Commodities down across the board; Copper Leads

How’s your business? Has deflation shown itself to you?

Our unscientific poll on Electricaltrends.com indicates that some distribution businesses are up year to date and some are down. A little bit deeper dive, indicates that depending on where you are located, that might be the reason why your business is up so much, or down so much. It seems to be a patchwork of areas that are doing well.

Roots of deflation

Our government continues its assault on coal and to lessor degree oil and gas. Businesses harvest a product like oil or natural gas and they have to store it, when it could be sold on the open market. In general, commodity products such as copper are falling.

The Fed has a base rate of 0%, yet food prices continue to creep up ( sign of inflation) and gasoline prices are predicated to continue to fall even further (and when they rise, that will create inflation).

From a consumer side, the price of gasoline is dropping and car sales and especially fully loaded pick-up trucks (i.e. Ford F150) are on the rise. But on the grocery side, store brand prices are rising and causing name brand products to coupon earlier than normal.

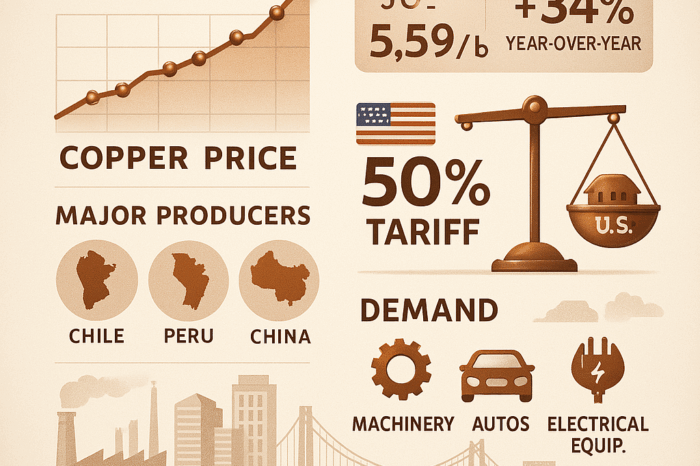

Commodity products like copper have fallen over the last 12 months. Witness $3.25 a year ago and today it is $2.34……..that’s a $0.90 cent (28%) drop! What if copper continues to drop to say $2.00 (another 14.5%)?

This chart was developed at http://www.nasdaq.com/markets/copper.aspx

If your a distributor and you sell a lot of copper, that drop in cost is significant when it comes to your sales and to your profits. And your “cost to serve” really hasn’t changed!

Consider:

- Some large distributors average the cost of copper….In times like this, is that a good bet for your business?

- How much copper do you currently carry? At what price? You’d be surprised at how many distributors can’t answer that question.

- When it comes to a project that you are about to quote, what will your profit level be?

- Or do you help your competitor get the business? At what point is wire / cable not profitable for you to take the order? Should you let your competitor increase his sales and lose profit on an order? Could this be a way to help your competitor lose money?

- While your at it, and if you are in the project business, would it help to look at the price of plastic PVC?

- While LED’s have been dropping in price, will they continue?

And then think about:

- Do you know what your wire cost to serve is? What is the cost of carrying wire inventory? Compare this to your gross margin. Are you making money? Should you be communicating to your sales organization that we don’t make money on wire orders that have less than X% margin? (and remember to incorporate sales commissions (multiple as you may pay on outside and inside salespeople plus bonuses that are based upon revenue for others)

- Will your purchases through wire master distributors (Omni, Houston Wire, WireXpress, Distributor Wire) increase due to reduced inventory? Is this good? Do you have a preferred supplier or does sales make its own decisions?

- If copper continues to drop and it reduces your sales, what does top line sales affect? Rebates (unless they are not in dollars), bonuses, perception that your business is declining?

- If 2015 sales are not meeting your objectives, have you factored in the impact of copper on your wire sales? Depending upon your product mix, it could be significant and could turn you from positive into negative, just like foreign currency has done for many manufacturers.

- Have you advised all stakeholders, including possibly your bank, about the impact of copper on your business?

Should you have a dashboard on your screen that shows you the trends in copper and PVC as part of being able to put your finger on the pulse of your business?

How are you coping with copper deflation? What impact has it had on your business?