2015 Planning, Part 3, Home Automation, Industrial Outlook, Home Building

Welcome to the third installment of “Time to Plan” to help with your 2015 planning and more planning questions to ask your distributors / suppliers..

- According to a new survey of the Business Roundtable, CEOs of the largest companies are scaling back hiring and capital spending plans over the next six months. Reasons include

- an underperforming economy

- Congress not extending expired tax breaks that encourage investment

This then begs the question, “Do you have a systemic approach to ask your key customers, as well as large companies, what their economic outlook is over the next 6 months and their sales, hiring and investment expectations?” Do you do this periodically throughout the year?

- The National Association of Realtors is expecting growth in 2015. “The NAR projects 1.1 million housing starts for 2014, a number that will increase to 1.4 million in 2015. Another increase is projected to happen in new-home sales, which will total nearly 500,000 in 2014 and then nearly 700,000 in 2015.” Or think of it this way, anothere 300,000 housing starts of which 200,000 will be single family homes.

The question is, “What is your local state realtor association projecting?”

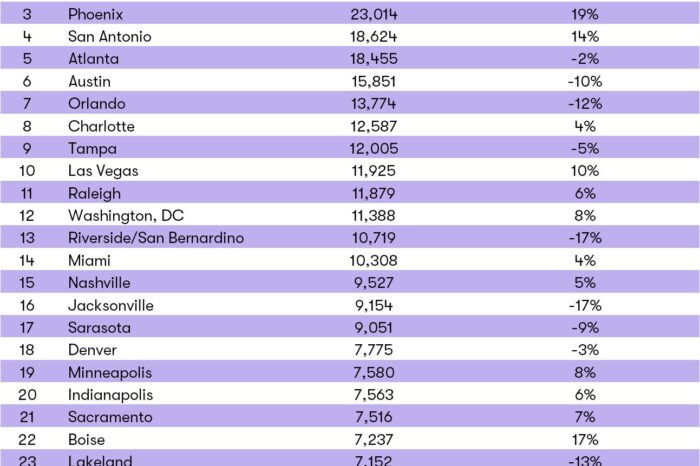

- We’ve noticed a trend that distributors in urban areas have greater growth rates than those in suburbia or rural areas (unless there are extenuating circumstances like oil and gas opportunities). Aside from commercial projects, perhaps here’s part of the answer, “CityLab’s Richard Florida cites a study by the Martin Prosperity Institute, as well as Bloomberg’s analysis of U.S. Bureau of Labor Statistics data, indicating that singles make up more than half of the population in 27 of the 50 states. According to a study by sociologist Eric Klinenberg, these singles prefer denser urban neighborhoods with more activities available and greater opportunities to meet and connect with other singles. Florida says the “changing demographic reality is an increasingly important component of the ongoing “great inversion” away from the suburbs and back to the cities.”

This generates increased commercial opportunities, multi-family developments and perhaps upgrades and automation opportunities. Concentrating resources on growth areas can help you take share. Being in, what I call, Tier 1, Tier 2 and Tier 3 cities can directly correlate to sales growth.

- Are you interested in the Home Automation market? Lutron is conducting a webinar with CEPro on Wednesday Sept 24 to answer:

- How to identify the mid-market customer opportunity and recommend the technology/products to match their needs and budget

- How to build a profitable business model that includes mid-market home automation systems

- How to successfully implement a marketing and sales strategy to capture this business

This is a growth market for distributors and selling to integrators is very similar to selling to contractors (and they buy other electrical material). Sometimes the question is “can you get the right price?” Click here to register

- According to a Wells Fargo economist, the next 3 years will be the best years of the decade with GDP increasing to 3%.

- Here’s some information on the global machinery market.

- MDM has a very good article on the 2015 industrial outlook with information from the quarterly Manufacturers Alliance for Productivity and Innovation U.S. Industrial Outlook, a report that analyzes 27 major industries. MAPI is projecting manufacturing production growth of 3.4 percent in 2014, 4 percent in 2015, and 3.6 percent in 2016.

And some planning suggestions / questions to consider:

- Have you segmented your customer base by market (contractor, industrial, institutional) and then by volume ranges? While many think their business subscribes to the 80/20 rule, rarely is this true.

- Consider asking your customers and staff for 5 adjectives that they feel represent your company. Are they the 5 that you want?

- When meeting with a distributor / supplier, ask them how often they review the joint planning that you conducted with them earlier in the year? What will change this year?

- Distributors, what is your A, B, C, D, X inventory position with each of your key suppliers in terms of $ and % of inventory? What could be done to “improve” this? Manufacturers, how can you help distributors improve the profitability / turns of your products?

- What is your line conversion decision making criteria?

Hope these help. I’ll be at the AD NAM October 6-8 and at the NAED Eastern November 9-12 if you’d like to discuss further.