Border States Going Solo. Leaves AD

Yesterday morning Border States shared a press release that surprised many in the electrical industry … that they were leaving AD after a 40-year relationship.

Yesterday morning Border States shared a press release that surprised many in the electrical industry … that they were leaving AD after a 40-year relationship.

Border States Exits Affiliated Distributors

According to the press release, dated December 1:

“Border States announces its departure from Affiliated Distributors (AD), effective December 31.

This move represents an evolution for Border States as they place renewed emphasis on activating internal strengths, processes and capabilities, positioning them closer to and better aligned with their vendors.

Border States has been an AD member since 1985, and they thank the organization for their years of productive partnership, and the opportunity membership presented to forge deep ties with other independent distributors.

“We are a team of employee-owners, grateful for AD’s incredible partnership and hold them in the highest regard,” said Jason Seger, Border States President and CEO. “Simply put, many independent distributors would not be in the position they are today without AD, and we remain anchored in the shared values we have with many AD members – deeply focused on the customer and our service to the local market and communities where we live and work.”

A short, succinct, message that presumably AD’s core manufacturers already were aware of but has many wondering “why” and “what does this mean for AD” or “is this a message.”

Thoughts

I received a number of calls from manufacturers and distributors asking for my thoughts, with some also knowing that I was with IMARK.

Some thoughts:

- Border States, according to Electrical Wholesaling and MDM, is the sixth largest electrical distributor in the US with revenues approaching $4 billion.

- But the company is also diversified with a strong utility business (of which much, if not all, is not part of its AD purchases). The company has also expanded into engineering services.

-

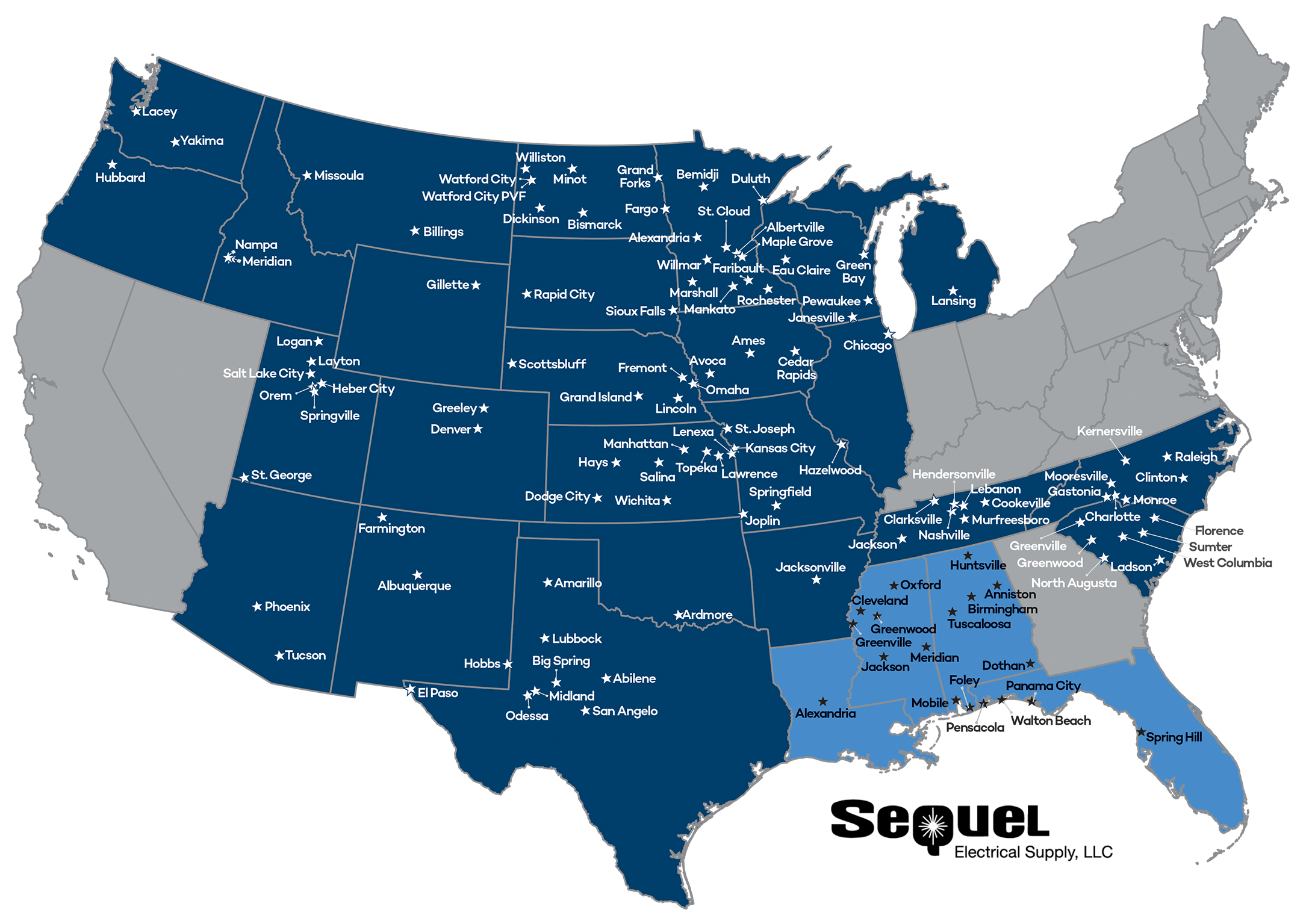

Border States Map as of August 2023

The company has expanded through acquisition and will presumably continue this path, especially as it invests in regional distribution centers (need revenue to support the local RDC.) While some say, “knowing people / companies by being in the group helps with acquisitions”, the reality is that Border States already has these relationships.

- Networking benefits? Again, Border has those relationships and can reach out to many. Perhaps it is part of its own networking group, perhaps it feels it was not benefiting as much as it was and does not want to be a primary sharer?

- AD’s marketing support? While beneficial for many, and AD Rewards can be effective for staff, I don’t know if Border participated in AD Rewards (each company makes its own decision) and Border already does joint planning (FMS) with its key suppliers, so the “muscle memory” is already within Border States.

- So, to the financials. With $4 billion in revenue, that is about $3.2 billion in COGS. Assume 30% going through the group (key lines like Rockwell and Schneider reduce the percentage) and that’s $960 million. Significant volume but by no means “significant” for AD. And remember, with the merger with IMARK, the new IESD has over 700 distributor members. If anything, cost / member grows a little but won’t be recognizable, and AD can manage this.

- With almost $1 billion in purchases to “manage”, Border will receive the same deals, if not better, from the lines it wants to have relationships with. Why better? They will have 100% visibility and can move business if they want to. And no manufacturer will not offer them a rebate deal.

- Administratively, Border States uses SAP. I’m confident that they can easily handle this within SAP, theoretically via Excel, or they could use tools from companies such as Enable or Band.

- And remember, this is only one company leaving AD. One is not a trend. There could be other reasons. Consider, years ago, Mayer Electric left AD and joined IMARK in 2018. There were rumors of “unrest” within the AD community and talk of another marketing / buying group being developed and more distributors leaving AD. The result? None left. One is not a trend; it is an individual decision.

- Now, could this trigger thoughts with Border’s peers? Companies like Elliott Electric, McNaughton-McKay, Crescent Electric, Lonestar and maybe a couple of others? Consider these the billion-dollar players. Yes, it could, but they would need to think strategically about this, develop the infrastructure, have a strong supplier relations management team.

- From a manufacturer point of view, some have said (and I paraphrase) “this may give manufacturers a moment of pause and question the model.” The reality is, most manufacturers have no interest in direct financial (rebate) relationships with 700 companies. It is one thing to sell to them (and they do this mostly through their reps), but it would add complexity and costs. Further, most distributors do not want to take on the effort and interact with 50-100 manufacturers. The only viable alternative for a manufacturer is if they change their distribution / rebate model to only offer rebates to selected companies.

- And yes, there will be more work for manufacturers – having to set up individual deals, administering them, perhaps more visits to Border States for planning, marketing, and similar. Essentially it expands the efforts of a manufacturer’s national accounts group. And Border will need to manage an influx of manufacturer interactions at corporate (and do not be surprised if some lines that are regional have “deeper” regional / local opportunities, which both parties can take advantage of.)

- Reps, you’ll eventually need a Border States linecard, just like you should have for the other national chains and for AD IESD. Ask your manufacturer if they already have a deal, or plan to have one, with Border States.

There have been rumblings within Border States for a couple of years that this could occur. Part has to do with the company vision of being, and being viewed, as a national company and treated as such. Their vision, an eight-digit number in 5 years, requires acquisition, infrastructure, and, to a degree, control. With this move they believe that being more in control of their supplier relationships, especially financially, is in the best interests of their employee-owners.

Lots of opportunity for Border States. While a short-term image tarnisher for AD due to the length of the relationship and visibility of Border States, remember, one is not a trend. There is strength in numbers … as in 700+!