Where will The Electrical Industry Lead AI or Will AI Lead the Electrical Industry?

AI is being talked about by many in the industry. Every tech company now is using the term. It’s the “hot” word. Put AI next to anything and it will open the door to a conversation. All want to know how it will “help” their business.

AI is being talked about by many in the industry. Every tech company now is using the term. It’s the “hot” word. Put AI next to anything and it will open the door to a conversation. All want to know how it will “help” their business.

It will, however, recognize that it is in the top of the 1st inning. There are already tools that you are using, or have access to, that are AI-powered and/or are giving you incremental functionality (and productivity benefits.) The “bigger” applications (perhaps should say “opportunities”) will take some time, and yes, financial investment (sometimes significant investment.)

Much will be said, and written, on the topic. Distributors and manufacturers need to crowdsource input and continuously evaluate opportunities to “step”, perhaps “dive” in.

Kevin Coleman, formerly Director, Market Intelligence, at Signify and now a an Executive-in-Residence for Channel Marketing Group specializing in market research opportunities, is taking a first look at Generative AI and shared some thoughts:

“The electrical industry is in flux and, perhaps, perplexed, as it looks towards 2024. With the backdrop of increased geopolitical tensions and high interest rates impacting business expansion, slower construction is expected. The recent turmoil in supply chains that drove calls for reshoring of manufacturing opportunities remain, albeit building factories takes time. The electrical industry should benefit from the CHIPS Act, IIJA and the IRA, all which include electrical investments.

In parallel, a wave of advancements has spawned great enthusiasm: the emergence of Generative Artificial Intelligence (GenAI), most popularly exemplified by ChatGPT which exploded on the scene in 2022 and was brought “mainstream” with Microsoft’s $13 billion investment in OpenAI. The intersection of these developments has created a unique opportunity for accelerating advancements. For a great overview, see the August Microsoft Poolside Chat Recap. However, this must be tempered with the fact that while GenAI has stolen the limelight, to date it has few meaningful business cases or revenue streams. “Classical” AI is still doing 80% of the “heavy lifting” in finding efficiencies and improving decision-making.

GenAI is being applied to enhance productivity and automate processes in areas such as customer service, warehouse efficiencies (see Artificial Intelligence (AI): Could it Help Your Warehouse?), product design, content development, and inventory management. These are so-called “low-hanging fruit” applications, but the technology is opening up new opportunities to generate market insights.

- Product Manufacturing – Machine Learning (ML)-based AI applications are a promising technology in the manufacturing process. The development of modern and advanced information technology, such as big data, AI, IoT, edge computing, etc. have driven the transformation of traditional manufacturing to intelligent manufacturing. This is propelling manufacturing to greater autonomy and active self-optimization. Promised results are rapid product development, enhanced product quality, and reduced production costs.

- Digital Twins for Smart Cities – AI is making rapid gains by creating more accurate and realistic digital twins for smart cities. Lighting companies are keen to capitalize on this opportunity. AI is ensuring more digital consistency with the material world through data accumulation – expanding large language datasets and incorporating raw data, which smart lighting systems supply. – simulations, and deep analysis.

Smart City digital twins building on AI can monitor status, analyze predictive maintenance, ensuring quality deployments. Further, with OpenAPI and APIs, integration of data such as weather and traffic, overlayed with maps, can speed delivery of products and ultimately enhance the efficient use of city spaces.

- Leveraging GenAI Against Internal Datasets – A promising avenue for growth and competitive advantage is the application of GenAI against large internal data sets, from pricing data to bids, and structured datasets available from third party market trackers. In marketing and advertising, GenAI can help create highly personalized marketing campaigns and advertisements, targeting very specific customer segments or personas.

For product marketers, GenAI can help write documentation, in different languages, as well as speed coding. GenAI can create content for knowledge management systems. At the moment, AI is being developed to have the ability to take on tasks like furnishing reports so that knowledge workers would be free to do more urgent or higher-value tasks.

Customer service and contact centers remain ripe for innovation where customer and internal queries can be trained on a deep knowledge base, creating chatbots to suggest next steps for customer service and even sales calls.

Recognizing Disruptions

Technology can, and often does, cause displacement. Having grown up in New England when there was a Digital Equipment Corp (DEC) office in many towns, the displacements and transitions can be painful and take time to resolve. However, history does show that, in the longer run, new jobs and even industries, are created. From the DEC example, the advent of the PC spawned growth in new occupations using the PC, from software, to call centers, to financial analysis, to industry analysts (think IDC and Garter).

Recently, major tech vendors have rushed to bring GenAI capabilities into their platforms, announcing new products, and roadmaps, including:

- Microsoft launching Copilot. Microsoft 365 Copilot will create a single user experience across Bing, 365 and Windows and more for enterprise customers in November along with an AI assistant, Microsoft 365 Chat

- Google released Duet AI in August

- Zoom’s released Zoom AI Companion(free to all Zoom paid-plan customers) in September

- Slack’ Slack AI will roll out Winter 2023, allowing developers to bring GenAI into workflows

These have the potential to increase productivity and lower costs across multiple industries. At the recent IT Symposium/Xpo in Orlando, Gartner Group predicts that by 2026, more than 80% of enterprises will have used GenAI APIs or models, and/or deployed GenAI-enabled applications in production environments, up from less than 5% in 2023. And analyst firm IDC predicts that enterprises will invest nearly $16 billion worldwide on GenAI solutions in 2023.

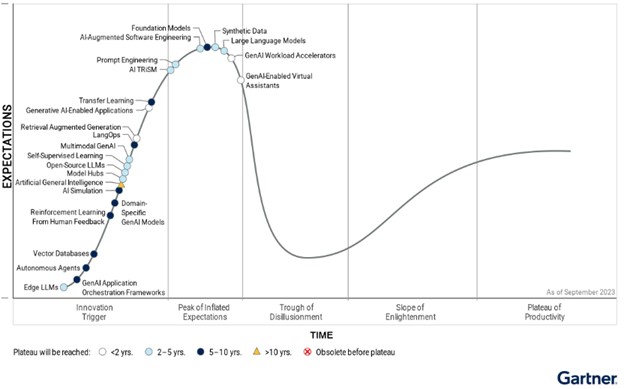

The electrical industry can gain insights into AI from technology analysts like Gartner who track the industry. For example, the 2023 Gartner Hype Cycle for GenAI identified technologies that are increasingly embedded into many enterprise applications. (see Figure 1).

Hype Cycle for Generative AI, 2023

Source: Press Release, Gartner Says More Than 80% of Enterprises Will Have Used Generative AI APIs or Deployed Generative AI-Enabled Applications by 2026, October 11, 2023.

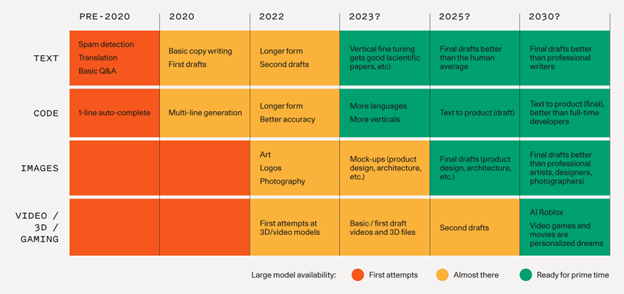

Sequoia Capital, who tracks start-ups in the GenAI apps and infrastructure space, created the following trajectory of GenAI’s evolution:

Source: Press Release, Lingero, The Feats and Caveats of Generative AI (Part 2)

GenAI in The Electrical Industry

The underlying problem in the electrical industry is that all too often, the data that the public domain large language models are trained on is often incomplete, and even flawed. The risk is that bad data gets repeated and picked up with no context or appreciation for its imperfections – generating dirty data or hallucinations.

An example comes from a web search of the market for lamps – there are published analyst reports showing that the lamps market is growing. A GenAI system trained on internet-based data could pick up on that and generate an output that is likely to follow the input text showing market growth. Of course, the reality is that the lamps market is not growing, for a multitude of reasons. The result may be generated artificially, but it may not be intelligent. In other words, the GenAI solution may make sense, without knowing what they’re saying. (It’s important to remember that the “free” version of OpenAI is based upon data prior to September 2021!)

Another area where the art of market intelligence is essential is – connecting the dots into insights . The promise is that analytics can automate the insights phase, but practitioners need to be aware these insights are based on history. The future is not always a straight-line projection based on the past … especially in the electrical industry where every customer interaction is, in some respects, a project.

What to Look Out For

There are also issues leaders should come to terms with in deploying GenAI capabilities, namely cost, security and compliance. There may be additional license fees as well as support and training. There will be ongoing software investments, maybe hardware too. To fully leverage GenAI, LLMs need to be trained on internal data, which may be costly. In addition, customer data will have to be partitioned from public data and security, compliance and governance must be ensured.

A survey published by Metrigy, a communications consulting firm, found that just 12.9% of end-users surveyed said they fully trusted GenAI and almost 31% said they did not trust it at all. When asked what would get those who do not trust GenAI to change their minds, the largest response was “human oversight.”

Many executives are caught in the headlights trying to figure out ethical frameworks and safety concerns. Meanwhile, junior colleagues are adopting AI tools and becoming AI literate, similar to the path of adoption taken by other technologies, like mobility.

Call to Action

Business leaders are increasingly risk-averse as the era of “free money” has ended. Therefore, proving future ROI is more important, and more elusive. While it is understandable that many execs are in a “wait-and-see” phase with regard to AI adoption, they cannot afford to be caught asleep at the wheel as agile competitors create new use cases and reap rewards.

Companies in all phases of the lighting and electrical value chain need to be learning by doing, experimenting, and building knowledge, to be AI-ready.”

Takeaways

So, some thoughts …

- We know large distributors, and manufacturers, have the talent and the resources, to spend time thinking about how GenAI can / will impact their business. For smaller companies, defined as < $1 billion, how are you thinking about this? Is it part of the responsibility of your IT / digital leader? Is it the CEO? Is the team? How are you crowd sourcing ideas?

- More importantly, especially if you are less than $100M, how are you going to fund development of initiatives or are you going to wait till your ERP or CRM solution has tools?

- What “off the shelf” tools should you be using / considering today?

- Are you thinking about “what if” to consider applications and how you structure your data (and what information to capture / source)?

This is a talent development opportunity for your company. As Kevin points out, this will require a commitment but opportunities to monetize the output need to be determined. It’s easy to identify “low hanging fruit”, but in a challenging economic environment, an ROI needs to be envisioned.

And here’s an idea? Perhaps a percentage of rebate earnings should be allocated to fund internal AI investments? (and take our State of Volume Rebates survey to gain insights on how you can optimize your rebate performance.)

Need a third-party perspective, give us a call.