Contractor Loyalty Research Reveals Growth Strategy

While personal relationships are a differentiator for electrical distributors with most customers have a defined list of distributors they buy from, another tool that some distributors use to capture their “unfair share” of a customer’s wallet, are loyalty and incentive programs.

While personal relationships are a differentiator for electrical distributors with most customers have a defined list of distributors they buy from, another tool that some distributors use to capture their “unfair share” of a customer’s wallet, are loyalty and incentive programs.

From a customer’s perspective, they expect quality products (and brands) to be sold by their preferred distributors; they expect, consistently, quality service; they frequent distributors where they have relationships with outside salespeople, inside salespeople and/or counter staff; they need credit; they hope for technical expertise, when they need it.

This is the “basics” of the business. In the contractor world, which represents a significant percentage of electrical distribution sales, and businesses are independently owned, a significant percentage also have a WIIFM (what is in it for me) perspective. When people are involved, human nature takes over!

Consider life as a consumer and how many frequent buyer / shopper / flyer programs you are involved in? Should contractors be any different? (And for those selling to the institutional and industrial markets, in some instances the same approach is feasible, albeit with nuances, which are explained at the end of this posting.)

A study conducted earlier this year by Channel Marketing Group for ITA Group, a leading customer loyalty company, reveals significant insights into contractor purchasing behavior, stressing the importance of loyalty and rewards programs.

These findings indicate that nearly half of contractors purchase more frequently from companies offering loyalty programs, and awareness of such programs remains a key growth opportunity.

Contractor Loyalty Research Highlights

Participation

🎯 50% are currently enrolled in a rewards program, highlighting growth opportunities.

⚠️ 22% are unaware of available loyalty programs from preferred distributors.

Performance

📊 49% of contractors increase purchase frequency with loyalty programs.

📈 63% perceive additional value from distributors with loyalty programs.

💡 57% choose distributors based on loyalty rewards.

Benefits

🔍 Loyalty programs can help differentiate suppliers in a competitive market.

🤝 Engagement through tailored programs is essential for contractor loyalty.

Key Insights

💰 Impact on Purchasing Decisions: Contractors primarily respond to loyalty programs through increased frequency and volume of purchases. When loyalty is tied to tangible rewards like discounts and enhanced customer support, it becomes a significant driver of sales. This represents an opportunity to take share within existing accounts. Further, the information provides interesting data points to track.

📉 Incremental Growth Measurement: While loyalty programs encourage more frequent purchases, their effect on overall spending is less pronounced. Contractors recognize loyalty influences frequency but may not correlate it with an increase in overall expenditure as they incrementally purchase more from their “preferred” distributor because they are being incented.

🎁 Tier Structure and Customization: Contractors respond positively to tiered rewards that recognize different levels of purchasing behavior.

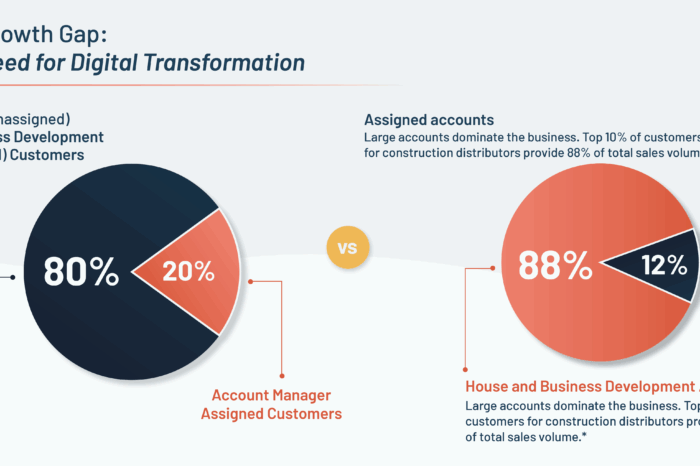

🔍 Program Awareness: Nearly half of contractors reported not being aware of any loyalty programs offered by distributors they buy from. This indicates that branding and outreach need improvement, suggesting that increased marketing efforts and communication can help bridge the gap. Further, it indicates that companies that launch a program have an opportunity to impact their customers AND, if desired, use the program as a customer acquisition tool.

🏅 Reward Preferences: The report delves into a variety of reward mechanisms ranging from aspirational rewards such as exotic travel and individual experiential travel to utilization of merchandise for larger items and allocating points / rewards to employees to entertainment tickets or direct financial benefits such as discounts and cash-based incentives. Rewards can also include investments into contractors’ businesses such as vehicle signage, repaving driveways, marketing tools, and more. For industrial and institutional accounts, training and “incentive meetings” can also be valued rewards.

💬 Feedback Channels: Contractors expressed frustrations about understanding their rewards or account statuses, emphasizing the need for clear communication and accessible reporting within loyalty programs to ensure continued engagement.

📊 Perception of Value: Even though rewards drive engagement, factors such as awareness and the delivery of loyalty programs can significantly enhance or diminish the perceived value of a distributor or manufacturer, impacting long-term contractor relationships.

Personal Feedback

When I started my career many moons ago, I started in the performance marketing (aka incentive and loyalty) industry. Coincidentally, just before I joined TIED (eventually renamed to IMARK Group), I was the Director of Marketing for ITA Group.

My first client was an electrical manufacturer – Carol Cable (which was eventually bought by General Cable) and then I sold a program to Capitol Light & Supply (which was purchased by Rexel.)

Over the years I developed and operated programs for many electrical distributors inclusive of many programs for All Phase (which was purchased by CED). Most programs were structured based upon incremental sales. All involved key suppliers who helped fund, and who benefited from, the program. Every program generated growth. Some of the people from these companies are still friends, and clients, today.

The key was understanding the business, developing pre-program projections, strong communications campaigns, tailored administrative platforms and supporting the program with desirable rewards. In the words of a competitor, “as long as the rewards are of quality, and free, contractors are happy.”

Over the past twenty-five years, Channel Marketing Group has helped clients structure programs as part of an overall growth strategy. We’ve outsourced implementation.

So, this research was “near and dear” because I’m familiar with the concept, know that it works, and it was good to reconnect with ITA, which has grown significantly over the years.

Take Aways

- Incentive programs work

- The research share insights from your customers.

- If you are interested in q cost-effective strategy to drive growth, increase market share, or strengthen customer loyalty, I recommend you take a deeper look at the efficacy of an incentive / loyalty strategy.

- If you are a manufacturer, these programs can work for you as either a sales motivation tool to your sales force / reps, as a strategy with independent distributors, for an end-user target account strategy, as an account-based incentive program and a myriad of other targeted initiatives.

- And, if you recall, I mentioned institutional and industrial accounts? Yes, companies, especially publicly held companies, have policies against these programs and “gifts,” however, companies that are private may be able to participate … but get appropriate signoffs within the end-customer. Another concept is “incentive meetings” where participants can earn components of the meeting (registration fee, hotel, air, etc.) for attending an industry conference or a conference your company develops … with appropriate educational content. It can be structured as “earned” or an “earn back” (where they commit to attending / paying and then “earn” their way and pay the remainder.)

Looking to differentiate yourself and take share in a marketplace that is looking “challenged”, consider a customer loyalty program that not only cultivates loyalty but also drives sales growth, enhances profitability and strengthens brand perception.

To learn more, request the complete report and I suggest reaching out to the nearest ITA Group office to learn more … and if you would like a specific referral, let me know and I’ll get a call arranged for you.