2015 NAED Western … Input from Electrical Wholesaling

Last week was highlighted by the NAED Western in San Diego. While we weren’t there due to business conflicts, we have heard feedback from a number of distributors and manufacturers.

The current issue of Electrical Marketing did share some highlights of the meeting. So, courtesy of Jim Lucy, we’re sharing his posting and have added some additional input based upon feedback that was provided to us by manufacturers and distributors (feedback / our comments are in italics).

Heard at the NAED Western Conference

Lots of the industry chatter in the halls of the Hilton Bayside in sunny San Diego at this week’s NAED Western was about the slow start distributors and reps in the nation’s oil markets have seen because of declining oil prices (I heard from one distributor who said every manufacturer meeting he had he was asked “how are you going to handle the downturn”? His response was to seek more opportunities in the marketplace.), and the decision by Mayer Electric Supply, Birmingham, Ala., to leave the Affiliated Distributors buying/ marketing group to join the IMARK buying/ group. Mayer Electric, a charter AD member and the 12th largest electrical distributor on Electrical Wholesaling’s Top 200 listing, bring some significant buying power to IMARK, as the company’s 2013 sales were $672 million. (lots of questions on this one, and calls we’ve received. Some say this is about SupplyForce and the assignments of contracts; some say there is more to the story; many are asking if more will change. In talking to one manufacturer today he said his company is wondering when the other shoe may drop and they are guessing whom it may be. Stay tuned on this.)

The NAED Western was the first of the regional conferences for IDEA’s Paul Molitor as CEO and president of the association, and he was busy meeting and greeting distributors and manufacturers. Molitor is a familiar face in electrical circles due to his time as a senior executive for the National Electrical Manufacturers Association (NEMA). Another man on the move is Sean Leahy, a long-time industry executive who will be joining Sonepar North America in a senior executive post in 1Q 2015. Leahy is best known in the electrical business for his stints with Vantage and Vanguard National Alliance (VNA) in national accounts, with Ideal Industries, and as author of The Sales Shot, a sales training book. (Interesting on Sean. He is going to get his third shot at developing a national account network. With Sonepar’s acquisition of IDG, Sonepar could be formidable in the national account space as it can bring electrical and industrial supplies to national accounts. Could this also provide a hint to the types of acquisitions Sonepar desires where it has “holes”?

And with Mayer joining IMARK, we’re hearing rumors from IMARK distributors about IMARK relaunching a national account initiative. When TIED and WIED merged to form IMARK the organization did form a national account group but never funded for development of internal management systems and the endeavor did not have much support.

The meeting had a good buzz about it and NAED staffers were pleased with attendance figures. Next year’s NAED (according to the last registration list I saw, there were about 750 or so people registered for the Western.)

Western Conference will be in Phoenix, Jan. 18-20.

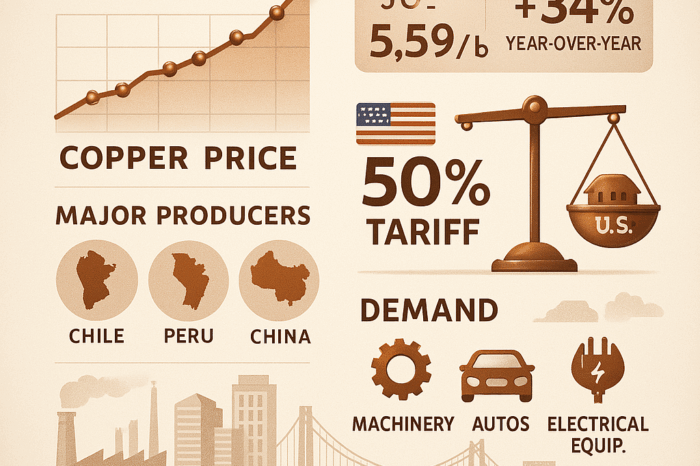

Another topic for some was the drop in copper and how this may impact distributor sales, gross profits and rebates (if they are based in dollars rather than pounds.) With a strengthening dollar, copper could go lower, resulting in distributors selling the same number of units as last year but for lower dollars, lower gross profit but the same operational costs, resulting in lower net profitability (or bigger losses) for wire. Distributors should ask their marketing group / purchasing departments or manufacturers if their rebate is based upon dollars or pounds (frequently reps are paid on pounds – this changed when copper pricing increased significantly years ago.

There was also reportedly discussion about Acme Electric being purchased by Hubbell and Schneider Electric / Square D seeking to make an acquisition that essentially would enable it to better “compare” vs Eaton’s package (names were mentioned, but just rumors).

If you attended, what did you hear or discuss

And I’m off to San Diego this week for the 2015 NEMRA conference where, baring the snowstorm, 1795 manufacturers and reps will gather.