The State of eCommerce … According to Electrical Buyers

Electrical buyer, both contractor and industrial, interest in ordering electronically (eCommerce) has come a long way in 8 short years.

Electrical buyer, both contractor and industrial, interest in ordering electronically (eCommerce) has come a long way in 8 short years.

Eight years ago, every industry association conference had non-industry consultants espousing that Amazon Supply (now Amazon Business) ending the role of the electrical distributor. eCommerce was going to take over. While it didn’t make sense, it was what “the experts” were saying.

In 2018, Channel Marketing Group conducted an electrical contractor study asking them how they were using websites. The feedback was “they were” but for information.

Many distributors have since invested in sites. Many bemoan the perceived lack of ROI as they don’t see incremental sales. In reality, customers are using sites for information and sales are increasing through this ordering channel.

Earlier this year we partnered with BigCommerce who sponsored an update to the research.

Over 350 contractors and industrial buyers shared their digital commerce usage, what is important to them, and other key insights. The complete report, with much detail, is available at www.ecommerce4distributors.com.

The bottom line … eCommerce is no longer optional.

Here are nine (9) key takeaways:

9 Key Takeaways from State of eCommerce Report

-

Digital Commerce Has Reached Critical Mass

The most significant finding is that 82% of buyers now use electronic ordering processes, with 62.3% purchasing electrical, HVAC, or industrial supplies online.

This represents a staggering increase in online purchasing since 2018, when only 4.3% of orders were placed digitally. Online purchases now account, according to survey respondents and across the industries, 30% of total material purchases.

While there could be a “halo effect” in respondents, the bottom line is that electronic usage has increased, whether it be searching for material, information, or ordering. Customers now expect the service to be available, even if they are not culminating every transaction.

-

Traditional Distribution Faces Competitive Threat

The competitive landscape has fundamentally shifted, with 58% of respondents purchasing materials outside traditional distributor relationships.

Over 100 competitors were mentioned by respondents, including Amazon Business, Grainger, Zoro, McMaster-Carr, and Home Depot.

This further tracks with Channel Marketing Group research that identified that the traditional electrical distribution channel now represented only 56% of total electrical material supply spend in 2024. There is more competition for contractor dollars.

-

Major Distributors Are Already Digital-First

Leading distributors have recognized this shift, with Sonepar, Rexel, Watsco, and Ferguson generating over 30% of their revenue digitally.

MSC attributes 50% of revenue to digital channels, Fastenal 63%, and Grainger even higher. This demonstrates that digital commerce isn’t coming—it’s here, and a customer expectation.

Further, it means that distributor sales organizations need to understand it and be trained on it, they need to ask customers questions about their usage of it, there must be sales management expectations, goals need to be set, it needs to be considered a “product” and it needs to be continuously, and creatively, marketed while being supported with ongoing promotion and financial support.

-

Mobile and Flexible Access Drive Adoption

Buyers demand 24/7 access across all devices, with 74% ordering from the office, 48% from vehicles, and many from job sites or home.

The takeaway – customers want to order “whenever and wherever they are”—on their terms.

This requirement influences how distributors must design their digital infrastructure and customer experience. Think “mobile first.” Think creatively – whether it be apps, tools like PO-to-Cart that enables text and voice-driven ordering such as from Motivate where customers can text, call, or “drag and drop” images and files and have it converted into a web order.

And it may require extended customer service support hours.

-

Customer Promotion Is Critical

Surprisingly, buyers discover new supplier websites primarily through Google rather than existing distributor relationships. This is surprising given that distributors expect their salespeople to promote their site and that their customers “pay attention” to their message on hold systems and read their emails! After awhile it all becomes “noise.” Consider how to add creativity to break through the clutter.

While Google is important, consider organic SEO initiatives that are heavily focused on local.

This highlights the critical importance of search engine optimization and digital marketing for distributors. Remember, you invested $X into your website, don’t you need to invest something into marketing it? If you opened a new branch, wouldn’t you staff it? Promote it? Allocate sales resources?

-

Integration and Real-Time Data Are Important

Customer expectations center on five critical website capabilities: accurate, customer-specific, pricing (that is not over-written by inside sales!), real-time inventory, robust search functionality, comprehensive product content, and seamless ERP integration are important for a “tier one” site. They differentiate.

This is not to say, “if you cannot integrate due to ERP functionality you cannot have a quality site.” There are workarounds and time = money, which means, launch in phases if you need to. Launch first with a catalog-only site. Consider batch pricing / inventory uploads (nightly), and other scenarios. A quality implementation resource can share ideas. Dmitry Kon from Access Development Solutions shared some ideas on this topic last quarter.

- Only 18% Are Not Interested in eCommerce

There are still some “purists.” Only 18% of buyers say they have not purchased any materials digitally. Their concerns focus on order complexity and personal interaction preferences rather than security concerns. This means 82% of the customers have used an electronic search / ordering system (eCommerce) for some material need … just maybe not with you.

So, when they say “no, they are not using it” it means either “not with you” or “I’m not the one doing it but others in my company are doing it for us / me, at least some of the time.”

Which begs the question of “how are you tracking site activity? Customer-specific activity?” This could be a good reason to have someone attend the NAED Marketing Summit where there is a session on Google Analytics.

-

Customers are Only to Save Time, and It’s Convenient FOR THEM

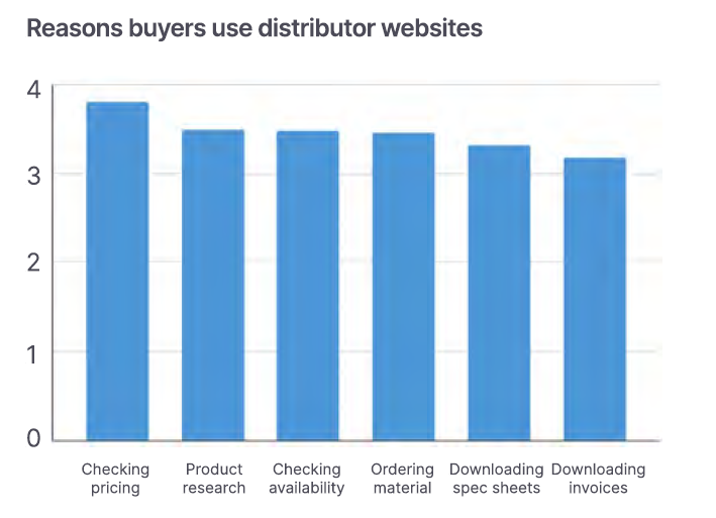

The top five reasons for online purchasing all relate to time savings and convenience:

- faster ordering, especially when they have only a few items … or they are tired of telephone tag / voicemail hell or back and forth emails.

- 24/7 availability – especially with small to medium contractors who may be estimating, or placing orders, at home after hours … or on Sunday as they plan the week ahead

- avoiding phone calls – and there are many reasons why people want to avoid calls!

- price checking – to support developing estimates / bids, especially when you have a structured pricing approach.

- streamlined reordering – this is especially beneficial when you take the time, analyze their XX most frequently purchased items and pre-build a Quick Order list or identify items that should be grouped / linked / packaged to enable “one-click” ordering.

Market your digital value proposition around time savings. Think of your customer (and sometimes, think of why you use websites!)

-

Content Quality and Search Functionality Determine Success

Beyond basic functionality, customer satisfaction hinges on search quality and comprehensive product information.

With national distributors and MRO suppliers offering over 1 million SKUs online, content depth, search accuracy, and specialized knowledge is important.

Natural language search is an expectation. Integration of local industry slang can be beneficial. Addressing idiosyncrasies of product name, product number, and misspellings are important.

On the product content side, robust product descriptions, and value-added content are competitive differentiators. BigCommerce has developed a relationship with Distributor Data Solutions to seamlessly integrate product data, and it is easy to import data.

Take Aways

First, there is even more in the report. You can download the full report at www.ecommerce4distributors.com.

First, there is even more in the report. You can download the full report at www.ecommerce4distributors.com.

The research reveals that eCommerce, defined as electronic commerce, so more comprehensive than a website only, is becoming a customer expectation because customers are using the sites for so much more than consummating a transaction.

It’s about ease. It’s about self-sufficiency. It’s about their desire for information when and how they want it, now, and without sharing the “why” they want it.

COVID accelerated trends that were already underway, but the changes appear irreversible. For some this is the way that they want to do business. For others it is now an integrated part of their information search and buying process. Few are rejecting it.

Contractors and industrial buyers discovered the efficiency of a digital buying journey and won’t return to solely a “personal” buying experience. The definition of a “salesperson” is changed. A “salesperson” may be part of the buying journey but they can be integrated into the process.

For distributors, the choice is clear: develop competitive digital capabilities or risk gradual market share erosion to more digitally sophisticated competitors as your customers become more sophisticated.

It’s following the evolution of the customer. The companies already generating 30-60% of revenue through digital channels demonstrate that customers are migrating.

The eCommerce research also reveals that digital isn’t just about technology—it’s about reimagining the entire customer experience, and perhaps more importantly, evolving with the customer (remember, they don’t tell you everything!). Successful distributors will combine the personal relationships and technical expertise that have always defined the industry with the convenience, transparency, and efficiency that contractors are desiring.

To learn more, download the full report at www.ecommerce4distributors.com. And if you’d like to compare the results versus the 2018 study, email me and I’ll send you the 2018 report.