NSi “Upgrades”, Positions for More Growth

NSi Industries, after making three acquisitions in 2019, itself was sold, which will position the company for future growth.

Ironically the company’s recent acquisition of Bridgeport Fittings helped trigger the sale of NSi by its private equity owner, Blue Sea Capital, to a larger private equity firm, Odyssey Investment Partners. NSi triples sales within the past four years.

And with a larger partner comes access to additional resources which bodes for potential future acquisitions.

The press release from Odyssey and NSi stated:

Odyssey Investment Partners, LLC (“Odyssey”) announced today that an affiliate has acquired NSi Industries (the “Company”) from Blue Sea Capital LLC. Financial terms of the transaction were not disclosed.

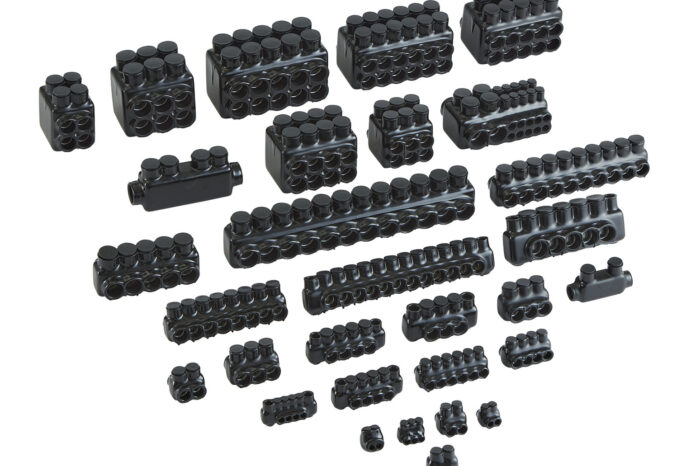

NSi is a leading supplier of a wide variety of electrical connector, fitting, control and wire management products for construction, maintenance and repair applications. NSi’s well-known brands include Polaris™ insulated connectors, Bridgeport Fittings, TORK® time and lighting controls and Platinum Tools® connectors & tools. NSi has a 40-year history of providing innovative, profitable and quality solutions to its distributor partners with an unparalleled customer-centric approach. NSi is headquartered in Huntersville, North Carolina, with additional facilities in Stratford, Connecticut and Newbury Park, California. More information on NSi can be found at www.nsiindustries.com.

The NSi management team, including CEO G. R. Schrotenboer and COO David Di Donato, has invested significantly in the transaction and will continue to lead the Company under Odyssey’s ownership.

Jason Cowett, a Managing Principal of Odyssey, said: “We are excited to acquire NSi Industries with the Company’s management team. NSi has established a strong, incumbent market position and a comprehensive offering of stock and flow products in a large, fragmented industry. We look forward to collaborating with G. R., Dave and their team to capitalize on NSi’s many attractive and diverse growth opportunities to build value for all of its stakeholders.”

Mr. Schrotenboer said: “We are enthusiastic about our new partnership with Odyssey, which has a long track record of supporting growing companies and management teams looking to further elevate their businesses. Our team has an ambitious agenda, including continuing to expand our product portfolio and service capabilities, and identifying new ways to help our distributor partners become even more successful. Odyssey understands our business and its opportunities, and is well-positioned to help us build on our accomplishments to date and achieve our full potential.”

The question becomes, who is NSi’s next acquisition. Their acquisition of Bridgeport shows that they are willing to be a portfolio company rather than everything falling under one brand. The commonality? Both have strong stock / flow businesses. Thoughts on whom could be next?