Distributors! Take Advantage of the Electrification Opportunity!

Can you go through a day without hearing the word “datacenter” or “new industrial opportunity / facility?” And then, shortly thereafter you hear about future power needs. A few years ago, we heard how EV’s were going to drive electrification needs. Now it is AI, technology, and the re-industrialization of America.

And remember, we’ve also been told for a number of years about the need for grid modernization. There is / was not enough capacity plus the capacity we have is old and reportedly decaying.

Plus, it is dangerous. Look at the wildfires that occur in the western part of the country. Some by lighting but some by sparks from utilities. And then the need to bury lines.

The investment demand will be massive … and some manufacturers (transformers??) are already in multi-year backlogs.

The opportunity is here (reportedly hyperscalers are “bringing cash to utilities to stimulate support and accelerate development).

NAED commissioned Ducker Carlisle to develop a report for the membership. In the following article, Keith Sarb synopsizes the findings.

Distributors! Take Advantage of the Electrification Opportunity!

Has there been a more exciting time in the electrical industry since the days of Thomas Edison and Nikola Tesla? Demand for electricity in the US is surging, driven by industrial reshoring and the explosion of data centers. This creates opportunities for distributors to capitalize and create new value, but they must move quickly or risk falling behind.

Ducker Carlisle and NAED recently partnered on an in-depth evaluation of electrification trends, growth opportunities, and how distributors can position for advantage (NAED Electrification Research). Two key findings from the evaluation:

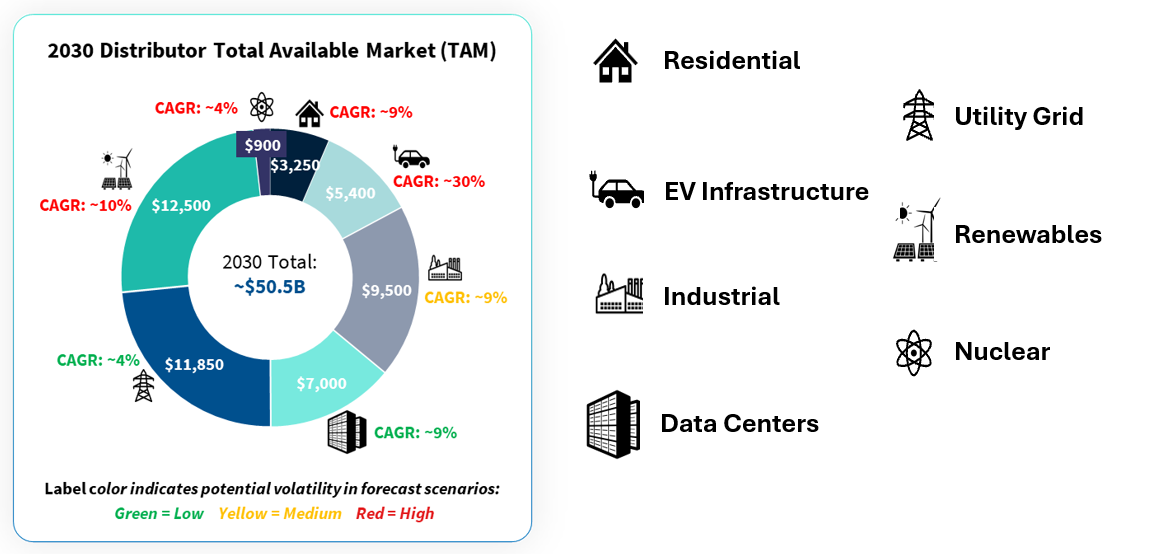

- Electrification represents a $50B+ incremental revenue opportunity for

distributors by 2030

Electrification Market Size for Distributors by Segment

- The strongest sectors for distributors include Utility Transmission & Distribution, Data Centers, Industrial Facilities, and Utility-Scale Renewables (see Figure 1)

In short, the transition to a more electrified economy isn’t a future event, it’s already reshaping where value is created and who captures it.

A Changing Role for Distributors

In these high-growth sectors, projects are becoming increasingly complex and technical, raising expectations of distributors and expanding their role in the value chain. With growing demand, supply chain challenges, and labor shortages, distributors are now being looked to as critical partners in project delivery and productivity improvement.

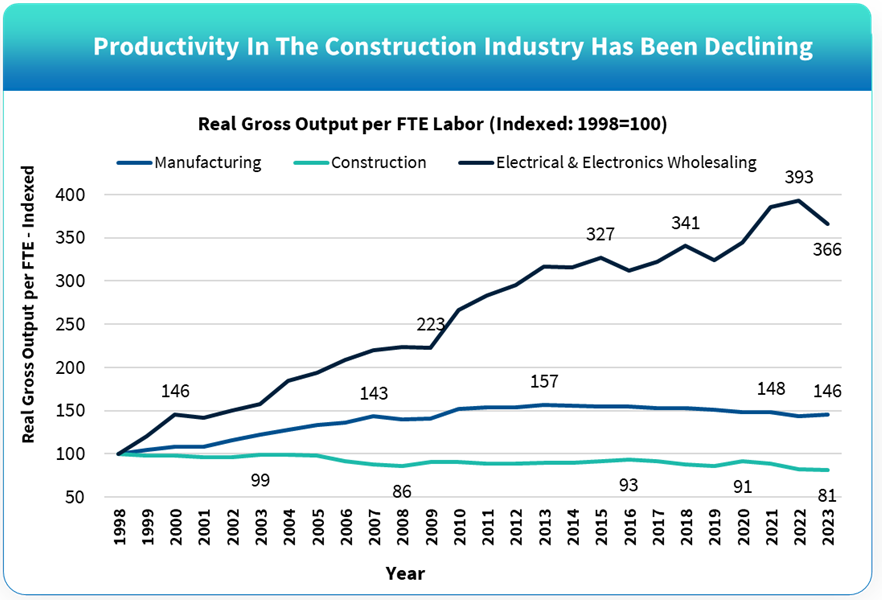

At the same time, labor productivity in US construction has been flat or declining for decades (see Figure 2), while electrical distributors have achieved significant productivity gains. This creates a clear opening for distributors to lead on efficiency and execution, not simply supply.

Ask yourself:

- How can we eliminate bottlenecks in project delivery?

- How can we share our productivity expertise with customers?

- How can we position as a strategic partner, not just a materials provider?

Distributors that answer these questions early will define the next decade of growth in electrification.

Figure 2: Labor productivity declining in construction and manufacturing, though growing for electrical distributors

Three Pathways to Create Value

Through our analysis and conversations with dozens of distributors, manufacturers, and contractors, we identified three categories of services distributors can offer to remove bottlenecks, enhance productivity and strengthen profitability.

-

Basic Services

Reliable inventory management and logistics capabilities remain the foundation. Value grows exponentially when distributors optimize staging, kitting, and pre-fabrication for complex jobsites, reducing install time and keeping contractors productive. Many distributors already offer these, but few execute them consistently and at scale.

-

Product and Solution Expertise

Contractors increasingly expect distributors to act as solution partners, recommending the right products, systems, and configurations for project goals. This requires investment in training, technical knowledge, and specialized talent. Distributors who own the product-solution conversation capture higher margins and stronger customer loyalty.

3. Project Execution Services

Some distributors are extending into project management, engineering, and commissioning support, even stamping and design. While this moves them deeper into the value chain, our assessment shows contractors often welcome this help, given their own labor constraints. The key is partnership, aligning on when the distributor leads and when the contractor does.

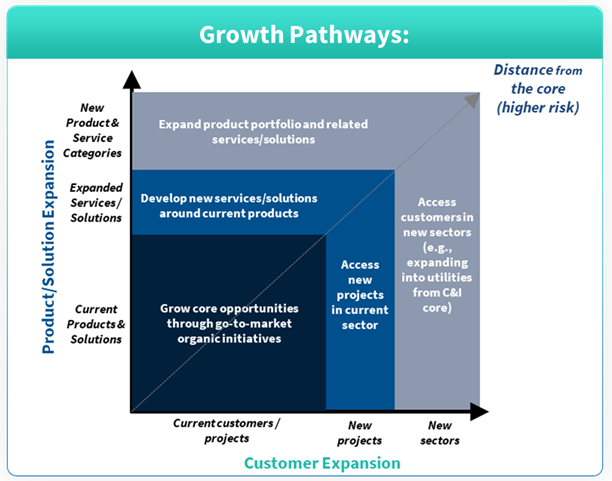

Finding Your Path to Growth

To determine how best to seize the electrification opportunity, distributor must first understand their core business today and the geographic market it serves today. Then, assess where to expand; whether through new services, markets, or partnerships and how far from the core they’re prepared to go (see Figure 3).

Figure 3: Growth pathways for distributors taking advantage of electrification opportunity

Key steps:

- Define your “core”: where products, services, and target customers intersect.

- Evaluate local market potential: which project types offer the largest upside?

- Prioritize opportunities: balance potential returns with investment and risk.

- Focus and commit: it’s impossible to pursue every opportunity, select, invest, and execute with discipline.

Distributors that act decisively now can position themselves as indispensable players in the nation’s electrification buildout.

The Bottom Line

This is a once-in-a-generation opportunity for electrical distributors. Electrification is accelerating demand, increasing technical complexity, and reshaping how value is created in the construction ecosystem. Those who move now; investing in capabilities, partnerships, and services will lead the next wave of growth.

Distributors: the power shift is already underway. Don’t wait to plug in.

To explore the full research findings, visit NAED’s Electrification website. For ongoing updates and industry news, check out ElectrifiED, tED Magazine’s dedicated hub for coverage of America’s electrification efforts.

Kevin G. Sarb | Managing Director, Ducker Carlisle – Industrials, B2B Growth, & Commercial Excellence Lead

Kevin G. Sarb | Managing Director, Ducker Carlisle – Industrials, B2B Growth, & Commercial Excellence Lead

Kevin is a Managing Director at Ducker Carlisle, leading the Industrials Practice. He has 20 years of management consulting experience and has led a multitude of engagements focused on profitable revenue growth across several industrial sectors, including building products, chemicals, climate technologies, electrical products and services, manufacturing equipment, materials processing, security solutions, and water management.

Thoughts

With the announcement of each new data center and new industrial facility (or expansion), at the same time you hear utility management and community leaders talk about “the grid” and power generation needs. The estimates of what is needed in many areas throughout the country is significant.

While many believe this is due to data centers, and more specifically, AI data centers and hyperscalers, the CEO of TKO Energy Capital recently commented that the projected load demands are only 60% due to data centers … the rest is due to manufacturing and demographic shifts. I don’t know if he was speaking about a specific geographic area, utility, or in general, however, it highlights that there are multiple inputs that drive demand … in an industry that historically only had 3% annual demand increases.

The opportunity is there.

The question is, “who can capitalize upon it?”

While it would be nice to say “distribution”, the reality is much of this material is bought direct by utilities. Then there is the tier of utility distributors … companies, or divisions, that specialize in this. The most prominent also happen to be electrical distributors (Wesco, Sonepar’s Irby division, Graybar, Border States). Others “dabble” and serve local needs (co-ops, utility contractors, and ancillary needs.)

Getting access to “the right lines” is a challenge. And it is imperative to have the right people who know people.

But there can be opportunities. Niche markets. Perhaps ad hoc project wins. A “favored nation” opportunity. Emerging markets – solar (okay, not emerging), battery storage, … And yes, you could get involved via acquisition (and on the manufacturer representative side, Yusen’s merger with The MacPherson Group and J.D. Martin’s recent acquisition highlight opportunities for reps (and there are reps, such as CBM, who already serve both markets.)

Is this a potential opportunity for you?

And it is admirable of NAED to invest membership resources into identifying future opportunities as well as doing deep dives into vertical markets.

![]() Speaking of electrification, remember data centers? Check out the collaborative effort between Channel Marketing Group and DISC and our Data Center research report.

Speaking of electrification, remember data centers? Check out the collaborative effort between Channel Marketing Group and DISC and our Data Center research report.