NAED 2016 Eastern … Orlando

Last week’s NAED epitomized much of the change that the industry is experiencing.

- Attendance, per NAED’s registration list, was 585 registrants (although some did not attend but did not cancel). The continuing result of consolidation? Companies scaling back expenses due to the economic environment (cost control)? A perception of the effectiveness of the meeting for these companies?

- There were 79 distributor main houses, inclusive of divisions / operating companies of national chains but excluding non-region attendees (i.e. Mayer, Revere and maybe 1 or two other)

- There were three ecommerce providers promoting their infrastructure solutions.

- Many manufacturers and distributors lamented their 2015 performance, especially their industrial business.

- Manufacturers and reps commented that they were seeing more strength in metropolitan areas, flatness in suburbia and flat to negative in rural areas. In some metropolitan areas the union benches are “empty.”

But the comment from a number of individuals that was most interesting was that the meeting lacked “energy“. (which Donald Trump seems to have made the word of the season.)

Perhaps this was due to:

- Hotel layout (seemed like an oversized Embassy Suites with a large open space that absorbed sound and was very spread out.

- The aforementioned attendance

- The comments from many manufacturers that they have been on the road essentially non-stop at various distributor “conferences” and had already seen most / all that they were meeting with at NAED (although a 1 hour suite meeting could trump a 17 minute or 20 minute one-on-one meeting).

- A lack of small to medium size distributor attendees may mean that manufacturers are meeting with their “key / more important” distributors at their location.

- Or something else??? If you attended, do you agree? If not, which is very viable since the hotel was well spread out, how would you describe it?

Some other observations / feedback from the meeting:

- Heard variable regarding the educational sessions.

- According to someone regarding the SPA session the focus was on the reality … various channel members want them; they are not going away; there is an increase in customer type / geographic SPAs (which were referred to as PAs (pricing agreements) whereas SPAs are “special” pricing agreements and infer for specific customers); and that both parties need to address, albeit individually, ways to improve their processes. At least that was the synopsized version shared with me.

- The ElectricSmarts / IDEA session regarding eCommerce through linkage to estimating systems was well attended (for the first session). Reportedly a number of manufacturers were surprised regarding the influence of estimating systems and their processes. Earlier in the year we wrote on this topic.

- Unfortunately insights from the other sessions weren’t shared (which may say something). Reportedly attendance ranged from 10/15-40 based upon the session.

- The general session speaker was entertaining with insights regarding the potential of online interaction. He was the founder of Geek Squad. Key insights included:

- find ways to “reduce friction” by using technology to enhance commerce and services and essentially “do things faster”

- enhanced usage of chat to serve customers and accept orders (a la Domino’s emoji ordering) will be a wave of the future

- follow-through is key

- The intro by Glenn Goedecke of Mayer Electric, NAED 2015/2016 chair, was well received as he shared his football upbringing and how that has built the attitude to “win”. His theme is “Connecting Forces Through the Channel” with key elements including:

- Importance of the channel

- Millenials

- Maintaining relevance in a Transformational age (with an emphasis on innovation)

- Developing long-term strategic planning (3 year, 5 year, 10 year) for NAED

and that stronger, more collaborative “partnerships / relationships” need to be built with milestones to ensure accountability.

- George Vorwick, President of United Electric and NAED VP Eastern Region, shared how sailing has impacted his outlook and drive. Next time you see George, ask him about these moving stories … he could be the industry’s next motivational speaker!

- Had a number of conversations with manufacturers and distributors regarding the word “partnership” which seemed to be used frequently by many. The challenge is that the term (and concept), while used at senior management levels, becomes disconnected at the field level and the reality of earning business from customers. We’ll have a future post on partnership vs relationship between manufacturers and distributors in the near future.

- Industrial market continues to contract.

- Expectations from manufacturers for 2016, combined contractor and industrial, remains 0-3% with contractor-oriented distributors in major markets and who are focused on lighting (fixtures) thinking 5-10%

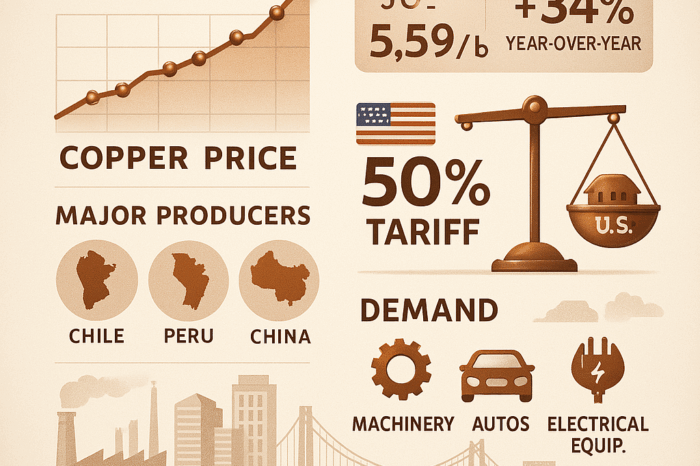

- The impact of copper pricing decline has impacted construction-oriented distributors’ sales by 3-5%.

- Some manufacturers suggested copper could be $2.30-2.50 as an average for next year but that the range could be $2.00-3.50, which indicates “no one knows!” Macroeconomic / global economic issues will continue to drive the price of copper.

- Interesting regarding lighting … no one is talking about the lamp market; all talk about the lighting (fixture) market as they see a declining MRO market. Also, the retrofit market is underpenetrated and, according to one manufacturer, the industrial lighting is 34% of the lighting market but, by their calculation, only 5% penetrated.

- Lots of interest in ecommerce with 3 companies represented and covering 2 different price points (high and low) with Unilog announcing an interesting relationships with AD to be their exclusive ecommerce service provider. A number of manufacturers spoke about AD’s eContent strategy and are trying to understand AD’s role in enhancing IDW content (for enhanced attribution) to provide to its members with some questioning how AD can edit / enhance the data since the manufacturer has not authorized AD for the data (it was also mentioned that manufacturers may need to update their data sharing agreements with distributors to address potential data liability issues.)

- In speaking with both Datalliance and Pan-Pro got the sense that VMI is increasing as an inventory management strategy for manufacturers and distributors. Some manufacturers report that distributors with whom they do VMI outperform non-VMI distributors.

- A couple of manufacturers mentioned that distributors, especially industrially-oriented ones, have been “de-stocking” with the industrial slowdown … taking advantage of return policies.

- Some distributors mentioned using analytics to improve their profitability … seeking areas where they can add customers to SPAs, identifying purchasing and pricing inconsistencies or improve the quality of their inventory. The trend appeared to be hearing this from larger distributors who are “professionalizing” these roles and investing in the appropriate tools

If you attended, what else did you hear (or send us your comments and we’ll post them anonymously for you). If you didn’t, perhaps share “why”?

(And we heard more, albeit they were client / company-specific)