Monday Mergers & Acquisitions – CED, Synergy

Monday seemingly was just another day in the electrical industry … with acquisitions and mergers being announced.

Monday seemingly was just another day in the electrical industry … with acquisitions and mergers being announced.

This time it was two acquisitions, which makes three in two days and, by my recollection, sixteen (yes, 16) in the past 60 days or so.

This year the acquisitions involve electrical distributors, electrical manufacturer and lighting agents (and yes, there have been some electrical and lighting manufacturers, but none that are overly noteworthy.)

The two deals announced yesterday were:

- CED acquired Parrish Hare. For those not familiar, Parrish-Hare, 41 year, 4 location, Schneider distributor that is a member of IMARK, was ranked # 61on the 2023 Electrical Wholesaling Top 150, which reports / estimates 2022 revenues. This ranks Parrish Hare about $200-220 million. The company has been very focused, according to sources, on the data center market and is has a nice “services” business, which helps its profitability. A quality company that is known for “doing the right thing.” The business will operate as a subsidiary of CED, retain its name, maintain its IMARK membership, Pat Hare will remain involved in the business and, according to sources, “essentially no change.” The company will benefit from some “backroom” services, and resources, that benefit the employees and reduce administrative burdens. Customers and suppliers will see no change in operations. The best of both worlds with “fuel to help grow” and retaining “Texas independence mentality.”

- Fuseco, which is also owned by Pat Hare, was not involved in the transaction.

- Synergy Electrical Sales, a Philadelphia area based diversified manufacturer representative agency expanded its reach in the northern NJ / NYC area with a merger with Electric Lighting Agencies after last week earning representation of Signify in the New York area. For those who question if a combined independent electrical manufacturer representative and a lighting agency can grow under one roof, take a look at Synergy. This deal, combined with The Diversified Group’s acquisition of ORA Lighting & Controls, is also emblematic that the NYC / Philadelphia metro sales representation market is becoming one. Much of this can be attributed to the distribution market given the influence of Cooper Electric and USESI, as well as other large distributors. The selling markets behave differently, although there are some large design / engineering firms and contractors.

And last Friday, Graybar announced that it had acquired two location southern Colorado-based Blazer Electric Supply 2.0. Blazer, in the EW Top 150, was ranked #101 with an estimated $88 million in revenue. For Steve Blazer, one of the founders of Blazer Electric, this was his second distributor “exit” from the industry, formerly selling Blazer Electric Supply to Westburne (which eventually sold to Rexel) in 1999 (and his father owned a plumbing / electrical distributorship before that.) Steve entered back into the business after a 10 year hiatus and rehired many of his prior employees. Congratulations to Steve and his family. Will there be a Blazer 3.0 in another 10 years?

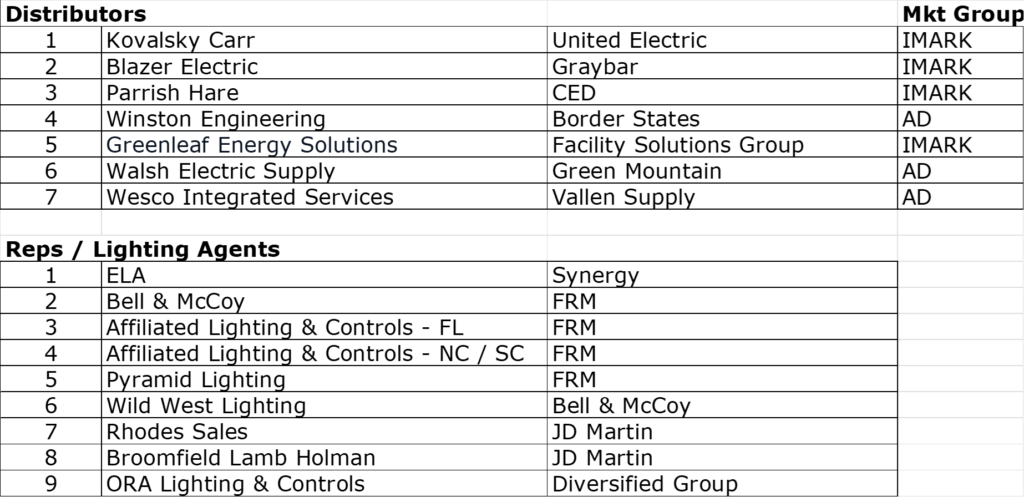

So, what other deals have occurred? Here’s a listing, in no particular order, through March 4:

In looking at the distributor deals:

- IMARK “lost” three members, however, the revenue stayed in the group as Graybar’s North American Subsidiaries is in IMARK and CED’s acquisitions that retain their name are in IMARK.

- AD “lost” a member but retained the revenue and two AD members added acquisition-generated revenue (with Vallen adding revenue for multiple AD divisions.)

- The Border States and FSG acquisitions are interesting as they suggest broadening their offerings … diversification.

- Border States adds a billable engineering organization that can bring unique opportunities. They can provide value-added assistance to customers, can assist in obtaining opportunities which will provide the “inside track” on winning business, and be a significant tool in retaining business. Further, it can evolve into a training center. According to sources Border States plans to further resource this organization.

- The FSG deal highlights the potential that they are seeing in the solar industry and, with monies that are allocated in the IIJA and the IRA Act, there are significant government resources that will help solar grow in all four market segments – residential, commercial, industrial and utility spaces. This is a savvy diversification strategy.

- The Green Mountain / Walsh Electric deal continues Green Mountain Electric Supply’s roll-up of small distributors in upper New England. This marketplace is now a chain market dominated by GMES, CED’s Yankee division, and Sonepar. Granite City Electric has a presence in this market and then some others have pockets of business.

In looking at the rep / lighting agent deals

- Many are concentrated in the south or NYC

- Most are involving lighting agents (although there are more electrical manufacturer representative deals “coming”.)

- What’s driving these mergers / acquisitions?

- Succession planning … which means ownership is getting older!

- Major lines wanting growth, which requires more resources

- Desire for diversification

- Rep / agency owners see the value in pursuing a broader market basket AND getting visibility into projects sooner (which lighting agents frequently do).

- Changes in the lighting market where “value-engineering” by contractors and distributors drives a higher percentage of opportunities than ever before.

- The FRM /Bell & McCoy merger is interesting. It creates a firm from New Mexico to North Carolina … the entire south, the fastest growing area of the country. And they are diversifying the FRM business with lighting acquisitions. Current is across much, if not all, of the platform, for the lighting side.

The electrical industry is undergoing an “arms” race.

The 2023 EW Top 150, when excluding utilities, is down to 109 distributors. The distributor divestitures further impact NAED’s reach as there become less distributors (and it makes national chain participation and involvement more important.) The marketing groups have less members but the same revenue potential.

Recently I was looking at revenue for a region of the country. We estimated that slightly over 50% of the total market size was “controlled” by national chains. Further, we estimated that 75% of the non-distribution equipment / controls market went through these companies. What does this mean for the market? How does this change manufacturer strategies?

But, for those who were not at NEMRA, one of these distributors said, “we need reps to create demand?” This says something about each companies strategies (and not only the role of reps.) Some are operationally focused, some are a hybrid, some are good at generating revenue while also serving their customers.

The market is changing. The arms race is won with money, however, smaller companies can, and will succeed, based upon achievement of their goals.

For a small to mid-sized distributor, it is feasible to win. The question becomes, what is your vision? Management’s timeline?

Channel dynamics will be changing. Acquisitions / mergers were the impetus. For those playing to win, now is the time for ideation and strategic planning. You cannot “play around the edges” anymore. Status quo only delays the inevitable (which isn’t bad if your goal is selling, just don’t play the game of musical chairs.

If you’d like to discuss what we see as some of the changing channel dynamics and discuss ideation and strategizing, give me a call.