Accelerating Demand, Generating New Opportunities

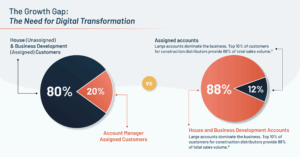

The chart says it all. 80% of the customers who transact with you throughout the year are unassigned accounts. In a market where demand is softening from your core customers, could there be opportunities with others … and “others” also means “other’s accounts?”

In an industry long dominated by relationship-driven, outside sales, distributors are now facing a critical inflection point. Market dynamics have shifted. Customer expectations are evolving. Traditional, reactive models no longer suffice. Demand generation is needed. Existing, albeit low performing, accounts need to be contacted.

How do we know this?

- Industry volume is flat

- Many have commented about a slow Q1, which is on top of benign growth for many the past two years.

- Those with above market growth are winning on large projects.

- National chains “grow” through acquisition.

- Layoffs are occurring, especially with manufacturers … so they are not seeing growth.

The end result … stagnant performance which gets companies thinking about “improving profitability through pricing, inventory management, productivity improvement” and inevitably companies consider technology tools (aka AI) as the panacea. The mantra is “we can cut our way to profitability growth.”

The reality is that this is a fallacy. They key to growth is out thinking and outperforming at the customer.

In many instances this requires focus. It requires intentionally thinking about customer segments and applications.

It requires work.

And senior / executive management cannot do it all. They need to focus on large dollar volume segments. They need to delegate to others to pursue niches that can be cultivated and grown.

How Demand Generation Tools Activate Untapped Revenue Stream, research Channel Marketing Group conducted for Prokeep, makes the case the next frontier for sales acceleration lies in leveraging proactive, digital-first sales strategies – especially for house / unassigned accounts. These accounts are frequently “cherry (brand) pickers”, infrequently need material, or are small (to you) accounts. In some cases, as they saying goes, there can be “gold in them thar hills” or the euphemism that sometimes you can find diamonds. Inevitably there are misassigned / neglected opportunities within your unassigned accounts.

Case in point … I was doing a customer satisfaction survey for a client. One of their unassigned accounts who received the survey (we segmented responses by <$50K and $50K+) commented “We buy $300K / year from you and love our inside salesperson. We wish we had an outside salesperson call on us periodically as we had a $1M project that we had others quote but we had no idea who to talk to at XYZ.” I called that customers, unbeknownst to the distributor, to ask them if they wanted me to ask the distributor to reach out and assign an outside salesperson.

This in-depth report distills insights from distributor research we conducted and presents a roadmap for modernizing sales strategies to unlock untapped revenue streams. It highlights a glaring execution gap: most distributors acknowledge the importance of outbound sales and demand generation but lack the systems, tools, and confidence to act.

That’s where technology like Prokeep can change the game and give a distributor a competitive edge.

7 Takeaways from the Research to Drive Sales in 2025

Below are the top 7 Takeaways from the report – with a clear focus on how they can help distributors grow sales:

-

Untapped Revenue Lies in House Accounts

Over 93% of a typical distributor’s customers are “house” or unassigned accounts – often neglected but ripe with potential. These smaller customers contribute only 26% of gross margin dollars, despite comprising nearly 90% of the customer base. By applying proactive sales methods, distributors can unlock significant, incremental revenue that is hiding in plain sight.

📈 How to drives sales: Proactively engaging these accounts means more frequent touches, improved sales opportunities, and deeper account penetration.

-

Proactive Sales Drives Revenue – But Few Do It Well

Distributors rated the importance of proactive, outbound sales at 7.35 out of 10 in reaching their 2025 revenue goals. However, only 22% currently have inside or marketing teams consistently engaged in outbound efforts. This misalignment between strategic intent and operational execution highlights an actionable growth gap. In other words, the “say / do” ratio is low!

🔑 How this drives sales: Shifting to a proactive model empowers inside sales teams to drive targeted engagement across all accounts – not just the top 10%.

-

Demand Generation Isn’t Optional – It’s Underutilized

While 55% of distributors want to increase sales to house accounts, most lack a formal demand generation strategy. Common barriers include limited time, lack of tools, and insufficient tracking systems.

🚀 How this drives sales: Implementing scalable demand-gen tools enables consistent outreach, automated follow-ups, and improved visibility across sales efforts – translating to real, measurable growth.

-

Prokeep Supercharges Sales and Productivity

Distributors using Prokeep report results like 300% increases in online sales, $31,000 in productivity gains with limited deployment, and improved sales per customer interaction. The platform centralizes all customer communications – text, email, digital – allowing inside sales to send targeted promotions instantly and respond to customer needs faster.

⚙️ How this drives sales: With centralized, streamlined communication, reps can manage more accounts, improve conversion rates, and reduce missed opportunities.

-

Text Management is the Digital Shortcut to Revenue

Texting isn’t just fast – it’s what your customers prefer. Over 47% of distributors surveyed don’t yet use a text management solution, missing a key opportunity. Prokeep allows segmented, personalized messaging by region, product line, or customer behavior – ideal for re-engaging dormant accounts.

💬 How this drives sales: Text outreach enhances retention, accelerates quote-to-order cycles, and supports product promotions and events with higher response rates. It is also very effective in supporting quote follow-up.

-

Sales & Marketing Must Align to Win Share from Competitors

The top priority for most distributors? Converting competitors’ customers. Yet, most marketing teams are underused, and digital tools like email and SMS are still secondary to outside sales efforts. This limits reach, speed, and targeting.

🤝 How this drives sales: Integrating inside sales and marketing using tools like Prokeep ensures every message is relevant, timed, and sent through the customer’s preferred channel as they opt-in, or verify, acceptance.

-

Digital Transformation Isn’t Coming – It’s Already Here

Nearly 90% of distributors expect a major digital shift in operations and customer engagement over the next 3-5 years. Still, confidence in current systems is low: demand generation was rated just 39/100 in effectiveness. This gap between where distributors are and where they can be is an opportunity for those willing to invest in sales tools. Consider, companies invest in CRM to support outside sales. What tools have you invested in to support inside sales? Unassigned accounts?

🔍 How this drives sales: Early adopters of tools like Prokeep can scale faster, deliver better service, and outperform their competition stuck in reactive selling models.

A Growth Playbook

The How Demand Generation Tools Activate Untapped Revenue Stream report highlights that there is opportunity for growth via proactive engagement and digital enablement. Tools like Prokeep can equip you with the ability to engage more customers, faster, and more effectively. And there are manufacturers, such as Schneider Electric and others if you are also in the HVAC space, that will help fund the acquisition of Prokeep for your business!

📥 Take the Next Step

If you want to boost sales for the second half of this year, or worst case get a start on developing your 2026 sales / growth plan, download the report or reach out to me and I’ll send it to you.