Opportunities in the Single Family Residential Market

While the residential market represents a relatively small segment of the overall electrical market, especially for electrical distributors, it is important for some. Further, when a “development” goes into an area there is a spurt of commercial construction activity.

While the residential market represents a relatively small segment of the overall electrical market, especially for electrical distributors, it is important for some. Further, when a “development” goes into an area there is a spurt of commercial construction activity.

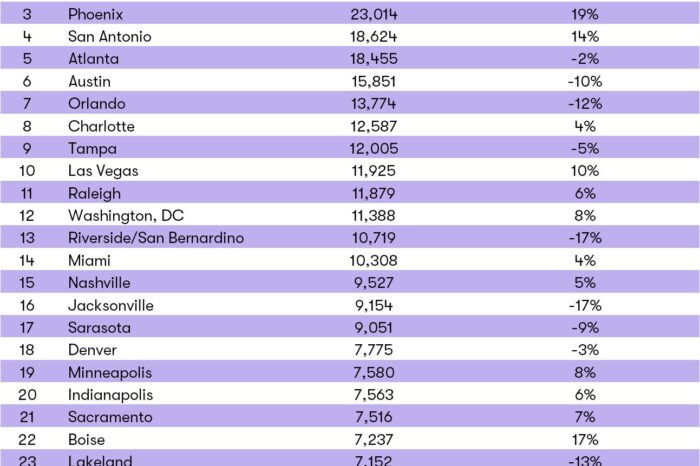

The new construction housing market, in many geographic areas, has taken a hit with higher interest rates, higher land costs, and population trends, but there were still about 1.5 million homes being built … with more focused in the Southeast and Southwest.

While builders, especially tract builders, may seek to “skimp” to maintain their costs, the electrical and lighting upgrade component of these homes can be a lucrative opportunity for electrical distributors if you can make the process “easier” for the builder and/or if you can communicate with the consumer.

Zonda Building Products is THE residential market advisory service. They research, and forecast, the residential Building Products market, and also provide custom advisory services for manufacturers, distributors, and financial intermediaries in the building products sector. They also offer monthly subscription analysis.

Zonda Building Products is THE residential market advisory service. They research, and forecast, the residential Building Products market, and also provide custom advisory services for manufacturers, distributors, and financial intermediaries in the building products sector. They also offer monthly subscription analysis.

Jacob Belk, their VP Advisory Services, and I were recently communicating about some of their information and then had a discussion on behalf of a Channel Marketing Group client. During our discussion we spoke about the residential new construction electrical and lighting upgrade market, which may or may not be served by electrical distribution. Jacob offered to share some of Zonda’s findings and research with ElectricalTrends readers.

The Residential New Construction Lighting & Electrical Upgrade Opportunity

“Lighting and Electrical upgrades in new single family residential homes were popular upgrades in 2024 with many consumers opting to pay extra to upgrade these products when offered the option. However, while Electrical and Lighting options have grown more than other options since 2019, they have lost some wallet share in recent years. Going forward, Lighting upgrades face significant risk in 2025 from proposed tariffs, while we expect Electrical option upgrades to be relatively resilient to tariff impacts. Both categories had high conversion rates in 2024, speaking to their ongoing desirability for consumers.

New Home buyers are offered a variety of design and product options. For example, they can pay more for an upgraded lighting or faucet package. What options get offered, and what products consumers pay to upgrade can reveal what consumers value, and how manufacturers can respond to and plan for demand.

History through 2024

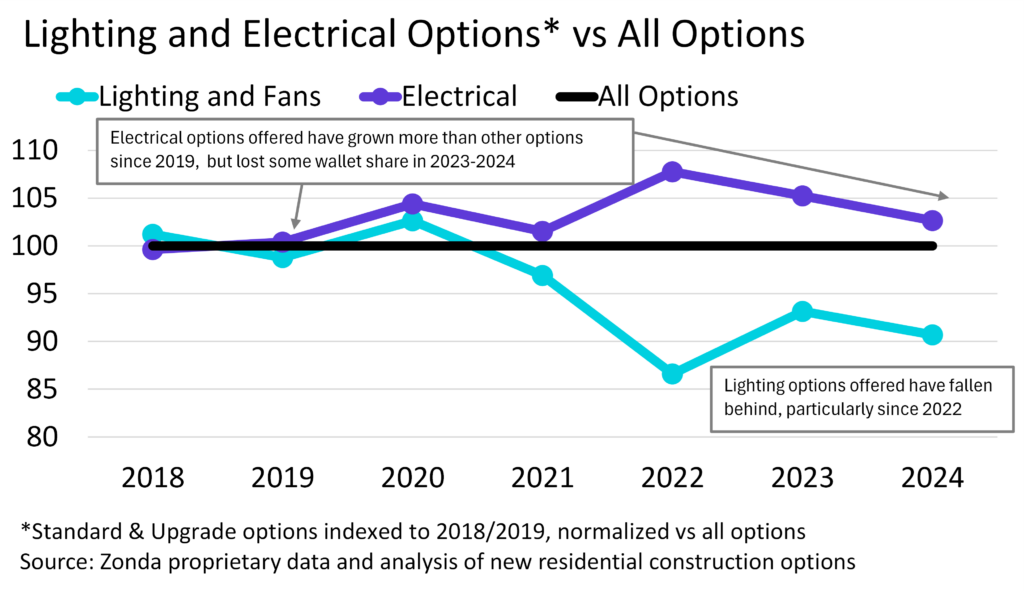

Offering buyers electrical options in their homes has grown in popularity among builders. Electrical options in new homes, such as structured wiring, home automation, surge protection, etc. have grown faster than other category options since 2019, with a particular jump in 2022, but they have lost some wallet share since 2022. (see Figure 1).

Figure 1

Lighting and Fan options on the other hand, have not kept pace with overall new home options, falling behind in 2022 in particular, as other options took priority in builder offerings. (see figure 1).

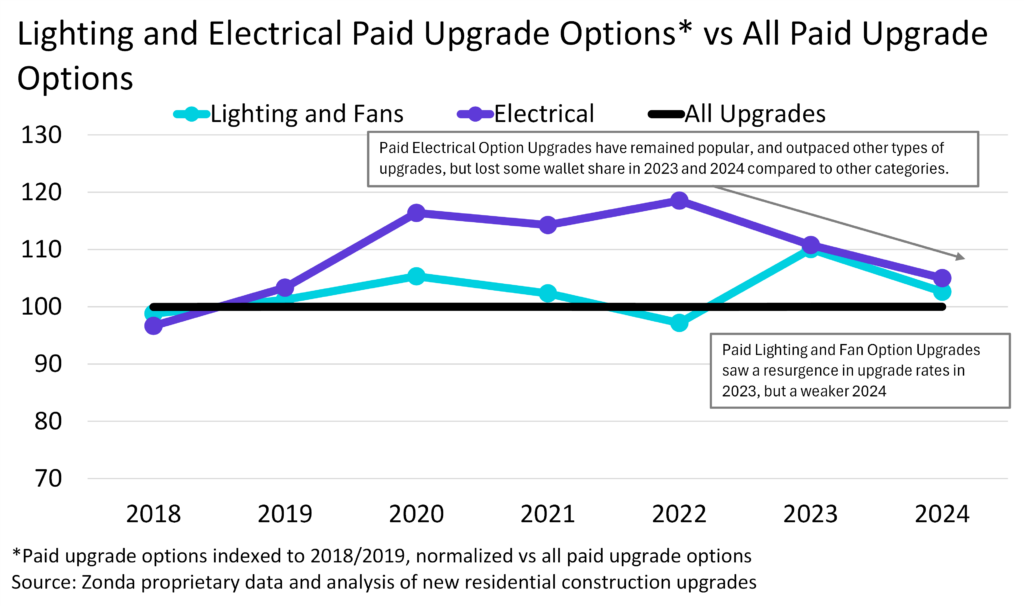

However, this doesn’t mean that consumers don’t want Lighting options installed in their new houses at purchase. Paid upgrade options for Lighting have outpaced the general market in most years and grew more compared to their 2018-2019 baseline (see figure 2). Paid Electrical upgrades have outpaced other upgrade categories since 2019, with the exception of a weak 2022 (see figure 2).

Figure 2

While some of these upgrades are likely the result of builders value engineering their base models by offering design and product options that were standard in prior years as paid upgrades (ex. Can lights used to be standard, but are now a paid upgrade), leading to higher upgrade rates, using our proprietary purchase data, Zonda can compare the growth in options with the growth in buyers who paid extra for an upgrade.

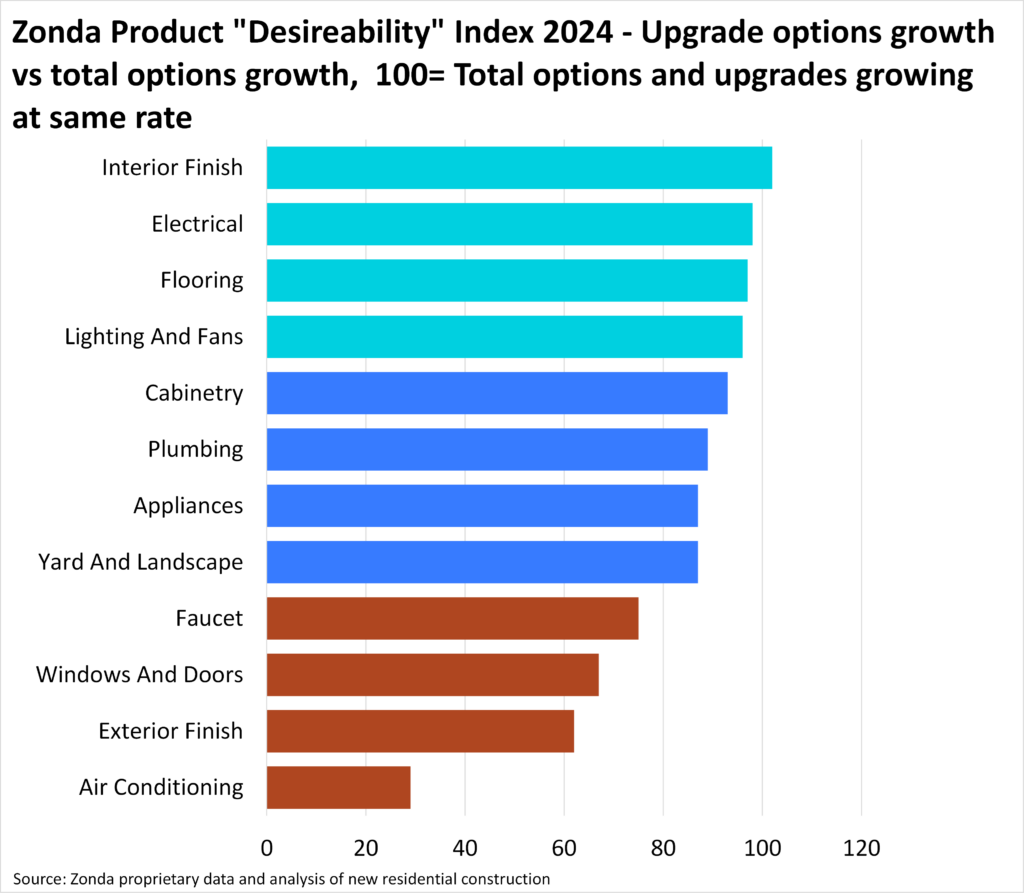

In 2024, both Lighting and Electrical upgrades grew almost as fast as the options were offered, giving them both strong “Desirability” ratings compared to other categories (see figure 3). Put another way, a lot of options got offered in 2024, but Electrical and Lighting and Fans were being purchased at almost the same as rate they were being offered. Other categories ultimately had more options purchased, but the conversion rate of “offered” to “purchased” was worse for almost all other categories.

Figure 3

Residential Outlook for 2025:

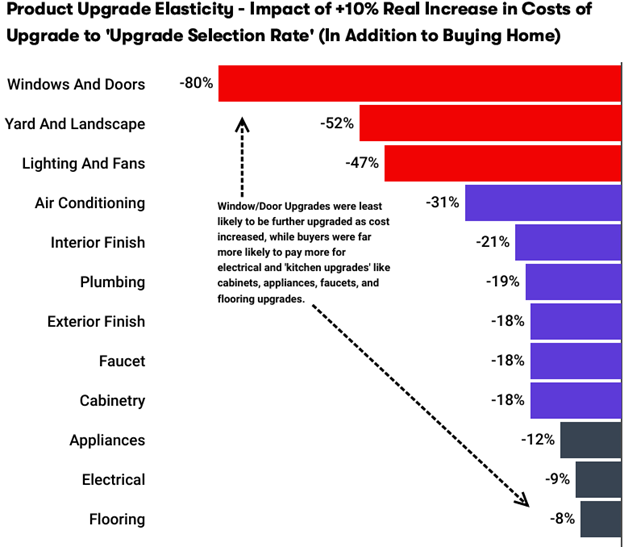

So what does 2025 hold? How will consumers respond to the proposed tariffs on foreign imports? The 2021-2022 supply chain snarls provide a great natural experiment on how consumers’ upgrade choices reacted to price increases. Lighting upgrade rates were highly reactive to price shocks, while Electrical upgrades were relatively inelastic (see figure 4).

Figure 4

Conclusion:

Despite losing a bit of wallet share in 2023 and 2024, both Electrical and Lighting Upgrades still rated as very desirable upgrades in 2024, with consumers purchasing upgrades at almost the same rate they were offered. Electrical upgrades in new homes will be relatively resilient to tariff impacts in 2025, while Lighting and Fans upgrades have a lot of exposure to price shocks from proposed Tariffs. We expect Electrical options to continue to be popular upgrades in 2025, but Lighting and Fan upgrades risk a large drop in demand from any tariff instigated pricing shock.

Email me at jbelk@zondahome.com if you would benefit from more detailed data on Electrical or Lighting upgrades in new homes. These additional insights can help you plan and execute on what is sure to be a dynamic 2025.

Observations and Take Aways

- Jacob, and Zonda, has more information and more information about specific types of upgrades for the residential new construction market … and probably by geographic areas.

- Zonda and Channel Marketing Group can work together to help you gather insights and develop the strategy. Zonda has the capabilities to conduct customized research, and potentially brand research, at the builder level, to help inform strategy and then monitor effectiveness.

- Many “construction-oriented” distributors do not do a good job of identifying the types of work that their contractors do … and frequently these are “small to medium-sized” contractors for distributors … and frequently unassigned accounts. Consider how you can learn more about your customers?

- Want to win business from Home Depot or Lowes? Show your contractor you want to help them increase their sales AND be more profitable. Help them target builders … especially custom builders.

- Further, any of these upgrades can also be used for the renovation market … and perhaps you are one of the few (maybe only) distributors in your market actively trying to market electrical upgrades to homeowners … with a select group of contractors? (and yes, it takes some time to build a brand to become known as “THE” resource.

- This is known as “building a market.”

- Further, any of these upgrades can also be used for the renovation market … and perhaps you are one of the few (maybe only) distributors in your market actively trying to market electrical upgrades to homeowners … with a select group of contractors? (and yes, it takes some time to build a brand to become known as “THE” resource.

- Get your contractors thinking about upgrades. Plumbing and mechanical contractors are better salespeople than electrical contractors. Consider how you can help your customers be better salespeople. Help them with a sales process, perhaps with marketing materials, perhaps a “residential upgrade kit?” Here’s a contractor who lists 8 “must have electrical upgrades” on their website:

- Smart Home Upgrade opportunities include, according to this contractor, LED lights, Additional Outlets, GFCIs, Electrical Panel Updates, Electrical Wiring Rework, Charging Stations, Energy Monitors

- Do a Google search for “new home construction electrical products upgrades” and see what contractors are promoting.

- And they didn’t list lighting controls, generators, landscape lighting, deck lighting, internal lighting upgrades (inclusive of decorative lighting), undercabinet lighting or ???? Consider the potential.

- Smart Home Upgrade opportunities include, according to this contractor, LED lights, Additional Outlets, GFCIs, Electrical Panel Updates, Electrical Wiring Rework, Charging Stations, Energy Monitors

While the builder may want to minimize to hit their selling price point (which is really the price point that they want to market the home at), if you can get the consumer during the buying process, they can add upgrades, cost effectively (it’s less expensive to do these changes when the walls are open!) and then either build into their mortgage or decide what to pay out of pocket.

There are opportunities in the residential market, if this is an area of focus (and/or growth.) Creativity, and time, matters … and reach out to Jacob for more insights.