The Muddled World of Tariffs in the Electrical Industry

For a word that wasn’t part of the national conscience, it is now front and center and bringing disruption to business. Tariffs. In an industry where price increases occurred annually, where pricing was stable except for copper, companies have now invested much time in updating their pricing systems. It’s occupied much time in conversation, much time in determining the impact and considering increases (from a manufacturer viewpoint), much time in updating systems (distributors) and then even more time in back and forth discussion / negotiation. And created much angst. Tariffs.

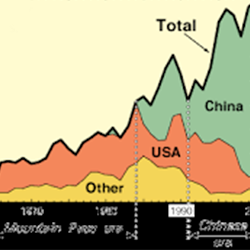

We’ve gone from steel and aluminum to a broader base last summer to a focus on lighting, to the latest “15%” (for a total of 25%) for much material from China and now to a 5% (potentially 25%) tariff on imports from Mexico.

Putting aside the politics and the reasons why, the reality is that manufacturers need to recoup an incremental cost and distributors need to pass the cost on.

Historically “price increases”, which a tariff is, can be positive for distributors as, if they maintain their margin percentage, it represents greater real dollars. Additionally, at time it can represent an opportunity to “add a little” to low margin items.

The same rationale exists for manufacturer.

And while “the market” typically likes price leaders, the latest round of tariffs have left some disparity within the market. Partially because it seems like tariff policy is based upon the “tweet of the day” and / or the “media sound bite of the moment” and many have hesitated. Some is based upon interpretation of the tariff language and a desire to maintain flexibility and/or use the policy as a means to capture sales (or share) for a short-time period.

What we’ve heard from manufacturers, distributors and reps

- While all manufacturers agreed that the tariff is on landed costs, most announced increases are 15%, hence on their current prices, not material costs. Only a couple shared that they are doing an increase of less than 15% for affected SKUs and have identified that the real increase is 11-12%.

- Some commented that they are negotiating with their Chinese factories and that currency devaluation may be able to help reduce their exposure.

- The tariff is only on products that are just

leaving China’s shores, so all agreed that companies implementing tariffs “now”

(as recent as May 15th) are using it to increase their top and

bottom line by charging on material that they have in their warehouse / already

in their supply chain. Essentially, they

are using a replacement pricing model.

- Some are “monitoring the situation”, “evaluating their inventory” and will make a decision that could go into force later in June, July 1st or later.

- Some companies are doing SKU specific

- Some are sourcing from other Asian countries …

Taiwan and Vietnam were mentioned.

- And with the current rhetoric from both parties indicating the issue may continue longer than expected, some may be looking at changing their sourcing and/or diversifying manufacturing locations.

- For projects, some distributors are asking “where is the product assembled” and “what % of components, and dollar value, are from China and therefore subject to the tariff?” as a way to negotiate and reduce pricing.

- Regarding MAP / iMAP, many manufacturers who do

not sell residentially-oriented products, or to Grainger, commented that they

do not have MAP pricing or hadn’t thought about it.

- And, as a distributor, if you sell online, make sure your publicly viewable online pricing gets changed.

- Some manufacturers are going to do a nominal percent increase “across the board” if Chinese products are a nominal percent of their business.

- All also said that, since much of lighting is project related, they expected to remain competitive with the market to win business.

So, not much consistency which makes this an ongoing process for distributors and requires personnel commitment as too much profit is at risk if mishandled.

And, potentially, some manufacturers may be able to improve their margins based upon the percent of their business that really comes from China, what they put increases on (perhaps follow their competitors?) and their negotiating abilities.

Country of Origin

Or, consider this. A required field in the IDEA Connector if Country of Origin. Many distributors have in their ERP system. Of the 2.5+ million SKUs in the IDEA database, according to IDEA there are only 198,000 with China as their country of origin.

Distributors could run a report based upon country of origin and identify SKUs that will probably increase to identify either inventory build strategies, anticipate tariff-induced increases or consider alternative sources of supply.

The 198,000 seems low, however, this may be an indication that many lighting companies are not providing content to IDEA and/or many manufacturers that are primarily sourcers / re-packagers are not populating IDEA even though they are private labeling those items. In either case, this could be another reason why distributors should encourage manufacturers to provide their product content to IDEA. (and we didn’t ask about Mexico given that the Mexican tariff wasn’t announced until late in the day.)

- Due to time constraints couldn’t ask for a comparable number from Trade Service but presume they have the same information.

Tariff Increases

- Satco announced a delay on their increase until July 1st and it only affects selected product categories. Rather than implement the complete 25% increase, they have, in their words, “absorbed” the first 10%.

- Acuity announced their price increase effective May 15th, per a letter on Edison Report

- Rab announced their price increase effective May 20th per Electrical Wholesaling

- Maxlite commented that they have inventory and was delaying any increase until July 1st

- TCP announced they are not doing a price increase through the end of 2019 (assuming no additional tariff actions)

- Hubbell Raco, Taymac and Bell have some price increases due to the tariff of 11%

- Intermatic, effective July 1, 2019, is implementing a price increase of up to 15% on select products

(It is interesting the range of strategies. From a distributor viewpoint, or perhaps a customer viewpoint, “will the differences impact sales opportunities? (i.e. decisions on what to buy / sell?)

And there are many more as distributors and reps can attest to (only sharing ones that we can publicly link to vs we’ve been told about. Feel free to post others below or email and we’ll post anonymously.)

While many companies have sought tariff exclusion waivers, a review of the requests since the first round of tariffs reveals few have been granted. The Office of US Trade Representation updates this states on a regular basis. Go to this site to view two spreadsheets (Initial $34 Billion Trade Action Index of Product Exclusion Requests and Review Status and Additional $16 Billion Trade Action Index of Product Exclusion Requests and Review Status.) There are electrical manufacturers you will recognize on the both lists.

Opportunity

As a distributor, there is one potential, albeit short-term opportunity. If you have cash, and confidence, there is an opportunity to add inventory of selected lines at the “lower” price and then increase your pricing with the market to capture either incremental profits or use your cost advantage to take share either at current prices or somewhere in-between.

Concern

It’s an issue that, in reality, there is no good solution for distributors and manufacturers. The bigger concern is, if the tariffs remain at these levels longer-term, will there be an impact on consumption … projects get delayed, renovation work get delayed, ROI analyses on lighting retrofits be extended and dissuade end-users from upgrading their lighting due to energy savings, etal. But again, not within our control.

The current state of tariffs in the electrical industry has generated conversation and reduced productivity but it something we need to muddle through to make the best of. Can only play the cards your dealt.

Without getting political, what have you seen from manufacturers?