Copper’s New Competitor and Its Impact

Copper, as every electrical distributor knows, is either a key component of sales (especially construction-oriented distributors) or a key component of many products. From a pricing viewpoint, if can be volatile. At times, as in the past few years, it has benefited distributor sales and profitability significantly. Other times distributors are “challenged”.

Copper, as every electrical distributor knows, is either a key component of sales (especially construction-oriented distributors) or a key component of many products. From a pricing viewpoint, if can be volatile. At times, as in the past few years, it has benefited distributor sales and profitability significantly. Other times distributors are “challenged”.

For years the US construction market was a significant market driver. More recent history is the impact of China’s usage. Now a third competitor for demand is coming into the market. We’ve been seeing it creep up.

A recent report by S&P Global titled “The Future of Copper” shed more light on the issue, and the challenges.

Chris Sokoll, President of DISC, and I attended the webinar (and hopefully many others in the electrical industry did also … or at least industry manufacturers) and Chris shared his thoughts regarding the future of copper.

The Copper Future: Becoming a Pawn in the Global Economy?

“Copper is the metal of electrification. Looking into copper’s outlook, here at DISC we see a long-term supply problem coupled by ample and sustained opportunity for the electrical community. Copper demand will double over the next 10 years as we move from petroleum as our primary energy source toward electrification.

The goal is to meet the international scientific and United Nations consensus of the net zero emissions target by 2050. Eventualities propelling copper prices skyward through demand will be led by renewable energy needs alone, which will consume twice as much copper by 2035 as we do today.

These technologies / applications (i.e. solar, wind, EV, the need to improve the grid, etc) in electrification will consume copper at ever increasing rates over the next decade. Demand will outstrip supply, and prices will go up as availability becomes more challenging.

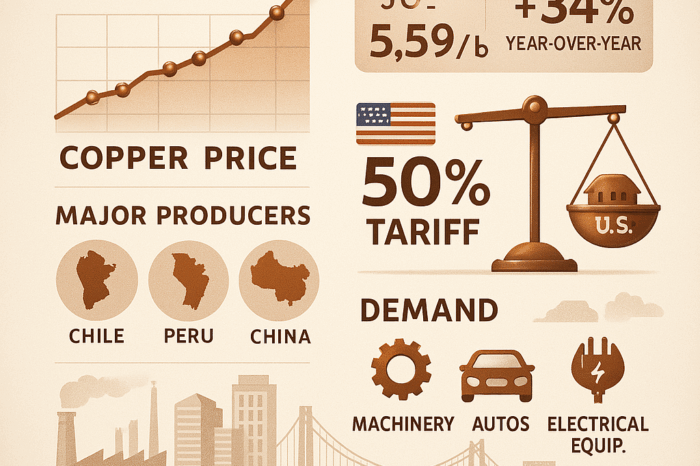

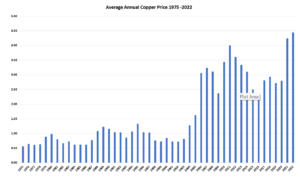

This is not a U.S. problem but a global one as the world looks toward electrification as a means to combat climate change. We have seen a long term rise in copper from 1975-2022 (as shown in the chart below) but historical and sustained incidents of price doubling are few and far between.

Average Copper Price, 1975-2022 Source – Macro Trends

The move from petroleum-based energy sources towards electrification has many implications for the electrical distribution community.

A potential doubling of copper prices should have all of us concerned about what the effects could be in the electrical distribution market. By our estimates, currently copper wire and cable makes up 10-15% of the total electrical distribution market. If we think of forecasting the price of copper doubling, we will see the electrical distribution copper wire market move from a low current estimate of $14 to $20 billion dollars to $28 to $40 billion within the next decade. This excludes the cooper in other electrical supplies that will be needed for electrification. This is a very fast-moving growth rate considering our history and removing the impact of inflation.

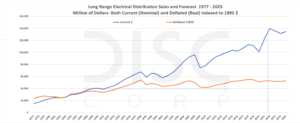

The graph to the right shows overall annual growth

Electrical Distributor Sales / Forecast from 1977-2025, Source DISC Corp.

rates for the electrical distributor market both real (indexed to 1982 dollars) and nominal from 1977-2025. The average real annual growth rate of our industry is about 1.7% from 1975 forecast to 2025. With inflation, the current growth rate is 4.6%.

Future copper supplies and demand on that supply will present both a problem and an opportunity for many. The U.S. Geological Survey shows total global copper refinery production through both primary (mining) and secondary (recycling) sources in 2020 at 25 million metric tons. According to S&P Global, the energy transition alone will account for an additional 20.5 million metric tons on top of non-energy usage of 28.4 million metric tons.

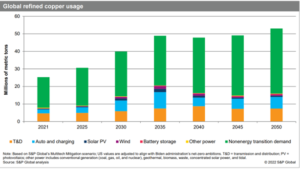

Copper Forecasted Usage from 2021-2050, Source S&P Global

The graph to the left shows current and forecast global refined copper usage. Clearly a steep hill to climb in a short time. This will create a demand curve that will push prices and availability to new highs. Offshore wind, tidal power, solar, biomass, battery storage, and onshore wind will all contribute to heavy demand on copper, among other electrical and industrial supplies.

Outside of electric vehicles (which consume 8-10x the amount of copper than a combustion engine, depending upon the vehicle), other high usages are mostly related to power generation technologies such as solar, offshore wind, geothermal energy, bioenergy, battery storage, the electric grid, nuclear, hydro, and onshore wind. Each of these are avenues for opportunity for anyone participating in the electrical economy.

Think of it this way … these new “users” of copper become competitors for the current usage of copper which, from an electrical distribution viewpoint, is construction-driven.

Much more demand, nominal supply increases equates to more dollars chasing fewer supply … and price leverage by the mines and manufacturers which gets passed to distributors and contractors, hence making projects more expensive.

Globally, mining and recycling will certainly be challenged to meet this demand. Any additional U.S. production is unlikely in the near term as environmental concerns and litigation typically hamper efforts to create new mines. Currently, China, Chile, and Peru lead the world in the mining and production of copper. Estimates put China in the driver’s seat with 47% of global smelting capacity, 42% refining capacity, and 54% of global consumption. Up until 1975, the U.S. was nearly self-sufficient in copper production, filling 90% of our own demand. Today, the U.S. produces only 50% of its copper needs. Reliance on imports is only going to increase with the demand in the coming years, even with limited additions to capacity and improved recycling.

Copper is certainly traded on a global market. We have seen shifts in the balance of power with the application of sanctions and tariffs on other commodities, and copper may well become a pawn in the global economy. In their work the Weaponization of Trade, Columbia University School of International and Public affairs lays out how weaponizing commodities is part of foreign trade, protectionism and power politics. Using commodities for pollical and economic gain has a long history and would not be unexpected in the complex copper markets. The unknown variable is how engineering, innovation, and deployment of emerging technologies in mining, smelting and superconductivity will lessen the impact of these looming problems.

We have recently seen a swift deceleration in copper price, down 20% per metric ton form the end of last year, a direct result of a rapid rise in inflation fighting interest rates causing slowing in investments in construction and new technologies. Further, construction activity in China has slowed significantly due to their periodic COVID-related shutdowns. This represents a temporary lull in price. According to The WSJ, OZ minerals LTD rejected an offer of $5.8 Billion from the giant of mining BHP Group, stating the offer was to low. Analysts are saying the long-term outlook for copper is “Robust” and OZ should realize 20-30% more from a sale. We see this as an indicator of the financial markets backing our assumptions.

What does this mean for distributors?

It is important to continue to price average your inventory, maintain high turns which means “tight inventory management”, and sell at the market price. Further, the reduction in price impacts distributor rebates at this time. In a few years, when copper pricing increases, expect market changes.

The takeaway is that our industry is in a position to usher in the next major economic transition. You and I need to remain aware of what is happening as we move forward with electrification. Afterall it is our business.”

Thank you Chris for the overview and the outlook. For those who don’t know Chris, prior to acquiring DISC, he spent his career in the wire / cable industry. For more insights on this market, contact Chris at chris@disccorp.com. And if you want better versions of the charts, email Chris.

If you’d like a copy of the S&P report, The Future of Copper, click here or, feel free to email us for a copy.

While copper pricing approached the $5 mark earlier this year and then fell back to $3.35 and is has since rebounded a little, interest rates, the value of the dollar, China and a possible recession could restrain the price, however, industrial reshoring, industrial growth and government investments into climate technologies (including credits for EVs plus the construction of EV factories, installation of EV chargers and EV vehicle growth) could move pricing higher. Which way to bet? No one knows, but, the supply vs demand issue will not change. There is a new competitor for copper production.

The questions then become:

- Alternatives to copper wire for construction?

- Product innovations that could mitigate the demand for copper? For instance, will EV copper usage decline due to a new EV technology?

- Possible impact on construction longer-term?