Impacts On Lighting If China Weaponizes Rare Earth Metals

We know tariffs can impact the electrical business. But rare earth metals?

We’ve had tariffs after last year’s tariffs on steel, aluminum and a number of other products. The recent acceleration of tariffs on Chinese imported products (price increases from many, if not all lines) is affecting many manufacturers and will impact most lighting lines. We can presume that the tariff on Mexican imports, if it becomes onerous, will result in increases on items such as wires and cable, telecommunication equipment, electrical power and distribution boards, electric motors and generators, electrical switches, electrical transformers and more with manufacturers such as Hubbell, Leviton, Eaton, Acuity, and Southwire, to name a few, having factories there.

Why rare earth metals? How could they affect the electrical industry?

First, what are they? According to Wikipedia, “A rare-earth element (REE) or rare-earth metal (REM), as defined by IUPAC, is one of a set of seventeen chemical elements in the periodic table, specifically the fifteen lanthanides, as well as scandium and yttrium.[2] Scandium and yttrium are considered rare-earth elements because they tend to occur in the same ore deposits as the lanthanides and exhibit similar chemical properties. Rarely, a broader definition that includes actinides may be used, since the actinides share some mineralogical, chemical, and physical (especially electron shell configuration) characteristics.[3]

The 17 rare-earth elements are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y).

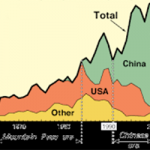

Despite their name, rare-earth elements are – with the exception of the radioactive promethium – relatively plentiful in Earth’s crust, with cerium being the 25th most abundant element at 68 parts per million, more abundant than copper. However, because of their geochemicalproperties, rare-earth elements are typically dispersed and not often found concentrated in rare-earth minerals; as a result economically exploitable ore deposits are less common

Our guest columnist, David Shiller, President of Lighting Solution Development, David’s company focuses on advanced lighting technologies and solutions. He shares his thoughts:

“China is threatening to use its near monopoly on rare earth metals to hurt the US economy, in retaliation for US tariff policy. More details in Bloomberg, here

Do you remember when China last manipulated rare earth exports, in 2010 / 2011? It was a nightmare for the fluorescent lamp industry, which relied on rare earth phosphors. I was selling millions of dollars a year in CFLs and fluorescent tubes, at that time, and lamp prices doubled quickly. It was VERY STRESSFUL and contributed to my abandoning lamp sales and instead becoming a consultant. Thank you, China. I’m much better off, now.

There are three big differences in the lighting industry, however, between now and then:

- LEDs require a small fraction of the phosphor (rare earths) that fluorescent lamps do. This means that a similar 10X to 100X increase in rare earth pricing impacts LED products a much smaller amount than it does fluorescent lamps. As a result, I predict such a move by China could destroy the fluorescent lamp industry and force a final shift to TLEDs and LED lighting, more generally.

- There have been some big investments around the world, after the last rare earth crisis, and new sources of rare earths have been found in various countries around the world. If China plays this card, they may trigger new rare earth mining, outside China, that breaks their current near monopoly on rare earths. (According to articles on the subject, much of the issue relates to China having a higher monopoly on processing of rare earth metals than the mining of rare earth metals.)

- Some alternative down converters could benefit from a rare earth crisis, such as quantum dots (QD), which don’t rely on rare earths. This could accelerate new downconverter investments, R&D, and lighting industry adoption. Osram released the first QD LED at LFI, last week (details here).

Lastly, rare earths metals are even more important for non-lighting industries, especially clean tech (EVs, wind turbines, etc.). China could damage these industries, globally, far more than the lighting industry.

During the last phosphor crisis, manufacturers that hedged and stockpiled extra inventory EARLY made a killing after prices spiked. The longer you wait to stockpile after prices surge, the greater the risk of getting stuck with high cost inventory.

For anyone in the lighting industry, this is a story to keep an eye on.”

David Shiller is President of Lighting Solution Development, a consulting firm specialized in product and business development, for advanced lighting manufacturers.

Potential challenges / opportunities:

- If you’re still selling much fluorescents, more price increases may be coming.

- Again, if you are selling fluorescents, perhaps

this is another reason to promote a conversion to LEDs? Or promote to your

customers for them to stock up (after you having stocked up before supplier price

increases occur?)

- Maybe run a query in your ERP system to identify whom you’ve sold fluorescents to in the past few years and craft a marketing message that promotes LED benefits … energy savings, maintenance savings, various control and color benefits, other application benefits depending upon the market, rebate opportunities and remind them that rare earth materials are in these fluorescents which could make replacements more expensive in the near future.

- If lighting is a focus of your business and you’re not aware of QDs, maybe they aren’t mainstream yet but perhaps something to become more knowledge about.

Just another thing to be aware of as macroeconomic interests impact the electrical industry.