WESCO Record Sales but Profitability Hit, Data Centers Drive Growth

WESCO shared their Q4 2025 and full year 2025 earnings on February 10, reporting strong top line performance, growing revenue $6.1 billion, up 10% and 9% organically, driven by a 30% increase in data center sales to $1.2 billion. For the full year 2025, WESCO sales were a record $23.5 billion, up 8%, with backlog up 19% to record levels, and featuring double-digit growth in the second half of 2025.

WESCO shared their Q4 2025 and full year 2025 earnings on February 10, reporting strong top line performance, growing revenue $6.1 billion, up 10% and 9% organically, driven by a 30% increase in data center sales to $1.2 billion. For the full year 2025, WESCO sales were a record $23.5 billion, up 8%, with backlog up 19% to record levels, and featuring double-digit growth in the second half of 2025.

Wesco Segment Q4 Performance

- EES revenue was $2.273 billion, up 9%, supported by OEM and construction demand and improving industrial activity.

- CSS revenue was $2.425 billion, up 16%. This was the strongest segment, driven largely by data‑center projects and strong backlog (up nearly 40% at year‑end). Highlights sustained strength in AI-driven hyperscale projects and related infrastructure. The majority of Wesco data center sales are concentrated in CSS.

- UBS was up 3%, with revenue of $1,371 billion, marking a second consecutive quarter of growth, led by investor‑owned utilities. Full-year UBS sales were $5.454 billion, down slightly from $5.735 billion in 2024. Public power customers was the weakest end market; however, utility backlog was up 23% at year-end, providing a strong setup for 2026. Management noted an indirect utility-data center overlap exists via grid upgrades supporting power delivery to data centers, but no specific UBS data center revenue was quantified.

- UBS sales are split about 60% investor-owned utilities, 10% direct to specialty utility contractors and 30% to public power companies.

Data Center Insights

- Wesco Data Center Solutions (WDCS) was up over 30% driven by hyperscale customer demand

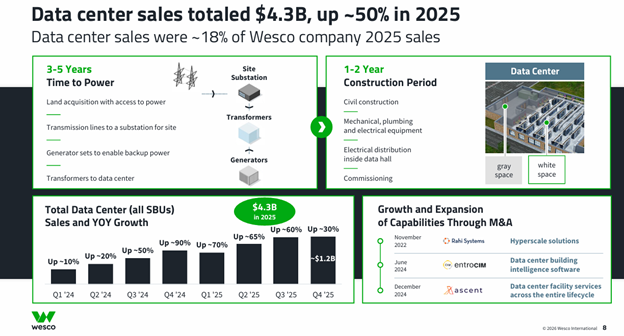

- Growth continues to be driven by data centers. For full year 2025, data center sales reached $4.3 billion, up roughly 50% year over year and representing about 18% of total company sales.

- Wesco’s data center revenue splits roughly 80% “white space” (CSS segment: networking, fiber, security systems, high-speed interconnects) and 20% “gray space” (EES segment: power distribution, electrical systems, MRO, automation).

- This breakdown held consistently across 2025 reporting, with Q4 data center sales at $1.2 billion (full-year $4.3 billion, up ~50% y-o-y and ~18% of total sales).

- For the electrical industry, electrical products fit into the gray space … only up to 20% of the spend!

Wesco Data Center performance in 2025 is shown in the slide below:

Key Wesco Data

- Wesco management noted a surge in supplier price increase notifications during Q4 2025, up over 125% year over year in count, with average increases in the mid-single-digit range. CFO highlighted this as consistent with past practice given timing lags between supplier notifications and revenue realization, continuing into January 2026 with higher-than-average notifications.

- Full-year 2025 pricing provided an estimated 2-point benefit to sales growth but no additional price realization baked into 2026 guidance due to uncertainty on pass-through timing,

- Strong order activity with backlog growth up 19% y-o-y, reaching a record level. CSS backlog was up 40%, UBS backlog was up 23% and EES backlog up 6%.

- Overall gross margin was flat y-o-y at 21.2% reflecting ~3% estimated price benefit (including 1 point from commodities) offsetting project/product mix pressures, particularly in public power utilities within UBS.

- Wesco’s overall EBITDA was down 5%-6% sequentially from 3Q 2025, or about $435 million implied, reflecting typical seasonality, with H2 strength noted but Q4 impacted by working capital build and lower free cash flow conversion.

- On a y-o-y basis, EBITDA was up 10% from Q4 2024, driven by 9–10% organic sales growth across CSS (+29% EBITDA) and EES (+16%), partially offset by UBS (-8%) and gross margin pressure from project mix/public power.

- Key secular growth trends driving the business are AI-driven data centers “we are not even close to seeing a peak in the cycle,” CEO John Engel, increased power generation tied to grid modernization, renewables integration and electrification supporting data centers and utilities and supply chain reshoring, boosting domestic manufacturing and infrastructure spending.

Other Insights from Wesco Earnings Call

The following is a review of the earnings transcript, and presentation, focusing on the EES division:

- “Construction sales were up low double digits in the fourth quarter, supported by strong wire and cable demand and continued infrastructure project activity. (As we know, wire / cable is lower margin as these types of large, sometimes super-large, projects. From a Wesco perspective, hopefully winning the wire business in Q4 is the 1st phase of winning other, more profitable, elements of the project in later quarters, otherwise they are winning this but losing other future elements. Plus, the increase in copper pricing helped drive growth.) Industrial sales were up low single digits year over year with notable strength in Canada. OEM sales increased mid-teens. EES backlog was up 6% year over year, reflecting healthy underlying demand across the portfolio.”

- EES represents 38% of Wesco in Q4 2025

- EES’ gross margin was 23.7%, up 50 basis points from 2024 Q4. (With the gain of 50 bps, is Wesco passing through price increases? With data center business strength, and representing 18% of the overall business, is the volume of project business increasing?)

- CSS was the star with sales of $2.4125 billion, up 14% organically. Their Data Center Solutions group is based here and was up over 30%. Wesco Data Center Solutions (WDCS) growth was driven by large project activity with hyperscale customers (While there is some data center business attributable to EES, and some projects in the UBS segment for grid upgrades, transmission, transformers and generators, most data center efforts are centralized in CSS. Much depends upon the customer, the salesperson, the material purchased, and the phases of the project that Wesco is involved.)

- Regarding pricing, “So we did not see the benefit of that mid to high single-digit price increase notification translate through to our results. We only saw a 2% benefit for the full year 2025 on pricing. And a point of that was commodity-driven.”

- Data Center details

- “The white space, representing approximately 80% of our overall data center sales through CSS, includes our next-generation connectivity and IT infrastructure portfolio. Beyond products, our services offer spans the full life cycle of a data center. We support customers from early planning and design through installation, commissioning, and integration, all the way to ongoing operations, modernization programs, managed services, and ultimately decommissioning. This end-to-end capability allows us to help customers adapt quickly and execute at scale in a rapidly evolving environment.”

- “WESCO’s capabilities now support every major phase of the data center life cycle. From power and electrical distribution infrastructure to advanced AI compute environments to on-site services that support construction, commissioning, and ongoing operations.”

- “In the gray space, which represents roughly 20% of our total data center sales through our EES business, we provide the critical power, electrical, mechanical, automation, and MRO products required to support the construction and operation of high-performance scalable facilities.”

- Continued digital investments….“The centerpiece of our new tech stack is a world-class data lake where we’re working to apply AI to improve the efficiency and effectiveness of our business. “

Analysts Concerns

Analysts voiced concerns over the EPS miss, weak cash flow, conservative 2026 guidance, and margin stability despite strong revenue and backlog growth. This prompted questions on whether project mix, SG&A leverage, or working capital issues masked underlying health. Management attributed it to large-project gross margin pressure (especially public power in UBS) and $200+ million receivables/inventory build, but investors pressed for why beats weren’t delivered given 10% sales growth and 19% backlog rise.

Intense scrutiny over the free cash flow drop, as it is just 0.5% margin ($30–54 million) versus 4.9% prior year. Analysts questioned the $976 million operating cash drop (to $125 million full-year) and if aggressive growth investments risked balance-sheet strains. Management attributed this to higher receivables and higher inventory balances (increased cost of goods)

Analysts questioned if the 5–8% sales and $14.50–16.50 EPS guidance was too cautious versus 2025’s data-center surge ($4.3 billion, +50%) and record backlog, with probes into why no upside given CSS backlog +40% and secular tailwinds. Management defended the guidance as disciplined in light of macroeconomic uncertainty.

Wesco 2026 EOY Guidance

Wesco’s 2026 guidance focuses on mid-single-digit sales growth, 5% to 8%, with revenue expected to be in the range of $24.7 billion to $25.4 billion, with margin expansion and double-digit EPS growth. CSS is expected to lead growth with mid- to high-single digits, driven by data centers. EES outlook is for steady mid-single-digit growth from OEM, construction, and industrial recovery. UBS’ outlook is for mid-single-digit growth as investor-owned utilities strengthen.

Take Aways

- Good performance with market share gains, but margin pressures.

- Wesco continues to benefit from its data center experience and relationships. The question becomes, is it going after the “shiny coin” or staying diversified on the end-user markets / different applications? Historically, a sales organization focuses on where it is having success, but markets can change quickly. Other end user markets were strong.

- Wesco is not significantly impacted by changes in the residential market, so they are more “insulated” here vs a company like Rexel, which also has more smaller contractor customers.

- Little commentary on the industrial market, which historically has been a core revenue strength for Wesco (global / national accounts.)

It appears to continue to be the case that as the data center / AI construction market goes, so goes Wesco.

As someone once sang … “it’s all about the data center, the data center. It’s all about the data center.”