Market Targeting – The story of Chicken Little

Chicken Little arrived in the US in mid-March and declared “the world is falling”, and it started to … and has. Humpty Dumpty fell and he then said, since his horsemen were missing (probably unemployed), “Carmen Sandiego will help in finding the pieces (after the government offers money to stabilize employment)” So, let’s find the pieces and help you in targeting opportunities!

(Yes, I can see those eyeballs rolling! It’s a case of being housebound for too long!)

Finding the business

The process requires a little macro analysis.

- The electrical industry was a $111 billion dollar market in 2019

- About 26%, on average is generated in Q2, which infers about $29 billion in 2019

- Let’s assume the industry was flat in q1 starting 2020. Some fear it could be down for them by up to 50% in q2 (DISC Corp is currently forecasting Q2 at -20.6% YoY, nationally, as are those who responded in our Mid-April Market Sentiment Report). Q3 and q4 will also be challenging.

- So, while q2, normally, may only be about $22 billion based upon latest projections, it’s still $22 billion (yes, we’re on-track for a $90 billion year … down $21 billion!)

Now the question becomes “where is the business”? Where to target?

And granted this is macro (nationally).

- There is some residential business, but realistically this is new construction with limited remodeling and renovation unless outdoor related, in most parts of the country.

- Commercial indoor light commercial is probably similarly challenged.

- Large projects could continue unless prohibited by government mandate.

- Obviously, anything hospital related, especially pop-up hospitals, which most likely is contractor oriented.

Wednesday’s Economic Impact on the Electrical Industry Webinar

On Wednesday Channel Marketing Group and DISC CORP hosted a webinar, conducted by IHS Markit, economists that support DISC. While they shared macroeconomic insights with specific commentary related to the automotive industry, residential housing and the commercial market, they also mentioned some market segments that they think will be “leaders” post-COVID. These include:

- Office renovation (preparing to make people more comfortable back in the office)

- Hospitality renovation (restaurants, perhaps others, who need to do some reconfiguring)

- Infrastructure

Click here if you want to watch the webinar (and we recommend advancing to the 7:40 market due to some technical challenges.) Click here for a copy of the presentation.

Where Else is There Business?

From what we have heard …

- MRO due to some early shutdowns

- Educational energy / lighting projects that are typically rebate driven due to early empty schools

- Projects that are funded due to bonds, or perhaps capital expenditures, that benefit from lack of people traffic

- Highway / roadway / street projects (especially lighting)

- Anything utility infrastructure oriented

- And then there is the industrial market.

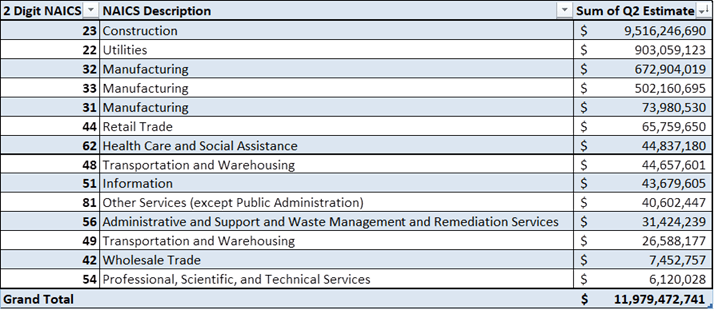

We then consulted with Chris Sokoll at DISC Corp to utilize their MarketTrack™ service which segments markets by SIC / NAICS within counties and shares the number of establishments, number of employees, electrical spend per employee ss well as total electrical spend. This helps in determining segments to target (both sales and marketing.)

We did some brainstorming to correlate segment potential with the current market and identified 13 categories of target markets where businesses / industries are defined as “essential” by the Department of Homeland Security and some target markets where there could be opportunity.

We identified about $12 billion in 77 end-user categories (SIC / NAICS), and there are 7 others that could be opportunities, nationally, of the quarterly projected $22 billion, that is defined as “essential” and could be areas to consider targeting in this quarter.

Collectively the opportunities could be in …

This is macro and differs based upon geography as well as distributor business focus. Contact DISC Corp to discuss how to obtain this data for your territory and get specific sales outlooks for your territory.

For example, while “retail” is closed, there are various definitions of “retail”, and some may still represent opportunity. Consider these sub-segments of the retail industry: MarketTrack™ drills it down with forecasts down to the county level.

MarketTrack can drill down potential with forecasts all the way down to the county level. They question then becomes; will they spend the money in a particular quarter? In some cases, they spend is MRO in nature and hence can be delayed or accelerated?

MarketTrack also provides an electrical spend per employee per SIC / NAICS, which enables you to identify account specific potential by estimating, asking a few questions or gathering Dun & Bradstreet type information.

For Q2 nationally we’ve developed, with DISC, an Excel-based “what if” calculator. You can adjust the outlook per quarter and by major market segment to come up with your own national economic forecast and “essential” customer segment projection. If you’d like the national Excel spreadsheet, email DISC or Channel Marketing Group.

If you’d like to do “what if” for your specific geographic area, DISC can provide the “what if” calculator, by state, for $200/state.

So, are you ready to pivot from survivability to thriveability? Looking for more ideas? Give us a call?