eCommerce Survey Results Preview

As all portions of the electrical distribution value chain continue on their journey of digitization, BigCommerce sponsored research to uncover insights from contractors and industrial buyers on their perspectives on eCommerce.

As all portions of the electrical distribution value chain continue on their journey of digitization, BigCommerce sponsored research to uncover insights from contractors and industrial buyers on their perspectives on eCommerce.

The forthcoming white paper (you can reserve your copy of the full report) provides a snapshot of the valued features and functionality of online sites, how much is purchased online, reasons for using and not utilizing distributor websites to purchase electrical material, and other key insights.

We gathered input from almost 400 buyers. People who make electrical, HVAC, and industrial supply purchasing decisions. Respondents value the ability to order from wherever and whenever, meaning from home, office, job site, or vehicle.

eCommerce Has Arrived! Customers Are On-Site

Here’s the shocker … nearly two-thirds (yes, almost 67%!) have ordered something online!

Further

- 64% have made mobile orders, either via an app or text

- Only 18% have not purchased any electrical, HVAC or industrial supply material electronically.

Of those who purchased electrical, HVAC, building materials or industrial supplies online, 59% have done so from a distributor, the second most frequent is from an online supplier, such as Amazon Business, Automation Direct, Home Depot.com Lowes.com or similar online only source; and the third most popular destination was from MRO distributors, such as Grainger, Zoro, Fastenal, MSC, McMaster Carr or others.

The buyers surveyed tend to make good use of online, in fact:

- 24% make more than half of their purchases online

- 29% make between 26% and 50% of purchases online and

- 37% make between 6% and 25% of purchases online, with

- 10% making less than 5% of purchases online.

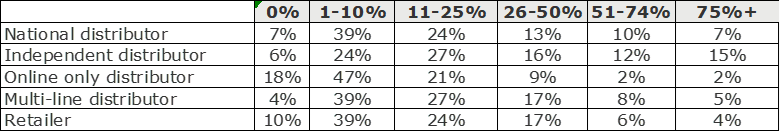

In terms of online purchases and the frequency of online purchases by type of site, it’s a growth opportunity for the channel.

Types of Sites Purchased from and Percentage of Online Purchases Made from Those Sites

The data shows:

- Customers are buying something online … so there is a willingness.

- They just are not buying regularly online.

It is interesting to highlight why and why not.

- Why buy online – The most common reasons for using online are ease, self-sufficiency, speed, and a broader selection.

- Why not buying online – The reasons for not making online purchases comes down primarily to relationship – preference to talk to a salesperson or visit a branch. It is rarely about technology or security. The reality is that more complex orders and project orders are not going online and that price accuracy, or interest in negotiating price, is a concern.

Usage and Features

The data shows that the features most valued vary.

The most common uses of a distributor or online site is

- checking prices, with 67% stating regularly or very frequently

- product research, with 51% checking regularly or frequently and

- checking availability / inventory, with 49% checking regularly or frequently.

Downloading invoices was not a high-ranking use, with 30% of respondents never or rarely for this purpose.

Shifting to distributor website functionality, the critical features are accuracy in ordering, delivery, inventory, and pricing. Also, customers expect the same experience they would receive if they ordered with salesperson / at branch. Very important features also include the ability to easily search your site and for the site to have complete product descriptions. The feature ranking lowest was product training and videos, and interestingly, new product information ranked next to the bottom.

The most important online ordering and product information features revolve around ease of search, either by product, manufacturer, or attribute. Having a quality search experience is paramount, especially since time is money. Having pricing on the site is also important, and it must be customer specific, as buyers demand accuracy with pricing used for negotiations. Quality information, i.e., product descriptions and product attributes, are also highly valued. There are a number of features ranked as “nice to have,” such as photo details of products, the ability to upload schematics, layouts / take-offs and the ability to compare product attributes.

Online account management and customer service features most valued concern order delivery and status tracking, followed by having access to invoices, followed by the ability to access a customer service person to talk or chat. The least valued features for online account management were accessing after hours call centers or after hours customer support and access to product specialists.

Delivery Options

Critical online delivery features include the ability to order online, pick up locally, which highlights planning ability as well as using the site for change orders. Free next day delivery and the ability to receive delivery first thing in the morning rank highest as extremely important, highlighting planning.

Performance Matters

From a website system functionality viewpoint, the most important feature, intuitively, is website performance and ease of use, followed closely by ease of ordering/reordering and pricing and discount transparency. Customer service and live support was the lowest valued feature for system functionality.

What Differentiates Distributors?

The top features that differentiate distributor websites are similar to the most value features – delivery time, ease of use, and ease of product search. The relationship is next level important, including relationship with the inside salesperson. Access to credit and the relationship with the outside sales persona are not as valued.

Online Competitors

eTailers, or companies with online only, such as AmazonBusiness.com, Grainger.com, Fastenal.com, Homedepot.com or other e-distributors are viewed as viable alternatives compared to preferred distributors for everyday material needs by nearly 2/3 of respondents.

eCommerce Taking Hold

In 2018 Channel Marketing Group conducted similar research. At that time consultants were forecasting the demise of the electrical distributor, and that Amazon Supply (now Amazon Business) would take over the industry.

Not only has that not happened, but today’s research shows that electrical distributors are winning.

This speaks to industry complexity and the value of relationships.

However, …

Electrical buyers have gone electronic (or we could say “digital.”) They are searching sites, seeking information, and buying online. The industry has gone digital.

A robust eCommerce platform is now a “table stakes” for a distributor.

Just because your customers may not be searching, or buying, on your website does not mean that they are not searching, or buying, from your competitors’ website! Your website is either a sales tool / sales generator or could be your greatest competitor (or Achilles heel) … or maybe a blind spot.

The complete research paper will be shared shortly. To reserve your copy, click here.

And if you don’t have a robust, digitally mature, eCommerce plan, check out BigCommerce’s digital maturity guide.

Attending the NAED National and want to learn more about how BigCommerce can help? Contact Paul Dabrowski to schedule some time. Trust me, it will be worth it.

Want to learn more about the research findings or discuss optimizing your eCommerce initiative, perhaps we can help?