Resideo Record Sales; ADI Spin Off Future Acquirer?

Resideo, the former Honeywell Homes and ADI Global Distribution business that was spun off as a separate entity in 2018, is a provider of home automation, air temperature and quality and humidity control and security systems, announced 2Q 2025 earnings on August 5. Kevin Coleman took a deep dive into the earnings report and shares his findings.

Resideo, the former Honeywell Homes and ADI Global Distribution business that was spun off as a separate entity in 2018, is a provider of home automation, air temperature and quality and humidity control and security systems, announced 2Q 2025 earnings on August 5. Kevin Coleman took a deep dive into the earnings report and shares his findings.

Record Revenue for Resideo

Results exceeded analysts’ forecasts with record high net revenue coming in at $1.94 billion, a 22% increase year-over-year. Profitability was up 20% to $210 million due to strong operational execution by both business segments and the addition of Snap One.

Overall, Resideo had 8% organic revenue growth with 10% organic growth at the ADI segment and 5% organic growth at Products & Solutions (“P&S”) segment.

The Distribution Business … ADI

ADI segment driven by continuing commercial customer strength and increased digital channel contributions. Organic Average Daily Sales were up 10% year-over-year. Margin growing activities included organic e-comm net revenue up 19% year-over-year and organic Exclusive Brands net revenue was up 32% year-over-year. Gross margin was 22.2%, up 280 basis points year-over-year.

The Manufacturing Business

P&S segment had its 9th consecutive quarter of YoY gross margin expansion, driven primarily by efficient utilization of manufacturing facilities. P&S had continued positive customer reception and demand for new Honeywell Home thermostats and new connected First Alert Smoke and CO detectors. Gross margin was 42.9%, up 160 basis points.

Operational highlights called out this quarter included continued progress with the Snap One integration, with run-rate synergies achieved in Q2’25 ahead of 2025 expectations. There was strong demand for the new Honeywell Home FocusPRO series of thermostats and First Alert SC5connected smart smoke and CO detectors.

Management raised the outlook for the rest of the year, with revenue forecast to come in in the $7.4 to $7.6 billion range, citing strong performance and the upcoming spin-off of the ADI business segment.

Tariffs

In terms of tariff exposure, for the ADI Distribution segment’s approximately $3 billion of cost of goods sold in the US, 23% are from Mexico, 21% from China, 16% from the US, 8% from Vietnam and 6% from Poland. ADI plans to mitigate tariff impacts via price increases and commercial actions with suppliers as well as moving manufacturing out of high tariff areas.

Of the P&S segment’s approximately $1,1 billion of cost of goods sold in the US, Mexico represents 90% of which 98% of that are USMCA compliant and China represents 4%. P&S’ plans to mitigate tariff impacts on cost of goods sold by evaluating bringing manufacturing to locations with a more favorable tariff profile, evaluating sourcing from alternative suppliers and phased price increases.

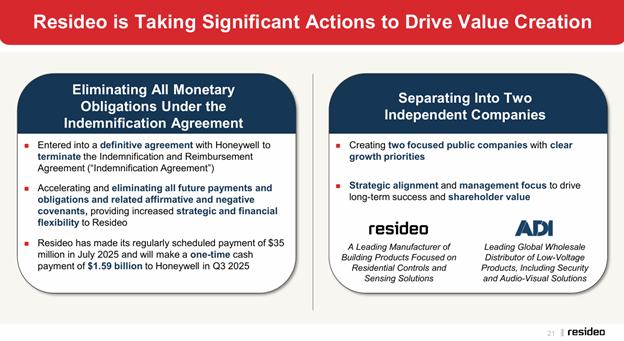

Terminating from Honeywell

Shareholders did express some concerns, primarily over the one-time expense associated with terminating a legacy indemnification agreement with Honeywell. Shareholders are wary of the impact of the upcoming $1.59 billion cash payment to Honeywell, scheduled for Q3 2025, and its effect on Resideo’s balance sheet and future financial flexibility. This drove a net loss of $825 million for the quarter, compared to net income of $30 million a year earlier.

Tomorrow’s ADI

Management’s decision to spin off the ADI Global Distribution segment—a move designed to unlock value—raised questions about execution risks and how two independent entities might be received by the market. Investors are watching for successful regulatory and financing milestones and how debt is managed post-spin, especially given Resideo’s gross debt of more than $2 billion.

While the company raised its full-year revenue guidance, some investors questioned whether resilient top-line growth would translate into sustainable margin improvement and reliable long-term earnings, given recent extraordinary expenses and competitive pressures

Finally, shareholders had some concerns over the integration of Snap One, if the promised synergies will come to fruition and the potential for operational disruptions.

Additional Thoughts

The ADI spin-off is interesting. While the company is focused on the security business, it also serves the home automation / AV market aka “smart home” segment. This is growing within the residential market. Some of this market is served by electrical contractors, and electrical distributors sell to some of these customers (also referred to as the CEDIA market.)

ADI also has a robust private label business of which some is into lighting controls (its Control4 brand), wiring devices, and some lighting fixtures as evidenced by this article in US Lighting Trends (a service of Channel Marketing Group.)

Other brands familiar to electrical distributors include ABB, Arlington Industries, Broan-NuTone, Cablofil, Dottie, Dual-Lite, Fluke, Hellermann Tyton, IDEAL Industries, Leviton, Lutron, Mersen, nVent’s Caddy, Erico and Hoffmann, Omni Cable, Panduit, Pass & Seymour, Philips Lighting, Prysmian, Schneider Electric, Warrior Wrap (NSI), Wiremold, WireXpress, 3M and probably others. There is nothing wrong with this as manufacturers go to where the customers are and most of these customers are not core electrical contractors. This highlights the fragmentation of the industry.

But, when ADI is spun off into a separate business next summer, it will be about a $5 billion business … with growth aspirations as well as investor and management goals. Will it be satisfied staying “in its lane” and being focused on the security / home automation market? Could it decide to expand more into the electrical distribution segment to serve a broader array of customers? Will it become an acquirer? Or, given it already has the brick and mortar, could it pursue other manufacturers and bring complementary products to its customers? Could it broaden its private label business?