution of non-residential projects. US sales were 1.79 billion Euros, or 83% of North America’s total, and grew 4%.

In the US market, project activity continued to be driven by strong backlog execution boosted in particular by non-residential end-markets. Quotation activity remained good with positive growth across all three markets – nonresidential, industrial, and residential – supported by datacenters and manufacturing. Rexel called out favorable momentum in the Southeast region (incl. Mayer) and in the Northeast both boosted by datacenters and new manufacturing plants (NY?).

Digital sales increased by +112bps in North America and represented 23% of Group’s sales.

Rexel reaffirmed 2025 guidance amid the uncertain macro-political context and the impact particularly of tariffs on sales and profitability in the US.

Observations – While at first glance Rexel’s North American performance appears to be the second best of the distributors mentioned, last year they acquired Talley, which diversified their business into a non-electrical segment. This can help “tweak” performance. They do mention data centers and the industrial market, again highlighting that large distributors / chains may have an advantage in the data center market … either at the contractor or key manufacturer level.

Overall Take Aways

- On the digital side, Grainger, Graybar, Wesco, and Rexel highlighted performance and investments. Whether there is any organic growth or transference of order methodology is unknown (excluding Grainger Endless Assortment) but it highlights that customers are desiring to consummate orders electronically (it’s questionable if these companies would share metrics that show customer and revenue generation.) The takeaway here is that ongoing digital investment is required by distributors. Whether it is to meet customer expectations, reduce operating costs, increase productivity, generate capacity, or something else, digital investment is not an option and, if you do not have a strategic technologist in this area, you’re already behind.

- Aside from Graybar’s performance, the Q1 trend was “slow.” In talking to other distributors, many exhibited this also. The “share winner” from these organizations was Graybar, however, every market, as distributors know, is local.

Given tariff uncertainty and weather that affected much of the country, and that Q1 is typically the slowest quarter, not bad results … and definitely not bad enough for some of the concern we’re hearing from some manufacturers that have pushed through price increases during the “tariff pause” (as an aside, given the current 90 day reversal with China, will manufacturers change their pricing again?) and are selectively pruning (and some more so than others) personnel to reduce costs.

If you’re looking for strategies to consider for the second half of the year that will pay longer-term dividends, consider reviewing some of the digital research that relates to contractor usage of eCommerce, market segmentation / demand generation research and customer loyalty research we’ve recently conducted and shared.

How was the market for you? Is your company panicking or confident in its strategy and seizing opportunities to support future growth?