Rebates … The Gift that Gives

Mention rebates to distributors and manufacturers and you’re sure to have an interesting conversation.

Mention rebates to distributors and manufacturers and you’re sure to have an interesting conversation.

Manufacturer Views on Rebates

Manufacturers question their efficacy in driving incremental sales, express frustration in their lack of behavioral modification of distributor field personnel (branch managers, salespeople, purchasing personnel), but recognize that it is “a necessary evil” and a cost of doing business.

For some it is a door opener (some distributors will say, “no rebate, no need for a meeting”). Others recognize it is the same as a loyalty / frequent buyer program … it may not change behavior but the lack of a program could influence behavior.

At the end of the day, most manufacturers want to “get on a preferred” list (which means that they offer a rebate to the distributor) for the right to call on the distributor to solicit business. Frequently there is limited commitment / accountability by the distributor.

Distributor Views on Rebates

For distributors, it is a critical component of profitability. Further, it helps them communicate to their organization (if they do) which suppliers the company prefers to support, whenever feasible and when it will not risk a sale. This occurs when distributors denote which suppliers are “preferred”, “strategic”, “supporting” or have a “star” in the distributor’s system or from their marketing / buying group.

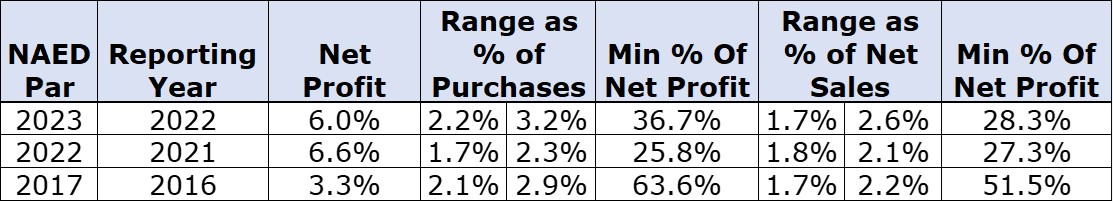

From a profitability viewpoint consider the following from the NAED PAR Report:

Before manufacturers get all “excited” about the rebate percentage and think that they are overpaying, consider that a significant percentage of distributor purchases do not earn a rebate. This could tie to one-time purchases from suppliers, lighting projects for spec material, switchgear projects and similar. Also, the range differs based upon distributor size.

What is interesting, however, is:

- The rebate percentages have remained relatively stable

- From a net profit viewpoint, distributors benefited mightily during Covid years, which also included supply chain issues, commodity price increases, and general supplier price increases. The question is, given that net profit declined 10% from 2021 to 2022, what will happen in 2023?

- Perhaps most importantly, the percentage of net profit that rebate income represents is significant.

So, rebates are important to both parties.

Last year we conducted a State of Volume Rebate research for Enable and a white paper was issued. (If you’d like a copy, email me.)

We’re updating the research.

So, if you are a manufacturer or distributor, we need your help.

If you are in sales, purchasing, branch management, marketing, finance, regional management or senior management… for either party, we need your input.

The intent is to compare last year vs this year.

Key areas the research covers include:

- Effectiveness in driving sales / affecting behavior

- Negotiating rebates

- Rebate structures

- Communicating rebates within your organization to gain support (distributors)

- Rebate Administration

- Collaboration to Optimize Rebate Returns

If you could share your input, it would be much appreciated. All input is confidential, and no respondent specific information will be provided to Enable (so no telemarketing!) At the end of the survey you can register to receive a copy of the report and for a variety of survey awards (three $250 Amazon certificates, ten $75 Amazon certificates) and every response funds a donation to One Tree Planted to plant 10 trees!

And, to see if we can get anyone to post a comment (even anonymously, or email me and I’ll post it anonymously for you) ..

Distributors

- How could rebate programs be more effective within your organization?

- If manufacturers did “X” their program would be more effective.

Manufacturers

- How could rebate programs be more effective for you?

- If distributors did “X” our program would be more effective with them.

Reps … your thoughts on rebate programs?