Talon Strikes

Siemens’ Talon business is undergoing some change.

Talon, a brand under the Siemens umbrella, sells meter mounting equipment including meter sockets, temporary powered-outlet panels, air conditioner disconnects and more through electrical distributors … both Siemens and non-Siemens distributors.

Due to its structure as a “stand-alone” business that is willing to sell to all distributors (essentially a saturation distribution model), the division has gone to market through manufacturer reps.

The reps not only call on distributors but also, due to the nature of the product, focus on developing relationships with utilities who specify the products to be used in their systems. Additionally, the reps work with the local contractors and then support distribution.

Given Siemens size and breadth of product offering, Talon is a small part of the business.

According to several reps, Talon held a “rep call” this week to announce a change in its business approach.

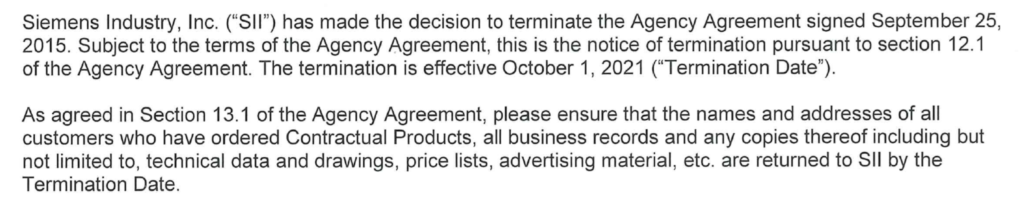

According to some who were on the conference call, It is “terminating” most of their reps effective October 1st and giving the sales responsibility for the line to the Siemens direct sales force.

According to Siemens, “This move is primarily being made to streamline our large portfolio of products, creating a simplified experience for our customers. Many Talon catalog numbers are also produced as Siemens products, and have been for years. Because of changes driven by NEC 2020 code updates, Siemens/Talon is consolidating its line of meter mounting equipment. In the process, Siemens is also consolidating SKUs for complex product families to make its products easier to shop. These changes will be phased to limit market disruption.”

Per the reps that contacted us, their perception is that the changes were being made due to cost challenges.

Either way, its a change in strategy for the division as the Talon brand will no longer be represented by many of its agents. According to Siemens, “Siemens Sales Engineers have always had responsibility for Siemens metering equipment, and will continue to be valuable resources for distributors, utilities and contractors through the product specification process. Siemens also has an inside sales organization and application engineering teams that provide technical and market-facing support for these product lines.”

While the Siemens sales engineers were supporting Siemens distributors, and maybe some reps were also, based upon experience it is very doubtful that a non-Siemens distributor will be open to supporting a Siemens sales engineer (but perhaps business can be moved to Siemens distributors.) Either way, the Talon brand has a change in its sales strategy.

Interesting that Siemens wants “all names and addresses of all customers who have ordered Contractual Products.” Since products are sold to distributors, aren’t those the customers? Presumably Siemens knows the addresses of where material was shipped, if shipped directly to an end-user (utility or contractor).

While we don’t know what percent of Talon’s business was with non-Siemens distributors, presumably having a Siemens direct salesperson call on a non-Siemens distributor will be, shall we say, a “challenge.”

Further, many Talon reps were stocking reps as customers in this product category have historically preferred local inventory access … meaning being able to serve emergencies as well as short notice for meter installations.

Further, given that Talon is a nominal product within Siemens, how much attention will a Siemens direct salesperson spend in pursuing utility specifications (or will they expect that the specs that their former reps developed will remain “loyal” to Talon / Siemens and hence the business will be an annuity?)

For Siemens distributors, this may mean more support as the direct salespeople should be expected, at least by a Siemens distributor, to “bring” Talon business to a Siemens supporting distributors.

Chris York, Siemens’ Head of Channel Sales, shared ” Siemens Sales Engineers have sold metering products under the Siemens name for years, and have a comprehensive understanding of the product line in their local markets and how it fits into Siemens overall product portfolio. Siemens/Talon authorized distributors will continue to experience the same great service they’ve come to expect from our hundreds of sales engineers and supporting network, no matter which market they’re in.”

And if you are a Siemens salesperson, you hope that the distributor knows the product specification process and the key decision-makers at the end-users to secure / retain the specifications.

So, Siemens generates a savings by removing support (commissions) for the reps and perhaps some other sales support resources.

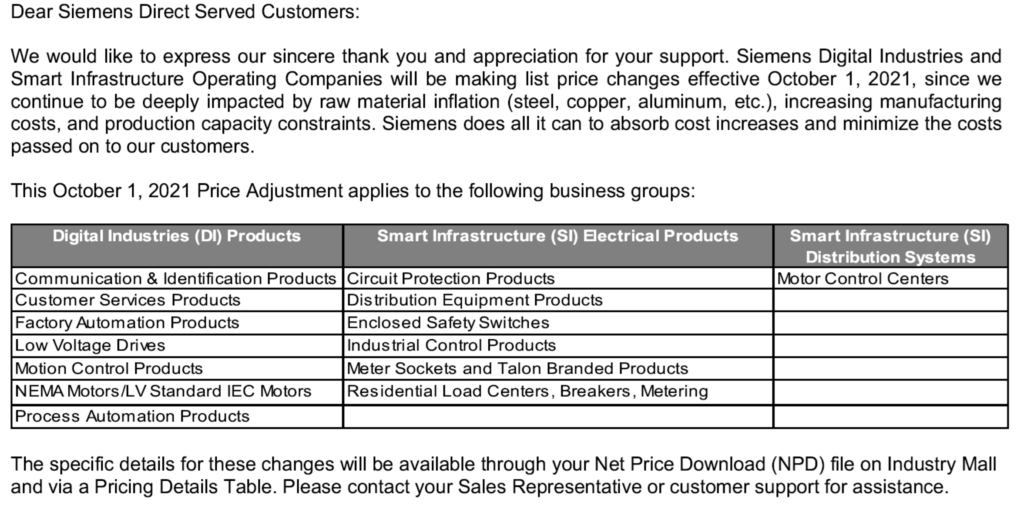

Perhaps coincidentally, this week Siemens announced its October 1 price adjustment (read increase, as doubtful anything went down this year). From the reps’ perception, the “cost” concerns have been alleviated with cost-reduction (reduction of commission and some sales support expense) coupled with a price increase … profit improvement.

The question becomes, will they retain the revenue or, since it may be relatively small, perhaps they have already factored in revenue erosion.

According to Siemens, they will be communicating these changes in further detail to their Talon channel partners in the near future.

And for Talon competitors, an opportunity?