Electrical Distribution is booming, but…

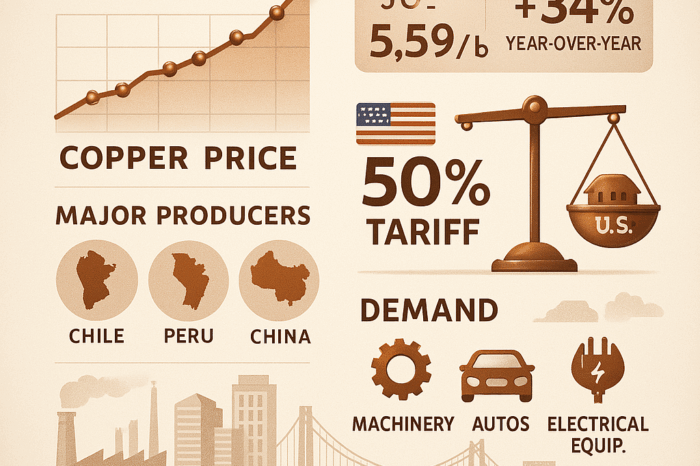

Last month Christian Sokoll from DISC shared an electrical industry forecast that depicted accelerated growth for the industry. We all know about the price increases that are occurring in the industry let alone some of the “why’s” (supply and demand issues, supply chain disruption, et al).

Now he shares that, while business is booming, be cautious.

DISC Corp … Looking Forward

Looking at the current economic picture, all is well and very rosy in the electrical distribution economy. Or is it?

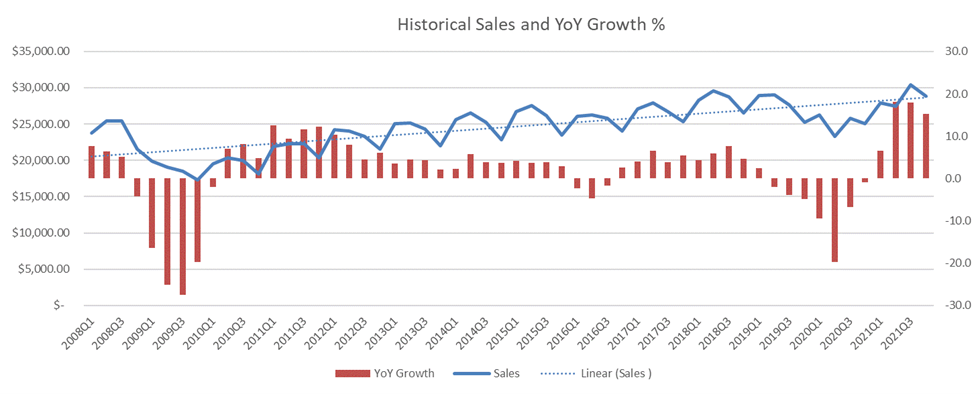

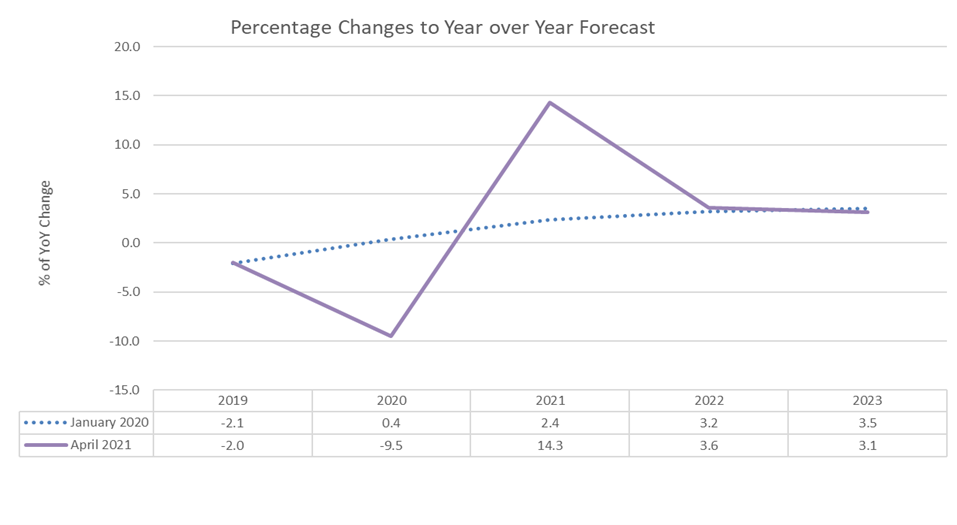

My company, DISC Corp., is forecasting 2021 year over year growth to be somewhere in the 14%, or more ,range.

This is a big stretch from historical (2008-2021) growth rates that averaged t 2% a year. It is easy to get caught up in the excitement of a growth cycle. We need to look ahead, through forecasting, to plan without the rose colored glasses of today. In other words, the combined benefits of COVID recovery, COVID recovery and raw material shortages will not last forever.

This chart gives a good picture of YoY changes in percentage of growth while showing a steady incline in sales.

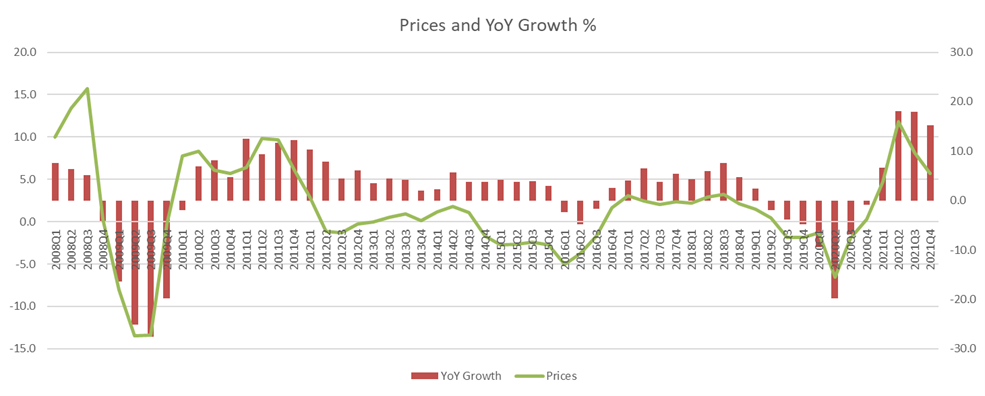

Laying the change in prices over time alongside the year over year percentage of growth, we can see that YoY sales change is correlated to the changes in price. The two are linked closely and can be traced to supply and demand.

When we have a “Black Swan” event such as COVID that disrupts both supply and demand, prices eventually contract along with period over period performance. Currently we are in a short-term recovery cycle that is a result of pent-up demand and supply chain disruption. This is pushing prices to the roof. Closely managing inventories and suppliers will greatly reduce lost profit as prices normalize in time.

The April DISC Flash report forecasts prices flattening out along with the sales curve beginning in 2022.

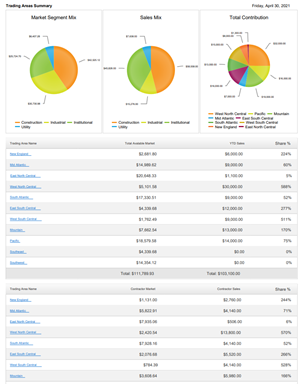

DISC reports monthly current conditions and forecasts for the electrical industry’s primary vertical markets – construction, industrial, institutional, and utility. In our Flash report, we show how the dynamics of the pandemic have impacted sales and what to expect by market vertical as we recover.

Below is an interesting chart that shows our pre- pandemic year over year forecast prior to the start of the COVID-19 crisis, and the current forecast that puts us back on track, after a rather intense Z shaped recovery, for normalized growth in 2022. The monthly Flast report includes this, and additional insights on these dynamics,that can be beneficial to running your business.

Forecasts to Support Planning and Determining Market Share

Our customers (manufacturers, distributors and repshave found it valuable to understand historical and forecasted market size and market share for their regions, branches, or agents (as well as associated salespeople). DISC integrated new visualization capabilities into our DataSearch reporting system to help identify and forecast sales and market share trends. With these new features you can create time-based share and market reports for planning and performance review. Measuring sales growth to market totals including price is a sure way to understand performance past, present and future.

These are drillable through various levels of your territory hierarchy with custom selectable date ranges.

At DISC We love to talk about how our tools and market forecasts can help you optimize performance.

Takeaways

Thank you Chris. So, some thoughts:

- If you can get material, times are good, but don’t expect today’s business mode to last into 2022 unless you proactively plan to pursue some of the growth markets that are developing … or are in a unique growth market geographically (i.e. here in Raleigh, Apple just committed to a $1 billion campus and a minimum of 3000 new jobs which will have a significant economic boost … and there will be a bigger ripple effect).

- Comparable results for every company should be great for Q2 & Q3. Don’t get lulled. Distributors need to always be looking at the # of units that they are selling to see if they are really winning or if “the tide is raising the ship” and hence your costs that are tied to sales (i.e. compensation)

- Inventory management must be a core competency as “the value of what goes up may come down”. This could impact distributors at the end of the year.

- Goal setting … will need much consideration towards the end of the year.

- Gross profit dollars should be improving (and this is after a year when many reported better than expected profits due to PPP funding and a reduction of expenses). Use this incremental profitability as an investment fund … to invest back into your business to plan for the future (and this is one reason why the acquisition market is heating up … publicly held manufacturers have had a large run-up in their stock price!)

And if you don’t subscribe to the monthly DISC Flash report, you are missing a valuable tool that has electrical specific insights as well as electrical forecasts to keep you informed. It’s a nominal expense … less than $85 / month! (And if you mention you’re an ElectricalTrends subscriber, Chris will provide you an additional discount through May.)