Home Depot / Lowe’s – Slowing Sales but Digital Gains

Lowe’s beat profit expectations, while Home Depot did not, and Lowe’s reported growth in comparable sales (sales of stores open at least 13 months) that outpaced that of Home Depot for a second straight quarter. Stepping back, the fact that both showed positive results, in the face of the headwinds, is a good sign. Both companies cited stubborn inflation and uncertainty about the strength of the economy hurting consumer confidence, particularly when it comes to large purchases that people need to borrow to pay for, such as home renovations as drivers of results.

Lowe’s beat profit expectations, while Home Depot did not, and Lowe’s reported growth in comparable sales (sales of stores open at least 13 months) that outpaced that of Home Depot for a second straight quarter. Stepping back, the fact that both showed positive results, in the face of the headwinds, is a good sign. Both companies cited stubborn inflation and uncertainty about the strength of the economy hurting consumer confidence, particularly when it comes to large purchases that people need to borrow to pay for, such as home renovations as drivers of results.

This marked the 20th straight quarter that Lowe’s beat on the bottom line, while Home Depot has missed profit expectations the past three quarters.

Below the surface, there were some rather interesting tidbits

- Both retailers stated that online sales grew 11%, it appears that pro contractors continue to adopt and use digital tools.

- The retailers are also expanding into new categories such as workwear and pet supplies and food. The category that led both was Appliances and Kitchen/Bath, could this be a leading indicator of recovery, especially among higher income customers?

- The key question is if the GMS and FBM acquisitions lead to cross-selling, especially in big projects with pro customers – drywall, insulation, metal framing, ceiling systems, commercial doors.

The retail giants continue to gain market share and consolidate the industry, with AI as a building block to customer service and delivery. This is positioning both Home Depot and Lowe’s to further penetrate the large building materials market.

The Home Depot

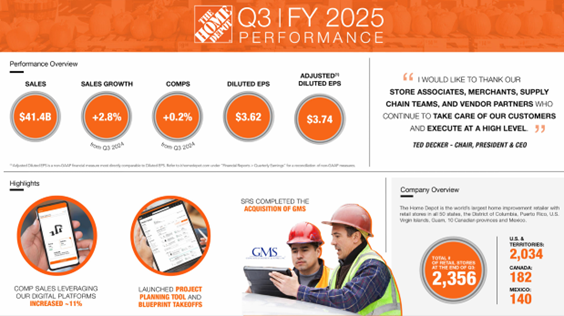

Home Depot announced 3Q 2025 earnings on November 18. Revenue increased 2.8% year-over-year to $41.4 billion, however, analyst expected slightly more. Comparable sales increased by 0.2% overall, with U.S. stores seeing a 0.1% comparable sales increase. Drivers were the lack of fall storm activity and subsequent rebuild, ongoing pressures from consumer uncertainty and challenges in the housing market. Sales were on a downward slope, with monthly comp sales in the US in August growing 2.2%%, in September 0.3% and in October contracting -1.7%. The Infographic highlights performance results:

Home Depot 2025 Q3 Overview

Sales increased $1.1 billion or 3% y-o-y. GMS sales were about $900 million, representing 8 weeks of sales in the quarter

Home Depot Shareholder Concerns

Shareholders were concerned about pressures on profitability due to declining operating margins, which dropped to 12.9% from 13.5% the previous year, partly driven by the GMS acquisition integration expenses. (Any surprise that the distribution business, especially of a commodity, would reduce margins?)

Management noted that consumer uncertainty and ongoing weakness in the housing market disproportionately impacted home improvement demand and slowing comparable sales growth.

The increased operating expenses and deleverage partly due to incremental costs from the major acquisitions and investments in fulfillment and pro customer capabilities were the topic of a series of questions around the long-term impact on profitability and market share growth. Overall, it was clear that both Home Depot and Lowe’s need to balance investments in technology, store expansion, and supply chain while managing costs carefully.

Despite these concerns, management emphasized strong execution, market share gains, and an optimistic long-term view on housing fundamentals and customer priorities. They also highlighted ongoing investments in digital tools and the pro ecosystem as pillars of future growth.

Guidance

Home Depot revised fiscal 2025 guidance downward, expecting total sales growth of approximately 3%, with GMS expected to contribute $2 billion in incremental sales. adjusted diluted earnings per share is expected to decline approximately 5% and adjusted operating margin is expected to be around 13.0%, down from prior expectations. This revision was driven by weaker-than-expected demand due to the lack of significant storm activity, consumer uncertainty, pressures in the housing market, and increased prices on core products.

Lowe’s

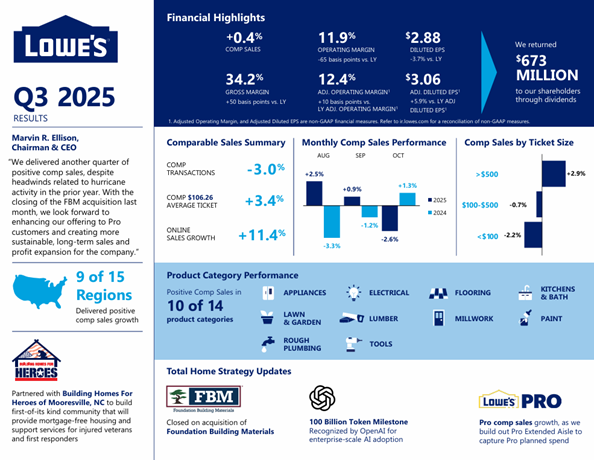

Lowe’s announced 3Q 2025 earnings on November 19. Revenue came in at $2.81 billion, growing 0.4% y-o-y, despite a roughly 100 basis point headwind related to Hurricanes Helene and Milton. Lowe’s delivered positive comparables in 10 of 14 merchandise divisions, especially appliances, flooring, paint, and kitchens and bath. and solid performance across both DIY and pro channels. Comparable average ticket increased 3.4%, driven by pro and appliances, mixed shifts into larger ticket purchases, and modest price increases. The Infographic highlights performance results:

Lowe’s 2025 Q3 Overview

Revenue had a slight miss from expectations, but earnings per share exceeded expectations. Gross margin increased 50 basis points to 34.2% and adjusted operating margin improved 10 basis points to 12.4%. Lowe’s believes there is pent-up demand and that delays in home improvement projects are estimated at $50 billion. And demand softness from macroeconomic uncertainties are impacting consumer spending.

Lowe’s shared updates on optimizing store footprint – rolling out a rural format in 150 more stores, bringing the total to nearly 500. Also, they’re rolling out workwear and pet sections to more than 1,000 stores.

Lowe’s Shareholder Concerns

There were questions about the slight revenue miss, which raised questions about near-term sales momentum, the cautious consumer and growth sustainability. There was some concern about the impact of recent acquisitions like FMB around integration costs and the effect on overall margins. There was some concern about the slight downward revision of adjusted operating margin guidance, reflecting pressures from acquisition-related expenses and higher interest costs and the higher interest expense and managing debt load amid economic uncertainties.

Guidance

Lowe’s maintains a flat full-year comparable sales outlook (at the bottom end of previous guidance) with projected annual sales of $86 billion. The company expects a full-year adjusted operating margin of 12.1%, a downward revision. Comparable sales to be roughly flat for the year, which is at the bottom end of our previous guidance. Sales from FBM sales are expected to be about $1.3 billion in 4Q 2025. Management is expecting increasing cross-selling between Lowe’s FBM and ADG.

Strategic focus areas include the integration of Foundation Building Materials (FBM) and ADG, alongside leveraging home equity loans as a growth opportunity. “HELOCs are going to become the next opportunity for us to drive discretionary remodel big-ticket projects” Said CEO Marvin Ellison. Lowe’s estimates that the average homeowner has over $400,00 in home equity at their disposal and remains reluctant to move. If interest rates start declining, that could “spur demand” for renovations and provide a boost to the home improvement market.

Also, Lowe’s recent pro survey showed that overall sentiment improved for small to medium pros as they remain confident in their job prospects and report stable backlogs. The same survey revealed that “roughly 75% of our Pros are very confident in their job prospects. And also, this segment of the Pro consumer continues to work on smaller ticket repair and maintenance projects.”

Leveraging AI … Say Hello to Milo!

Lowe’s MyLow

AI capabilities are having results, the “virtual assistants, Milo and Milo Companion, which are built on an OpenAI platform, are answering nearly one million questions per month about everything from product specs to project know-how to the status of a customer order. In fact, when our customers engage with Milo online, the conversion rate more than doubles”…”When our associates use Milo Companion to help customers shopping in our stores, we are seeing customer satisfaction scores increase 200 basis points. Every interaction with our virtual assistant is feeding our proprietary models, allowing us to continually improve accuracy and build a durable advantage in home improvement expertise.”

FBM has a strong commercial business and has been involved in several data center projects, healthcare and multifamily residential.

Questions & Thoughts

Clearly, for both companies, the large acquisitions enhances offers to Pro customers and commercial projects, specifically in the areas of faster fulfillment, expanded product offering, cross-sell opportunity, Pro digital tools, and robust trade credit program

Lingering questions

- Will big projects unlock in 2026? This is a bet with the recent acquisitions from both Home Depot and Lowe’s. How the macro environment plays out will dictate the speed and intensity of unlocking pent-up demand.

- Will the pace contractors order on eCommerce platforms continue to accelerate?

- The investment in AI tools to make transactions easier and more intuitive, so expect digital and productivity gains to continue.

- How well can both companies sustain sales growth given ongoing consumer uncertainty, housing market pressures, and the softer demand following a lack of storm-driven sales this fall?

- Fundamentally, how will external factors such as interest rates, inflation, tariffs, and global supply chain dynamics shape operational performance and market share competition between the two behemoths in 2026?

- How effectively will Home Depot (GMS) and Lowe’s (FBM) integrate recent acquisitions and generate cross-selling especially for big projects and high income consumers, without continued margin pressure and elevated expenses? The impact on long-term profitability and synergies has yet to be demonstrated.

- For Home Depot, can they reverse declining profitability trends and control costs, and for Lowe’s, can they sustain growth and deliver profits with higher debt levels and integration costs?

- What are the strategies in 2026 that Home Depot and Lowe’s will implement to continue to grow the pro customer sales channel and continue digital innovations?

For distributors … big companies are investing, scaling, and customerizing AI to deliver results. They are unleashing talent and empowering them to think “what if?” Could you?

For manufacturers … these companies will be asking for more digital assistance which means data, and they will be able to share (usually for a fee) information. The question becomes, are you asking the right questions and can you provide the data?

Lessons to learn … invest in tech, diversify offerings, consider complementary markets, think about your customer and ask “what else can I do for them?”