The Canadian Electrical Market – 98% Consolidated

Nowadays it’s difficult to tell if the US electrical distribution market is following its northern counterpart or if the Canadian market is following the US market.

Nowadays it’s difficult to tell if the US electrical distribution market is following its northern counterpart or if the Canadian market is following the US market.

While the Canadian market has historically been 10-12% the size of the US market, the structure of the two markets was similar but with less distributors although, because of each market’s size, the Canadian market was more consolidated with essentially the same chain owners (some slightly different names.)

The US market consolidated much in the past 3 ½ years with 104 deals representing almost $9 billion at acquisition price. The Canadian market, until recently, had been quieter.

And the marketing group model was similar, until the recently announced AD / IMARK merger here in the U.S.

Within the past 45 days there have been 4 announced electrical distribution acquisitions in Canada, and reportedly a few more to be announced. Further, given the AD / IMARK announcement there were many questions about what would happen with AD Canada and IMARK Canada.

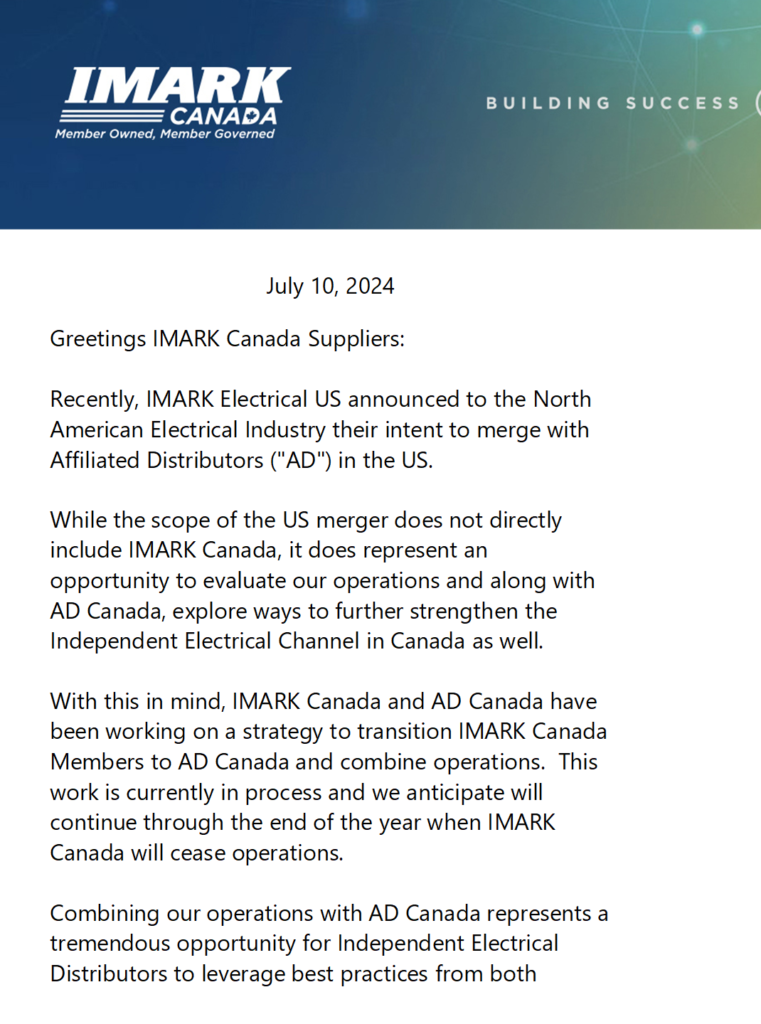

The answer to that is now in. This month, five IMARK Canada  members have become AD members. More are expected to convert to AD, pending meeting AD’s criteria, as IMARK Canada announced on July 10th that it would be shutting down the end of the year due to lack of back-office support (which IMARK Electrical provided, which tells you when IMARK Electrical is closing.)

members have become AD members. More are expected to convert to AD, pending meeting AD’s criteria, as IMARK Canada announced on July 10th that it would be shutting down the end of the year due to lack of back-office support (which IMARK Electrical provided, which tells you when IMARK Electrical is closing.)

What happens to the remaining IMARK Canada members? Perhaps some / most go to AD. Some may go to SPECTRA if they want networking (although there are few electrical supplies members in that group). Maybe another group gets formed or maybe these companies do not belong to a group.

The Changing Canadian Electrical Distribution Market

So, lots of change.

But John Kerr and Owen Hurst, two individuals with extensive visibility in the Canadian market, and the leadership of Canadian Electrical Wholesaler, which also researches and publishes Canada’s PathFinder report, the definitive report on the industry, recently shared an overview of the Canadian electrical market changes.

The recent acquisition announcements in the past month or so represent a mix of new moves being made in the electrical distribution channel in Canada that we feel demands some close reflection.

The landscape is changing dramatically and quickly with the recent M&A activity that included two one branch independents, a venerable long standing provincial powerhouse and an up and coming national. All these firms were privately held but only one went to another privately held entity with the others going to the number one and number two brands in the county. Also lost in the fray was the sale of a national chain strong in the industrial segment.

This M&A activity is moving at the fastest pace it ever has in Canada.

Canadian electrical distribution market has seen 43 distributor deals since 1999 (click here to see the list.)

We see that all the industry leaders have been active these past few years with Guillevin, Rexel, Deschenes, Wesco and most recently Sonepar all picking up key Independents. And there will be more to come. This is such an interesting time too as there are approximately 32 new Greenfield branches planned and, on the books, as of early January this year.

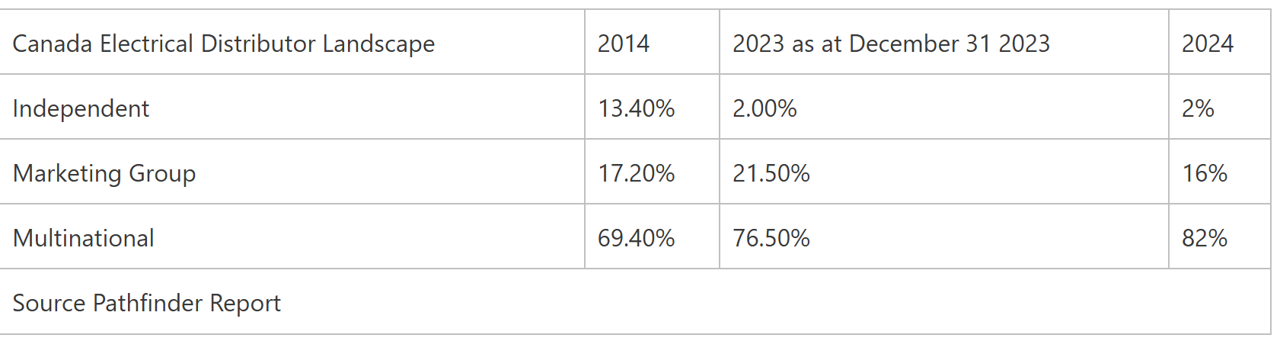

Here is a comparison of how the landscape in Canada has changed according to the Annual Pathfinder report.

So, underlying all this one can easily see that the larger independents are moving. The revenue shifts alone from these moves approach $600 Million and is affecting the Marketing Groups, dropping their share to a ten-year low at 16%.

These moves too have also shifted the relative positions of key companies with Wesco holding the number one spot now followed by Sonepar, Rexel and Guillevin. And we can now recognize that, as it remains independent, Franklin Empire has regained its position as Canada’s largest privately held independent.

Regionally, Sonepar has significantly improved its position in the Ontario market as well.

And as all this is happening AD in Canada and IMARK Canada have apparently opened discussions mirroring the actions of their US counterparts.

The drivers behind this consolidation trend are multifaceted. Larger distributors seek to expand their geographic footprint, increase market share, and achieve economies of scale. For smaller, often family-owned businesses, selling to larger entities can provide an exit strategy for owners without succession plans or a way to access greater resources and technology to remain competitive. A further driver is the end user that is increasingly relying on distributors for technical expertise and solution services and support.

Looking more broadly we see this consolidation trend having a wider impact on the entire electrical supply chain in Canada. As distributors grow larger, they gain increased buying power with manufacturers and can potentially offer more competitive pricing and a wider range of products to customers. However, this consolidation also raises concerns about reduced competition and the potential loss of personalized service that smaller, local distributors often provide. Wil History repeat itself. After Ruddy Electric was acquired by Westburne in May 1988, a number of independents were established and then the System integrator channel followed closely.

Looking ahead, the consolidation trend in the Canadian electrical distribution industry is likely to continue to be driven by the ongoing technological changes in the industry, including the growth of e-commerce and the need for sophisticated inventory management systems. Together these factors may drive smaller distributors to seek partnerships or buyouts from larger, more resource-rich companies.

Some Key Takeaways

The impact of these acquisitions is substantial:

- Revenue shifts of approximately $600 million have occurred

- Marketing groups’ market share has dropped to a 10-year low of 16%

- The relative positions of key companies have changed, with Wesco now holding the top spot, followed by Sonepar, Rexel, and Guillevin

- Franklin Empire has regained its position as Canada’s largest privately held independent

- Sonepar has significantly improved its position in the Ontario market

Drivers behind this consolidation trend include:

- Larger distributors seeking to expand geographic footprint and market share

- Achieving economies of scale

- Smaller businesses looking for exit strategies or access to greater resources

- Need to adapt to technological changes, including e-commerce growth

- Demand for sophisticated inventory management systems

- End user technical support”

Thoughts

- It’s interesting to see how consolidated the electrical channel is in Canada. With AD Canada considered “a channel”, 98% of the business is national chains and AD. The US will not get that consolidated soon, but it is getting there.

- With the channel, read “distributor relationships” for rebates so consolidated, the ability to affect change at the distributor level becomes more challenging as there are “barriers to entry” for many. The key to success for manufacturers will be “focus on the customer”, meaning the end-user. And the only way to ensure that, especially in a market where there is so much of a land mass, is by manufacturers embracing their reps.

- Personal opinion … while manufacturers invest in their reps via commission, and hence it is a performance-based relationship, in a market that is this consolidated, manufacturers may want to reconsider their resource (investment) allocations and consider the tools / resources that they want to have deployed in the field to ensure customer coverage. Either manufacturers will need to do this or invest in these tools and centralize them (and have the requisite FTEs.)

- Could you see rep mergers to cover more territory with more resources under a common umbrella so there is greater consistency in deployment? And then this may mean the need for more reps to address conflict issues.

Could the Canadian electrical distribution market become a “testing ground” for manufacturers to find effective go-to-market strategies?